Climate Risk Analysis for Real Estate Portfolios

Analyzing Financial and Operational Impacts

Financial Analysis Fundamentals

Financial analysis is a crucial component of evaluating a company's health and potential. It involves scrutinizing financial statements, such as the income statement, balance sheet, and cash flow statement, to identify trends, patterns, and potential risks. Understanding these statements is essential for making informed investment decisions. A thorough analysis considers factors like revenue growth, profitability margins, debt levels, and cash flow generation. This process helps to assess the company's ability to generate profits, manage its finances, and meet its obligations.

Key ratios, such as the debt-to-equity ratio and return on equity, provide valuable insights into the company's financial health and performance. Analyzing these ratios allows investors to compare the company's performance against its peers and industry benchmarks. This comparison allows for a deeper understanding of the company's strengths and weaknesses relative to the broader market. Thorough financial analysis enables investors to assess the overall financial strength of a company.

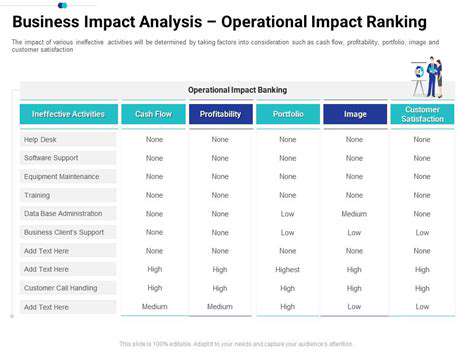

Operational Efficiency Evaluation

Operational efficiency analysis focuses on evaluating a company's internal processes and procedures to maximize output and minimize costs. This encompasses examining various aspects of the business, including production, inventory management, supply chain logistics, and customer service. Improved operational efficiency leads to cost savings, increased productivity, and a better bottom line. This aspect of analysis is crucial for long-term sustainability and growth.

Evaluating key performance indicators (KPIs) such as production cycle time, inventory turnover, and customer satisfaction scores is essential. Monitoring these KPIs provides a clear picture of the effectiveness and efficiency of operational processes. By identifying areas for improvement, companies can streamline workflows, reduce waste, and enhance overall productivity. This, in turn, contributes to a more profitable and resilient business model.

Integration of Financial and Operational Data

Integrating financial and operational data provides a holistic view of a company's performance. By combining insights from financial statements with operational metrics, a more comprehensive understanding of the business emerges. This integrated approach allows for a more accurate assessment of the company's performance and potential.

Analyzing the relationship between operational efficiency improvements and financial results is crucial. Identifying cost savings from operational improvements and correlating them with profit growth is essential for long-term strategic planning. This interconnected view enables companies to make data-driven decisions that enhance both profitability and efficiency.

A deeper understanding of the correlation between operational improvements and financial outcomes also helps in identifying areas for potential improvement. By connecting the dots between operational efficiency and financial success, companies can develop more effective strategies to achieve their long-term objectives. This approach can lead to a more sustainable and profitable business model.

Strategic Implications and Decision Making

The analysis of financial and operational data has significant strategic implications for decision-making. Understanding the current financial health and operational efficiency provides a foundation for developing future strategies. This understanding is critical for making informed decisions about investments, expansions, and cost-cutting measures.

The insights gained from the analysis can inform strategic planning and resource allocation. By identifying areas of strength and weakness, businesses can tailor their strategies to maximize their potential and mitigate risks. This type of data-driven approach is crucial for long-term success in today's dynamic market environment. These decisions can have a significant impact on the company's future prospects and success.

Read more about Climate Risk Analysis for Real Estate Portfolios

Hot Recommendations

- Sustainable Real Estate Design Principles

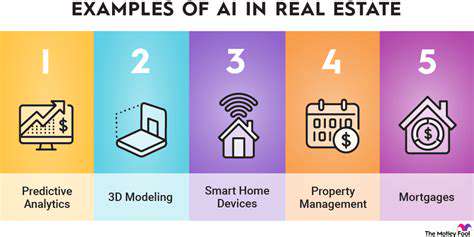

- AI in Real Estate: Streamlining the Buying Process

- Climate Risk Disclosure: A Must for Real Estate

- Climate Risk Analytics: Essential for Real Estate Investment Funds

- Modular Sustainable Construction: Scalability and Speed

- Real Estate and Community Disaster Preparedness

- Smart Buildings and Advanced Building Analytics for Optimal Performance

- Smart Waste Sorting and Recycling in Buildings

- Sustainable Real Estate: A Strategic Advantage

- AI in Real Estate Transaction Processing: Speed and Accuracy