AI Driven Transaction Management: Streamlining Real Estate

The financial landscape is undergoing a dramatic transformation, driven by the integration of artificial intelligence (AI) into transaction systems. This revolution promises to enhance efficiency, security, and accessibility for all stakeholders, from individual consumers to large financial institutions. The core principle of these systems is to automate and optimize financial processes, leading to faster transaction times and reduced costs. This innovative approach is poised to reshape how we interact with money and financial services.

Intelligent transaction systems are not merely about speed and efficiency; they are also about improved security. By leveraging sophisticated algorithms and machine learning models, these systems can detect and prevent fraudulent activities with greater accuracy than traditional methods. This proactive approach to security is crucial in today's increasingly digital world, where financial fraud is a constant threat.

Key Features Driving the Transformation

Several key features are driving the adoption of intelligent transaction systems. These include advanced analytics capabilities, which allow systems to analyze vast amounts of data to identify patterns and predict potential risks. This proactive approach to risk management is a significant advantage over traditional methods that often react to problems after they occur.

Furthermore, these systems often incorporate natural language processing (NLP), enabling more intuitive and user-friendly interfaces. This user-centric design is crucial for enhancing accessibility and fostering broader adoption of these technologies. Users can interact with these systems in ways that are more natural and less cumbersome, ultimately increasing satisfaction and engagement.

Enhanced Security and Fraud Prevention

One of the most significant benefits of intelligent transaction systems is their enhanced security capabilities. By analyzing transaction patterns and identifying anomalies, these systems can detect and prevent fraudulent activities in real-time, minimizing potential losses for individuals and institutions. This proactive approach to security is crucial in an environment where financial fraud is constantly evolving and becoming more sophisticated. Protecting sensitive financial data is paramount, and these systems play a critical role in safeguarding against these threats.

Sophisticated algorithms are employed to scrutinize every transaction, flagging suspicious activities almost immediately. This swift action significantly reduces the window of opportunity for fraudsters, protecting both consumers and businesses. The combination of advanced analytics and machine learning models enables an unparalleled level of security.

Improved Accessibility and User Experience

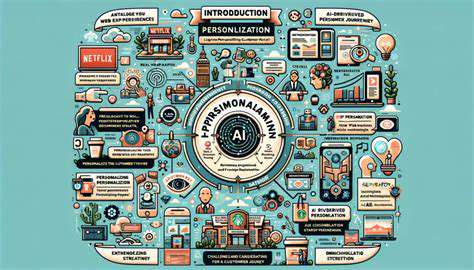

Intelligent transaction systems are designed to make financial transactions more accessible to a wider range of users. By incorporating intuitive interfaces and personalized recommendations, these systems cater to diverse needs and preferences. This improved accessibility is particularly important for underserved populations and promotes financial inclusion.

The Future of Financial Transactions

The future of financial transactions is undeniably intertwined with the rise of intelligent systems. These systems are not just improving efficiency and security; they are fundamentally changing how we interact with money. Imagine a world where transactions are seamless, secure, and personalized to individual needs. This vision is not far-fetched, as intelligent transaction systems are rapidly evolving and becoming more sophisticated.

The integration of AI into financial systems is transforming the industry and shaping the future of finance. The possibilities are vast, from automated investment strategies to personalized financial advice, and the potential impact on individuals and businesses is profound. This evolution is undoubtedly reshaping the way we interact with the global financial system.

