Climate Risk Analytics: Essential for Real Estate Investment Funds

Integrating Climate Risk Analytics into Investment Processes

Understanding Climate-Related Financial Risks

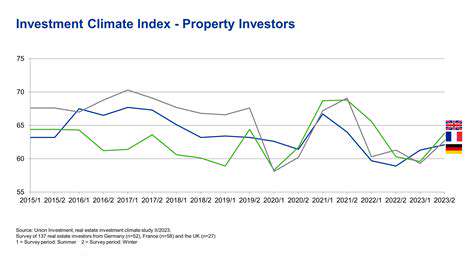

Integrating climate risk analytics into investment processes is crucial for long-term portfolio resilience and sustainability. Understanding the potential financial impacts of climate change, such as extreme weather events, sea-level rise, and changing agricultural yields, is paramount. These risks can manifest in various ways, impacting asset values, operational costs, and even the long-term viability of certain industries. Thorough analysis of these risks is essential to building a robust and adaptable investment strategy.

Climate change is no longer a distant threat; its effects are being felt globally. Investors need to move beyond simple environmental, social, and governance (ESG) considerations and actively incorporate climate-related financial risks into their decision-making processes. This includes assessing the vulnerability of investments to physical risks, such as floods or droughts, as well as transition risks, such as the shift to cleaner energy sources and regulations aimed at decarbonizing the economy.

Developing Climate Risk Assessment Frameworks

Creating robust climate risk assessment frameworks is a critical step in integrating climate considerations into investment decisions. These frameworks should encompass a comprehensive analysis of potential climate impacts, including both physical and transition risks. This involves identifying the specific climate risks relevant to different asset classes and investment strategies. For example, real estate investments in coastal areas require a different risk assessment than investments in fossil fuel companies.

A well-structured framework should also consider the specific geographic locations of investments and the potential impacts of climate change in those areas. This necessitates the use of climate data, models, and scenario analysis to provide a realistic assessment of the potential financial implications of climate-related events. Ultimately, a robust framework helps investors make informed decisions that minimize their exposure to climate-related risks.

Implementing Climate Risk Mitigation Strategies

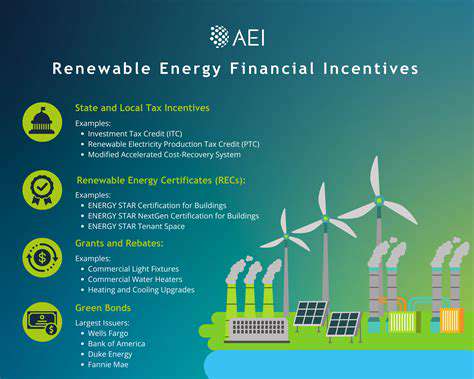

Once the climate risks are assessed, investors need to develop strategies to mitigate those risks. This includes diversifying portfolios to reduce exposure to specific climate-sensitive sectors, implementing hedging strategies to manage potential losses, and actively engaging with companies to encourage sustainable practices. These strategies may involve divesting from high-risk industries, investing in renewable energy, or supporting businesses that are transitioning to cleaner technologies.

Integrating Climate Analytics into Portfolio Management

Integrating climate risk analytics into portfolio management is an ongoing process that requires continuous monitoring and adaptation. This means regularly updating risk assessments, incorporating new climate data and research, and recalibrating portfolio strategies as climate conditions evolve. Furthermore, it necessitates transparent communication with investors regarding the portfolio's exposure to climate-related risks and the strategies employed to manage them. Effective portfolio management in the face of climate change requires an iterative approach that incorporates feedback loops and adapts to new information and evolving realities.

Finally, this integration requires strong collaboration between investment professionals, climate scientists, and other experts. By working together, investors can develop a more holistic understanding of climate risks and create more resilient and sustainable investment strategies for the long term.

Read more about Climate Risk Analytics: Essential for Real Estate Investment Funds

Hot Recommendations

- Sustainable Real Estate Design Principles

- AI in Real Estate: Streamlining the Buying Process

- Climate Risk Disclosure: A Must for Real Estate

- Climate Risk Analytics: Essential for Real Estate Investment Funds

- Modular Sustainable Construction: Scalability and Speed

- Real Estate and Community Disaster Preparedness

- Smart Buildings and Advanced Building Analytics for Optimal Performance

- Smart Waste Sorting and Recycling in Buildings

- Sustainable Real Estate: A Strategic Advantage

- AI in Real Estate Transaction Processing: Speed and Accuracy