The Investor's Guide to Climate Risk in Commercial Real Estate

Understanding Flood Risks

Flooding represents one of climate change's most destructive consequences, posing substantial financial and operational threats to property owners. Comprehensive flood risk evaluation must consider historical flood data, projected flood zones, and potential sea level impacts on coastal assets. Investors should carefully examine property vulnerabilities and potential insurance limitations in flood-prone locations.

Detailed flood assessments should incorporate local building codes and flood mitigation regulations. Evaluating construction materials and techniques for flood resistance proves equally important, requiring examination of structural histories, reinforcement possibilities, and future flood probabilities. Thorough research into local flood patterns, including event frequency and severity, helps create accurate risk profiles.

Evaluating Fire Hazards in a Changing Climate

Escalating wildfire risks present growing concerns for property owners as climate change intensifies fire conditions. Investors must assess fire damage potential, including property loss and operational disruptions. Critical evaluation factors include proximity to fire-prone areas, historical fire data, vegetation density, and prevailing wind patterns.

Assessment should also examine local fire prevention measures, including fire department capabilities, water resource availability, and fire-resistant construction materials. Insurance considerations, including premium increases and specialized coverage options for high-risk zones, form another essential component of thorough risk analysis.

Evaluating the Impact of Extreme Weather Events

Beyond floods and fires, various extreme weather phenomena pose escalating threats. Investors must consider how droughts, heatwaves, and severe storms might disrupt operations, damage infrastructure, and affect property values. Historical weather pattern analysis provides crucial insights for comprehensive risk assessment, including evaluation of potential increases in storm frequency and intensity.

Infrastructure resilience evaluation should address roads, bridges, and utility networks. Contingency planning for supply chain disruptions forms another critical analysis component. Additionally, assessing potential agricultural yield fluctuations due to prolonged droughts or excessive rainfall helps evaluate broader economic implications.

Transition Risks: Adapting to a Low-Carbon Future

Transition Risks: Navigating the Shifting Landscape

Organizations confront numerous transition risks while adjusting to global economic transformations. These multifaceted challenges span technological evolution, changing consumer behaviors, geopolitical instability, and regulatory shifts. Effective navigation requires proactive risk evaluation and flexible strategic planning.

Technological Disruption and its Impact

Rapid technological innovation continues reshaping industries, creating both opportunities and substantial risks. Businesses failing to adopt emerging technologies risk market irrelevance. The accelerating pace of innovation demands continuous technological assessment and adaptation.

Successful adaptation requires not just technology adoption but understanding how innovations might transform existing business models. This necessitates forward-looking strategies and organizational willingness to embrace change.

Consumer Behavior Shifts and Market Volatility

Evolving consumer preferences, driven by social trends, economic conditions, and information access, require business agility. Companies must adjust products, services, and marketing approaches to meet changing market demands. Anticipating these shifts proves critical for maintaining competitive advantage.

Geopolitical Instability and Global Uncertainty

Geopolitical tensions and global unpredictability significantly impact international operations. Currency fluctuations, trade policy changes, and political conflicts can create unexpected business challenges. Risk mitigation strategies include supply chain diversification and strategic partnerships.

Regulatory Changes and Compliance Requirements

Businesses must monitor evolving regulations and compliance standards across jurisdictions. Non-compliance risks substantial penalties and reputational harm. Proactive adaptation to regulatory changes remains essential for sustainable operations.

Talent Acquisition and Retention Challenges

Securing and retaining skilled personnel presents significant challenges in competitive labor markets. Talent availability fluctuates with economic conditions, education systems, and skill gaps. Effective workforce management strategies are vital for building adaptable organizations.

Supply Chain Disruptions and Resilience

Global supply chain vulnerabilities continue posing operational risks across industries. Disruptions may stem from natural disasters, geopolitical events, or other unforeseen circumstances. Building resilient supply networks proves essential for maintaining business continuity and minimizing operational impacts.