Automating Key Tasks for Enhanced Efficiency

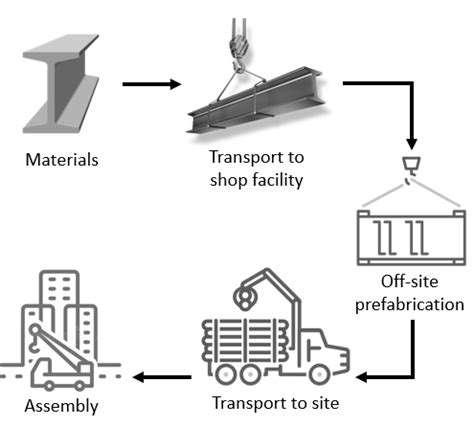

Streamlining Transaction Processing

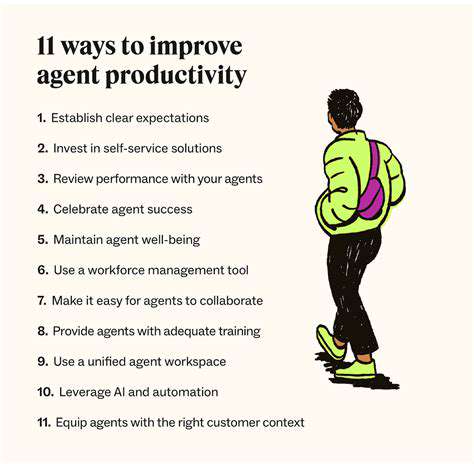

Automating key tasks within transaction management systems is crucial for enhancing efficiency and reducing errors. By leveraging AI-powered tools, businesses can automate repetitive processes like data entry, validation, and reconciliation. This frees up valuable human resources to focus on higher-level tasks, strategic decision-making, and customer interaction. The accuracy and speed of automated processes significantly improve the overall transaction processing cycle, leading to faster turnaround times and greater operational efficiency. This automation also helps mitigate the risk of human error, ensuring greater data integrity and compliance with regulatory standards.

Furthermore, AI can analyze transaction patterns to identify anomalies and potential risks in real-time. This proactive approach can prevent fraudulent activities, detect errors early on, and minimize financial losses. Predictive modeling capabilities within AI systems can also forecast future transaction needs, enabling businesses to optimize resource allocation and proactively address potential bottlenecks. This proactive approach to risk management, coupled with improved accuracy and speed, is a game changer for any organization seeking to enhance its transaction management processes.

Intelligent Data Analysis for Informed Decisions

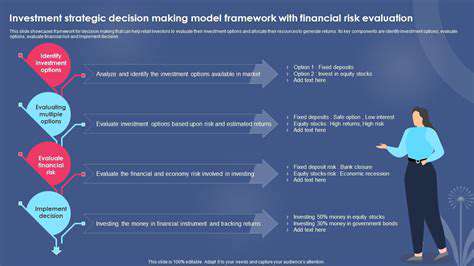

AI's ability to analyze vast amounts of transaction data offers valuable insights into business performance. By identifying trends, patterns, and correlations within transaction data, businesses can gain a deeper understanding of customer behavior, market dynamics, and operational efficiencies. This intelligent data analysis can inform strategic decisions, optimize pricing strategies, and personalize customer experiences. For example, AI can analyze customer purchase history to recommend tailored product offerings, personalize marketing campaigns, and improve customer satisfaction.

Beyond customer insights, AI can analyze transaction data to identify areas for process improvement, optimize resource allocation, and pinpoint bottlenecks in the transaction workflow. Real-time monitoring and analysis of transaction data can allow businesses to adapt to changing market conditions and customer demands with greater agility. This ability to extract actionable intelligence from transaction data is instrumental in driving business growth and maintaining a competitive edge in the market.

AI-driven analysis can also uncover hidden patterns and anomalies within the data. This proactive identification of potential risks and opportunities allows for timely intervention and mitigation strategies. The ability to interpret large datasets and identify critical insights is essential for any organization looking to make data-driven decisions and improve overall business performance.

This capability translates into a more efficient and effective transaction management system, ultimately leading to optimized business operations and increased profitability.

Data-Driven Insights for Informed Decision-Making

Leveraging AI for Enhanced Transaction Visibility

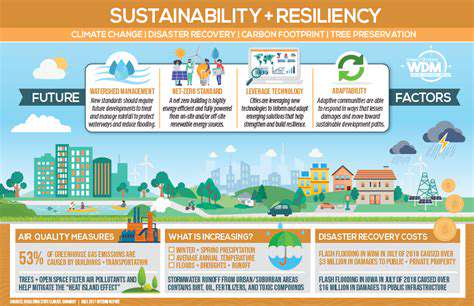

AI-powered transaction management systems offer unparalleled visibility into the flow of transactions. This visibility allows businesses to track every step of a transaction, from initiation to completion, providing a comprehensive view of the entire process. Real-time data feeds and automated alerts enable proactive identification of potential issues, such as fraud or delays, allowing for swift intervention and minimizing disruptions to the workflow.

