The Essential Guide to AI Driven Real Estate Valuations

Understanding the Role of Data

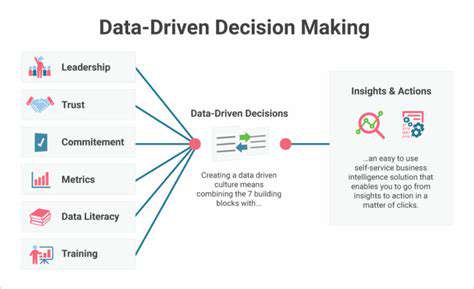

In today's rapidly evolving landscape, the ability to harness data effectively has become indispensable for evaluating Artificial Intelligence (AI) models. The quality and diversity of data sources directly influence the accuracy of valuation outcomes. From performance benchmarks to user interaction patterns, each data point contributes uniquely to our understanding. Historical datasets combined with real-time analytics enable us to spot emerging trends and refine predictive models.

However, raw data alone isn't sufficient. Rigorous data cleansing and validation processes are non-negotiable steps to ensure the integrity of insights. When these steps are overlooked, valuation models risk producing misleading results due to inherent biases or incomplete information.

Evaluating AI Model Performance Metrics

Measuring an AI model's effectiveness requires examining multiple dimensions of performance. Traditional metrics like accuracy and recall remain important, but they only tell part of the story. For instance, how quickly a model processes requests (latency) or scales under heavy usage (throughput) can be just as critical in real-world applications. These operational factors often determine whether an AI solution remains viable long-term.

Industry professionals are increasingly looking at composite metrics that balance predictive power with practical constraints. A model might achieve 95% accuracy but require prohibitively expensive hardware - such tradeoffs must be factored into any comprehensive valuation.

Analyzing Market Trends and Competitive Landscape

The value proposition of AI solutions doesn't exist in a vacuum. Regulatory changes, breakthrough technologies, and shifting consumer preferences continuously reshape market dynamics. Forward-thinking companies monitor these macro-trends to anticipate where AI investments will deliver the highest returns.

A thorough competitive analysis goes beyond surface-level comparisons. It involves dissecting competitors' technological approaches, identifying underserved market niches, and projecting how emerging innovations might disrupt current business models. This depth of market intelligence separates reactive valuations from strategically informed ones.

Beyond Traditional Metrics: Unveiling Hidden Value

The Importance of Employee Well-being

Organizations that prioritize their workforce's mental and physical health consistently outperform their peers. This isn't just feel-good rhetoric - numerous studies demonstrate clear correlations between employee satisfaction and key performance indicators. When team members feel genuinely valued, they demonstrate greater creativity, collaborate more effectively, and remain committed during challenging periods.

The inverse is equally true. Neglecting workplace culture leads to attrition, knowledge drain, and ultimately, diminished valuation. Smart investors now scrutinize employee retention metrics and workplace policies as leading indicators of organizational health.

Customer-Centricity: The Cornerstone of Success

In an era where alternatives are just a click away, customer experience has become the ultimate differentiator. Businesses that systematically gather and act on customer feedback create self-reinforcing cycles of improvement. This manifests not just in satisfaction surveys, but in tangible outcomes like reduced churn and increased lifetime value.

The most sophisticated companies have moved beyond transactional relationships. They're building ecosystems where each customer interaction strengthens the overall value proposition, making switching costs prohibitive while organically driving referrals.

Operational Efficiency and Process Optimization

Streamlining operations isn't about cutting corners - it's about eliminating waste while enhancing output quality. Process mining technologies now allow organizations to visualize workflow bottlenecks with unprecedented clarity. When combined with AI-powered optimization algorithms, companies can achieve step-change improvements in productivity.

The most impactful efficiency gains often come from cross-functional alignment. Breaking down silos between departments frequently reveals redundant efforts and missed synergies that, when addressed, create value far beyond cost savings.

