The Economic Impact of Climate Risk on Real Estate

Assessing the Financial Implications of Coastal Erosion

Understanding the Economic Losses

Coastal erosion, driven by climate change impacts like rising sea levels and more intense storms, poses significant economic threats. The gradual disappearance of valuable coastal land—including homes, businesses, and critical infrastructure such as roads and bridges—leads to measurable financial harm. These costs include repairing or replacing damaged structures, declining property values, and interruptions to businesses that rely on coastal access. Accurately measuring these losses is essential for developing effective coastal management and adaptation plans.

The economic fallout isn’t limited to immediate property damage. Over time, erosion can stifle growth in coastal communities. Declining tourism revenue, struggling fisheries, and other coastal-dependent industries create a domino effect, reducing employment and weakening local economies.

Impact on Property Values and Insurance Costs

Coastal erosion directly affects property values. As shorelines recede, perceived risk rises, causing market values to drop. Homeowners may see their equity shrink and face challenges when selling. Insurance providers frequently hike premiums for properties in high-risk erosion zones, making ownership more expensive and less attainable.

The growing threat of storm and flood damage, closely tied to erosion, further drives up insurance costs. Insurers adjust their risk models, resulting in higher premiums for coastal residents and businesses.

The Cost of Coastal Protection Measures

Mitigation efforts like seawalls, beach replenishment, and dune restoration require substantial funding. These projects demand large upfront investments for materials, labor, and engineering. Ongoing maintenance adds to the long-term financial burden.

Debates persist about the effectiveness and sustainability of these measures. While they may offer temporary relief, their long-term viability is questionable, especially in rapidly changing coastal zones. Conducting thorough cost-benefit analyses is critical to identifying the most sustainable solutions.

Disruption to Coastal Businesses and Industries

Erosion severely disrupts coastal-reliant industries like fishing, tourism, and shipping. Lost access to ports, harbors, and beaches harms trade, recreation, and jobs. Relocating affected businesses and compensating for lost revenue can be costly.

Tourism, a cornerstone of many coastal economies, is especially vulnerable. Vanishing beaches and shorelines deter visitors, hurting hotels, restaurants, and other tourism-dependent businesses. Transportation disruptions compound these economic losses.

The Long-Term Economic Consequences

The ripple effects of coastal erosion extend far beyond immediate costs. Displaced populations, plummeting property values, and business closures can destabilize coastal communities. Addressing these challenges requires significant investments in relocation, new infrastructure, and economic diversification.

The degradation of coastal ecosystems, which provide natural storm protection, support fisheries, and offer recreational value, compounds long-term economic losses. Their decline increases vulnerability to climate impacts and diminishes the overall economic vitality of coastal regions.

Extreme Weather Events and Their Real Estate Fallout

Extreme Weather Events and Climate Change

Extreme weather events—hurricanes, droughts, floods, and heatwaves—are growing more frequent and intense, threatening lives and livelihoods. These aren’t random anomalies; they’re clear symptoms of global climate change. Rising temperatures directly correlate with the increased severity of these phenomena.

Warmer temperatures accelerate evaporation, fueling heavier rainfall and flooding. Warmer oceans energize hurricanes, making them more destructive. The scientific consensus on these links is robust.

Impacts on Human Populations

The human toll of extreme weather is devastating. Displacement, disrupted livelihoods, and infrastructure damage create lasting economic scars. Vulnerable groups—the elderly, children, and those with health conditions—bear the brunt of these impacts.

These events also trigger public health crises, from disease outbreaks to trauma-related mental health issues. Recovery efforts often strain local and national resources.

Economic Consequences

The economic fallout is profound. Rebuilding damaged infrastructure—homes, businesses, and transport networks—requires massive investments. Agricultural losses from droughts and floods drive food shortages and price spikes, hitting the poorest hardest.

Insurance claims soar, and government disaster spending balloons. Supply chain disruptions, tourism declines, and broader economic instability amplify the damage.

Environmental Impacts

Extreme weather wreaks havoc on ecosystems. Floods contaminate water supplies, droughts trigger desertification, and habitat destruction threatens biodiversity. These disruptions destabilize delicate ecological balances, creating long-term environmental crises.

Mitigation Strategies

A multi-pronged approach is essential. Early warning systems and disaster preparedness save lives. Sustainable land management reduces flood and landslide risks. Transitioning to renewable energy and improving efficiency are critical to slowing climate change and curbing extreme weather. Global cooperation is vital for effective mitigation.

Adapting to a Changing Climate

Adaptation is equally important. Resilient infrastructure—flood defenses, drought-resistant crops—protects communities. Water conservation and early warning systems minimize risks to life and property.

Investment Strategies in a Changing Climate

Adapting to Shifting Weather Patterns

Climate change disrupts agriculture, infrastructure, and supply chains with more frequent extreme weather. Investors must assess portfolio vulnerabilities across sectors—agriculture, energy, real estate, and insurance. Droughts, floods, and rising seas increase operational costs and disruptions, demanding proactive risk management.

Diversifying into climate-resilient sectors like renewables and sustainable agriculture mitigates risks. Scrutinizing companies’ climate strategies—emissions reductions and adaptation plans—is now essential.

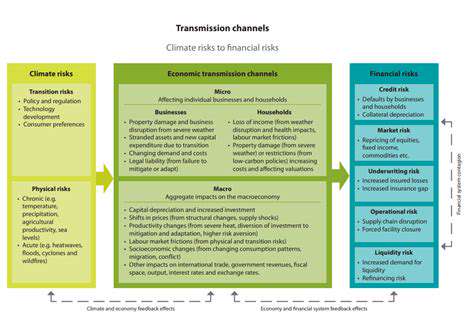

Evaluating Climate-Related Financial Risks

Climate risks extend beyond physical damage. Rising seas erode property values and inflate insurance costs, hitting real estate portfolios. The low-carbon transition may strand fossil fuel assets, hurting unprepared companies.

Thorough due diligence and scenario planning are now mandatory. Investors must integrate climate factors—both physical and transition risks—into financial analysis.

The Importance of Sustainable Investments

Sustainable investing isn’t just ethical—it’s profitable. Companies with strong ESG practices often outperform peers long-term by mitigating climate risks. Green bonds, sustainable funds, and impact investments offer growing opportunities. Aligning portfolios with ESG principles can enhance returns while supporting sustainability.

Understanding Carbon Pricing Mechanisms

Carbon taxes and cap-and-trade systems incentivize emissions reductions, driving clean innovation. Investors must track evolving carbon policies to spot opportunities and risks across sectors.

Integrating Climate Change into Portfolio Management

Climate considerations must now permeate investment processes—research, analysis, portfolio construction, and risk management. New tools and expertise are essential, requiring collaboration between investors and climate experts.

The Role of Policy and Regulation

Government policies shape climate responses and investment landscapes. Renewable energy incentives, efficiency standards, and sustainable infrastructure projects create opportunities. Monitoring national and international regulations helps investors navigate the shifting climate investment environment.

Read more about The Economic Impact of Climate Risk on Real Estate

Hot Recommendations

- Sustainable Real Estate Design Principles

- AI in Real Estate: Streamlining the Buying Process

- Climate Risk Disclosure: A Must for Real Estate

- Climate Risk Analytics: Essential for Real Estate Investment Funds

- Modular Sustainable Construction: Scalability and Speed

- Real Estate and Community Disaster Preparedness

- Smart Buildings and Advanced Building Analytics for Optimal Performance

- Smart Waste Sorting and Recycling in Buildings

- Sustainable Real Estate: A Strategic Advantage

- AI in Real Estate Transaction Processing: Speed and Accuracy