By centralizing and correlating data from various sources, AI systems can identify patterns and anomalies that might otherwise go unnoticed. This improved visibility translates to a more efficient and responsive transaction process, enabling businesses to optimize their operations and gain a competitive edge.

Predictive Analytics for Proactive Risk Management

AI algorithms can analyze vast amounts of transaction data to identify patterns and predict potential risks. This predictive capability allows businesses to proactively address potential issues, such as fraudulent activities or compliance violations, before they escalate into significant problems. By anticipating risks, businesses can implement preventive measures and mitigate potential losses, ensuring the smooth and secure processing of transactions.

Machine learning models can be trained on historical transaction data to identify indicators of fraudulent activity. This allows for the development of sophisticated fraud detection systems that can flag suspicious transactions in real-time, minimizing financial losses and safeguarding sensitive information.

Automated Transaction Processing for Enhanced Efficiency

AI-powered automation streamlines transaction processing, significantly reducing manual intervention and improving overall efficiency. By automating repetitive tasks, such as data entry and reconciliation, AI systems free up valuable human resources to focus on higher-level tasks. This increase in efficiency translates to faster processing times, reduced operational costs, and improved customer satisfaction.

Automated systems can also handle complex and high-volume transactions with unprecedented speed and accuracy. This is particularly beneficial for businesses that process numerous transactions daily, enabling them to maintain a high level of throughput without sacrificing quality or compromising security.

Personalized Customer Experiences through AI-Driven Insights

AI can analyze customer transaction data to understand their preferences and behaviors. This understanding enables businesses to personalize the customer experience, tailoring products, services, and communication to individual needs. Personalized recommendations and targeted marketing campaigns can increase customer engagement and loyalty, driving revenue growth.

By understanding customer needs and preferences through AI-driven analysis, businesses can provide a more tailored and satisfying experience, fostering stronger customer relationships and increasing brand loyalty.

Improved Compliance and Regulatory Adherence

AI can assist in ensuring compliance with various regulations and industry standards by automatically monitoring transactions for compliance violations. This proactive approach minimizes the risk of penalties and legal issues, maintaining a positive and compliant business environment. AI-driven systems can quickly identify and flag transactions that do not meet regulatory requirements, allowing businesses to take corrective action immediately.

This proactive approach to compliance ensures that businesses operate within the boundaries of all applicable laws and regulations, safeguarding their reputation and avoiding costly legal challenges.

Real-Time Monitoring and Alerting for Timely Interventions

AI systems can monitor transactions in real time, providing immediate alerts for suspicious activity or deviations from established patterns. This allows businesses to take immediate action to address potential problems, minimizing disruptions and safeguarding sensitive data. Real-time alerts enable rapid responses to issues, preventing potential financial losses and maintaining the integrity of the transaction process.

The ability to react swiftly to anomalies and irregularities is crucial in today's fast-paced business environment. AI-powered real-time monitoring and alerting systems provide the necessary tools for proactive intervention and efficient management of transactions.

Data Security and Privacy Enhancements with AI

AI can play a crucial role in enhancing data security and privacy by identifying and mitigating potential threats. AI-driven systems can detect anomalies and suspicious patterns in transaction data, enabling the implementation of security measures to prevent unauthorized access and data breaches. This proactive approach safeguards sensitive information and maintains the trust of customers and stakeholders.

AI can also be used to develop robust encryption and access control protocols, further strengthening the security posture of the transaction management system. This ensures the confidentiality and integrity of sensitive data, maintaining the trust of customers and stakeholders.