The Future of Real Estate Valuation: AI's Potential and Challenges

Advanced Valuation Techniques

The valuation profession stands at an inflection point as machine learning models begin processing variables human appraisers could never feasibly analyze. These algorithms digest thousands of data points - from local school district ratings to microclimate patterns - to detect non-obvious value drivers. What once took weeks of comparable analysis now happens in minutes with greater precision.

However, the most valuable implementations combine algorithmic outputs with human expertise. Seasoned appraisers provide essential context, ensuring models don't miss nuanced factors like neighborhood character or upcoming zoning changes that data alone might overlook.

Impact of Technological Advancements

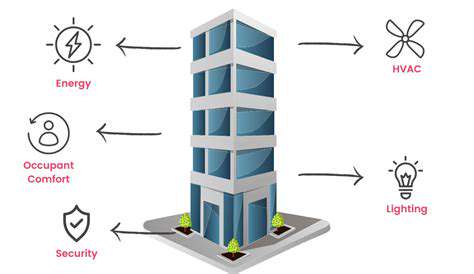

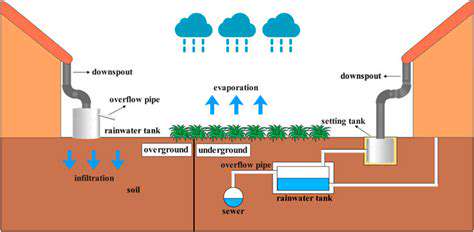

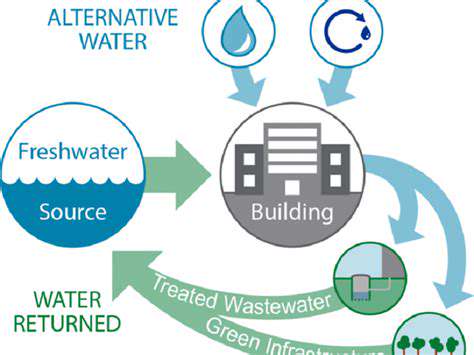

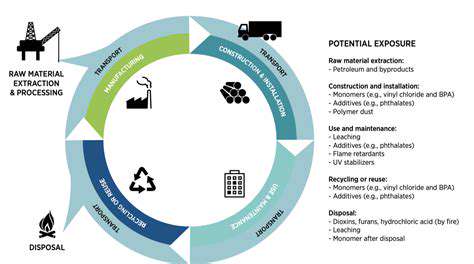

PropTech innovations are transforming every valuation touchpoint. Drone-generated 3D models provide centimeter-accurate property measurements, while IoT sensors track building systems' performance in real-time. This flood of high-fidelity data enables valuations based on actual performance rather than estimated characteristics.

The challenge lies in synthesizing these disparate data streams into coherent models. Firms investing in unified data platforms gain significant advantages, as their valuation models can incorporate more dimensions of property performance than competitors relying on fragmented systems.

The Future of Real Estate Valuation Professionals

Tomorrow's most successful appraisers won't just understand real estate - they'll be fluent in data science. The profession is evolving from artisanal assessment to tech-enabled advisory services. This means mastering new tools to validate AI outputs, explain complex models to stakeholders, and identify when human judgment must override algorithmic recommendations.

Continuing education programs now emphasize computational thinking alongside traditional appraisal coursework. Those who embrace this hybrid skill set will find themselves at the forefront of valuation's next era - one where technology amplifies rather than replaces human expertise.

Read more about The Essential Guide to AI Driven Real Estate Valuations

Hot Recommendations

- Sustainable Real Estate Design Principles

- AI in Real Estate: Streamlining the Buying Process

- Climate Risk Disclosure: A Must for Real Estate

- Climate Risk Analytics: Essential for Real Estate Investment Funds

- Modular Sustainable Construction: Scalability and Speed

- Real Estate and Community Disaster Preparedness

- Smart Buildings and Advanced Building Analytics for Optimal Performance

- Smart Waste Sorting and Recycling in Buildings

- Sustainable Real Estate: A Strategic Advantage

- AI in Real Estate Transaction Processing: Speed and Accuracy