Real Estate Climate Risk: Assessing Portfolio Resilience and Future Proofing

Integrating Climate Risk into Investment Decisions

Integrating Climate Change into Investment Strategies

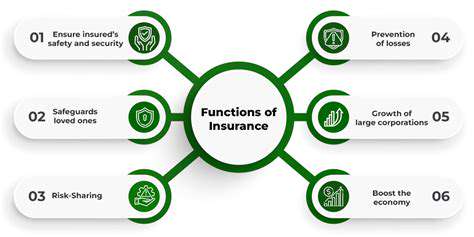

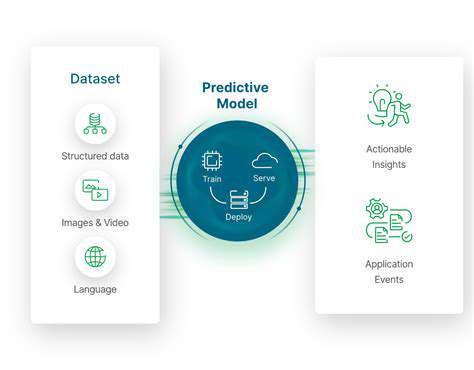

Climate change poses significant risks to investments across various sectors, from energy to agriculture. Understanding and incorporating these risks is crucial for long-term portfolio resilience and sustainability. Investors must move beyond a narrow focus on traditional financial metrics and recognize the potential for physical and transition risks associated with climate change. These risks can manifest in the form of extreme weather events, changing resource availability, and shifts in consumer preferences.

Failing to account for climate change in investment decisions can lead to significant financial losses and reputational damage. Proactive strategies that integrate climate considerations into portfolio construction and management can mitigate these risks and unlock opportunities for sustainable growth. This involves assessing the climate-related financial risks and opportunities of different companies, sectors, and geographies, and adjusting investment strategies accordingly.

Physical Risks and Investment Portfolios

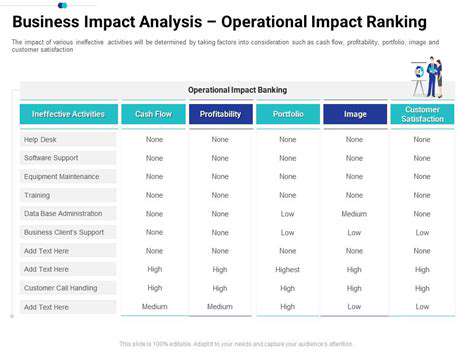

Physical risks, such as extreme weather events, rising sea levels, and changing precipitation patterns, are increasingly impacting businesses and infrastructure. These events can lead to disruptions in supply chains, damage to assets, and increased operating costs. Investors need to assess the vulnerability of their portfolio companies to these physical risks and consider how they might be mitigated.

Climate-related disasters can cause significant damage to physical assets, impacting profitability and potentially leading to complete business disruption. Evaluating the exposure of assets to climate-related hazards is crucial for informed decision-making. This includes considering the location of assets, the resilience of infrastructure, and the potential for future climate impacts.

Transition Risks and Sustainable Investments

Transition risks, arising from the shift towards a low-carbon economy, also represent a significant challenge for investors. These include regulatory changes, technological advancements, and shifts in consumer preferences. Companies that fail to adapt to these transitions may face financial penalties and reputational damage. Investors must carefully consider the implications of these transitions on their portfolio holdings and consider opportunities in the emerging low-carbon economy.

Companies that embrace sustainable practices and innovative technologies to address climate change are likely to be better positioned for long-term success. Identifying and investing in these companies can enhance returns and contribute to a more sustainable future. This includes identifying companies actively working on renewable energy, sustainable agriculture, and other climate-friendly solutions.