Integrating Climate Risk into Investment Strategies

Understanding the Importance of Climate Risk

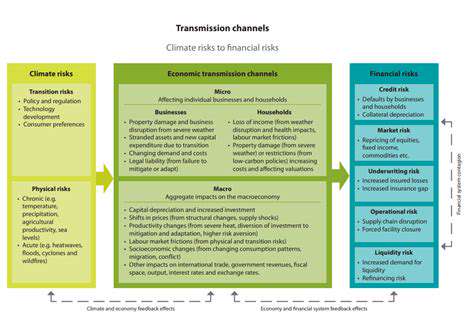

Climate change impacts now require fundamental reassessment of investment approaches. Incorporating climate risk analysis into investment decisions has transitioned from optional to imperative for long-term financial stability. This involves evaluating both physical risks (extreme weather events) and transition risks (policy changes promoting decarbonization) that could significantly impact investment performance.

Assessing Physical Climate Risks

Physical climate risks involve direct impacts from extreme weather and changing climate patterns on assets and operations. These include threats from flooding, droughts, wildfires, and rising sea levels that can disrupt business activities, damage property, and reduce profitability. Thorough risk assessment helps investors identify potential losses and enhance portfolio resilience.

Comprehensive analysis combining historical data with climate projections enables more accurate risk quantification, supporting better informed investment choices and strategic portfolio diversification.

Evaluating Transition Risks

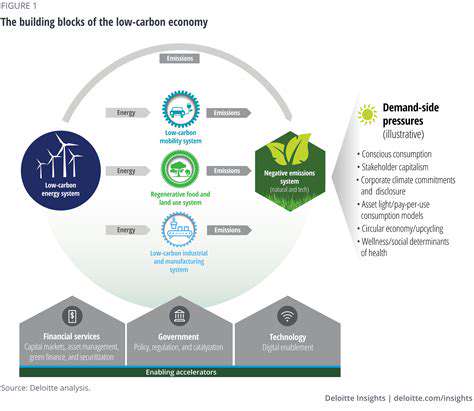

Transition risks emerge from economic shifts toward low-carbon systems. These include emission reduction policies, technological advancements, and changing consumer preferences. Such transformations may disadvantage fossil fuel-dependent industries while creating opportunities in renewable energy and sustainable technologies. Investors must understand these dynamics to adjust their strategies accordingly.

Developing Climate-Resilient Investment Strategies

Effective climate risk integration requires multifaceted approaches including detailed risk analysis, scenario planning, and climate-conscious investment practices. This involves assessing investment environmental impacts, identifying climate-resilient companies, and engaging with portfolio companies to encourage sustainable practices.

Businesses effectively managing climate risks typically demonstrate stronger long-term growth potential. Aligning investment portfolios with sustainability goals can generate both financial returns and positive societal impact.

Data and Tools for Climate Risk Analysis

Reliable data and sophisticated analytical tools are essential for accurate climate risk assessment. These resources help investors evaluate climate impacts on portfolios, assess company resilience, and identify transition opportunities. Advanced climate modeling and data analytics provide significant advantages in quantifying and understanding these complex risks.

Read more about The Investor's Guide to Climate Risk in Commercial Real Estate

Hot Recommendations

- Sustainable Real Estate Design Principles

- AI in Real Estate: Streamlining the Buying Process

- Climate Risk Disclosure: A Must for Real Estate

- Climate Risk Analytics: Essential for Real Estate Investment Funds

- Modular Sustainable Construction: Scalability and Speed

- Real Estate and Community Disaster Preparedness

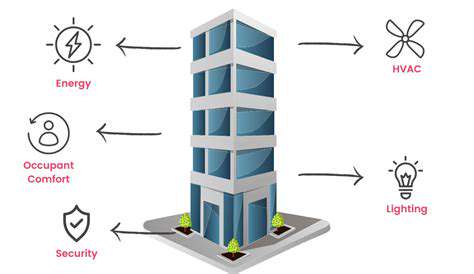

- Smart Buildings and Advanced Building Analytics for Optimal Performance

- Smart Waste Sorting and Recycling in Buildings

- Sustainable Real Estate: A Strategic Advantage

- AI in Real Estate Transaction Processing: Speed and Accuracy