Developing engaging and effective leadership simulations requires careful planning and consideration of various factors. The core objective should be to create a realistic and challenging environment where participants can practice and refine leadership skills in a safe space. This includes accurately portraying the complexities of real-world situations, potential obstacles, and the dynamics of diverse teams.

Predictive Analytics for Enhanced Risk Management

Predictive Modeling Techniques

Predictive analytics leverages various statistical and machine learning techniques to forecast future outcomes. These techniques range from simple regression models to complex algorithms like neural networks, each with its strengths and weaknesses. Understanding the strengths and weaknesses of each technique is crucial for selecting the most appropriate model for a specific business problem. Choosing the right technique is critical for accurate predictions and informed decision-making.

Models like time series analysis, particularly ARIMA and exponential smoothing, are well-suited for forecasting trends in data over time. These techniques are often used in areas like sales forecasting and demand planning. By accurately predicting future trends, companies can optimize their inventory levels and anticipate potential fluctuations in demand.

Data Preparation and Feature Engineering

High-quality data is the foundation of any successful predictive model. Data preparation involves cleaning, transforming, and preparing the data for use in the chosen predictive model. This process often includes handling missing values, removing outliers, and converting categorical variables into numerical representations. Thorough data preparation ensures the model's accuracy and reliability.

Feature engineering plays a critical role in enhancing the model's predictive power. It involves creating new features from existing data or transforming existing features to improve the model's ability to identify patterns and relationships. This often involves techniques like binning, scaling, and interaction terms.

Model Evaluation and Validation

Evaluating the performance of a predictive model is essential to assess its accuracy and reliability. Common metrics include accuracy, precision, recall, F1-score, and area under the ROC curve (AUC). Understanding these metrics allows data scientists to identify potential biases and limitations of the model.

Validating the model on unseen data is crucial to prevent overfitting. Techniques like cross-validation help to ensure that the model generalizes well to new data and provides reliable predictions on unseen data sets. Overfitting can lead to poor performance on new data, so careful validation is essential.

Applications in Business

Predictive analytics finds wide-ranging applications across various business functions. In marketing, it can be used to predict customer churn, personalize marketing campaigns, and target potential customers effectively. This can lead to increased customer retention and improved marketing ROI.

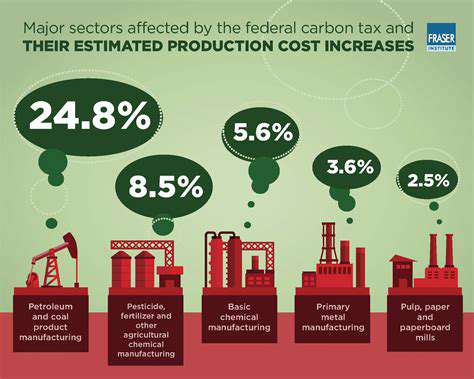

In finance, predictive models can forecast credit risk, identify fraudulent transactions, and price financial instruments accurately. These applications can significantly reduce financial risks and improve investment strategies. Furthermore, in supply chain management, predictive analytics can be used to forecast demand, optimize inventory levels, and minimize disruptions.

Deployment and Monitoring

Deploying a predictive model into a production environment requires careful consideration of scalability, maintainability, and integration with existing systems. This often involves using cloud-based platforms or dedicated data science infrastructure.

Continuous monitoring of the model's performance is crucial to ensure its accuracy and relevance over time. This includes tracking key performance indicators (KPIs), detecting changes in the underlying data distribution, and retraining the model periodically to maintain its predictive power. Regular monitoring is essential to ensure continued model effectiveness.

Ethical Considerations

The use of predictive analytics raises important ethical considerations, especially regarding fairness, transparency, and accountability. Models trained on biased data can perpetuate or even amplify existing societal biases. It's crucial to address these biases and ensure that predictive models are used responsibly and ethically.

Transparency in the model's decision-making process is also important. Understanding how a model arrives at its predictions allows for better scrutiny and accountability. This is critical for building trust in the model's outputs and ensures its ethical application.