Opportunities in the Green Economy

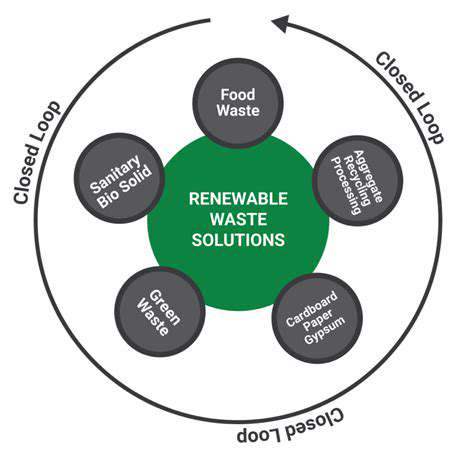

The transition to a low-carbon economy presents considerable investment opportunities. The green economy offers a wealth of possibilities for innovative technologies, sustainable infrastructure, and climate-resilient solutions. Identifying and investing in companies and projects that contribute to this transition can drive both environmental and financial outcomes. These opportunities span across renewable energy, energy efficiency, sustainable transportation, and carbon capture technologies.

Investing in the green economy can yield substantial returns while contributing to a more sustainable future. This includes supporting companies focused on sustainable agriculture, responsible resource management, and innovative solutions to climate change. Analyzing the potential for long-term growth in these sectors is crucial for investors aiming to generate both social and financial value.

Building a Sustainable Future for Real Estate

Understanding the Urgency of Climate Risk

The real estate sector is a significant contributor to greenhouse gas emissions, and the impacts of climate change are already being felt globally. From rising sea levels threatening coastal properties to increased frequency and intensity of extreme weather events, the risks to real estate investments are substantial and multifaceted. Understanding these risks is critical for investors, developers, and policymakers alike to ensure a sustainable future for the industry and for the communities it serves. The urgency of addressing climate risk is paramount to mitigating potential financial losses and ensuring long-term value preservation.

Assessing Physical Climate Risks

Physical climate risks encompass the direct impacts of climate change on real estate assets. These include flooding, wildfires, extreme heat, and storm surges. Assessing these risks involves analyzing historical climate data, projecting future scenarios, and evaluating the vulnerability of specific properties. Detailed analysis is needed to understand the likelihood of different climate-related events occurring and the potential damage to buildings, infrastructure, and surrounding environments. This careful evaluation is essential for making informed decisions about investment, development, and insurance.

Evaluating Transition Risks

Transition risks refer to the changes in regulations, policies, and market dynamics that arise from the global shift towards a low-carbon economy. These changes can include stricter building codes, carbon pricing mechanisms, and shifts in consumer preferences for sustainable properties. Understanding how these transition risks might affect a property's value over time is crucial for long-term planning. Developers and investors need to adapt to these changes to avoid potential losses and ensure alignment with future market demands, which are increasingly focused on sustainability.

Integrating Climate Considerations into Investment Decisions

Integrating climate considerations into real estate investment decisions is no longer optional but essential for long-term success. This involves incorporating climate risk assessments into due diligence processes, adjusting investment strategies to reflect future climate scenarios, and actively seeking out properties with a lower environmental footprint. This requires a proactive approach to understanding and managing climate risks, from the initial stages of property acquisition to its ongoing management. Investment portfolios that fail to account for climate risk are at significant risk of devaluation and financial losses.

Strategies for Building Resilience in Real Estate

Building resilience in real estate involves implementing strategies to mitigate the impacts of climate change and transition risks. This includes adopting sustainable construction practices, incorporating climate-resilient design features, and investing in green infrastructure. Furthermore, effective risk management strategies must be developed and implemented to minimize potential damages and ensure the long-term viability of real estate assets. Building resilience is essential to safeguarding property values and ensuring the continued prosperity of the real estate sector in a changing climate.

Read more about Real Estate Climate Risk: Assessing Portfolio Resilience and Future Proofing

Hot Recommendations

- Sustainable Real Estate Design Principles

- AI in Real Estate: Streamlining the Buying Process

- Climate Risk Disclosure: A Must for Real Estate

- Climate Risk Analytics: Essential for Real Estate Investment Funds

- Modular Sustainable Construction: Scalability and Speed

- Real Estate and Community Disaster Preparedness

- Smart Buildings and Advanced Building Analytics for Optimal Performance

- Smart Waste Sorting and Recycling in Buildings

- Sustainable Real Estate: A Strategic Advantage

- AI in Real Estate Transaction Processing: Speed and Accuracy