Climate Risk Analytics: Essential for Real Estate Development

Assessing the Impact of Climate Change on Real Estate Investments

Understanding the Correlation Between Climate Change and Real Estate Values

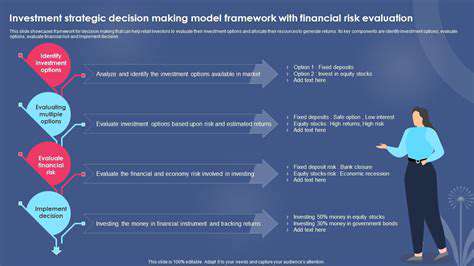

Climate change is no longer a distant threat; its effects are being felt across the globe, impacting various sectors, including real estate. Understanding the complex interplay between rising temperatures, extreme weather events, and shifting sea levels is crucial for investors and stakeholders in the real estate market. Analyzing historical trends, projected climate scenarios, and local vulnerabilities is critical to assess the potential impact on property values and investment returns. This necessitates a sophisticated understanding of how specific locations and property types are at risk.

The correlation between climate change and real estate values is often nuanced and geographically specific. For instance, coastal areas face a higher risk of sea-level rise and storm surges, potentially leading to significant property damage and devaluation. Conversely, areas experiencing increased drought or wildfires might see decreased property values due to water scarcity or elevated fire risks. Accurate risk assessment tools and models are essential to quantify these impacts and inform investment strategies.

Evaluating Physical Risks to Properties

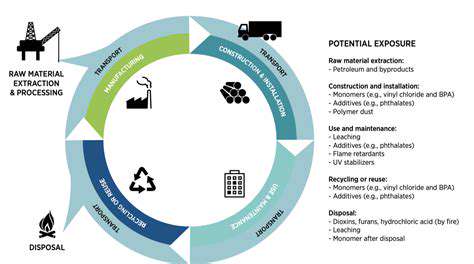

Physical risks pose a direct threat to real estate investments. Flooding, drought, wildfires, and extreme heat events can cause substantial damage to structures, infrastructure, and the surrounding environment. Assessing the vulnerability of a property to these risks requires careful consideration of its location, construction materials, and existing mitigation measures. This includes evaluating the property's proximity to floodplains, wildfire zones, or areas prone to extreme heat.

Detailed analyses of historical data, including past weather events and their impact on similar properties, are vital for identifying potential physical risks. This data can help to project future risks and inform decision-making regarding preventative measures, such as flood defenses or fire-resistant materials. Predictive modeling and scenario planning are also crucial to understand the potential consequences of various climate change scenarios.

Analyzing Regulatory and Legal Impacts

Beyond physical risks, regulatory and legal changes are increasingly influencing real estate investments in the context of climate change. Governments worldwide are enacting policies to reduce emissions, adapt to changing conditions, and incentivize sustainable practices. These policies can include building codes, zoning regulations, carbon taxes, and incentives for renewable energy. Understanding and anticipating these regulatory trends is paramount for investors to make informed decisions.

Changes in building codes, for instance, can significantly impact the development and renovation of properties. Investors need to be aware of these potential regulations and their impact on property values and the feasibility of future projects. Understanding the legal frameworks surrounding climate change impacts, including liability issues and potential insurance restrictions, is also critical for mitigating risk.

Exploring Opportunities in Climate-Resilient Investments

While climate change presents significant challenges, it also creates opportunities for innovative and resilient investments. The growing demand for sustainable and climate-resilient properties is driving a shift towards eco-friendly building practices and materials. Investors can leverage this trend by investing in properties with high energy efficiency ratings, renewable energy systems, and green building certifications. This not only mitigates risk but also potentially enhances the long-term value of the investment.

Furthermore, developing and implementing climate-resilient infrastructure projects, such as flood control systems or drought-resistant water management strategies, presents substantial investment opportunities. These projects can not only enhance the resilience of communities but also generate returns by addressing immediate needs and creating long-term value.

Read more about Climate Risk Analytics: Essential for Real Estate Development

Hot Recommendations

- Sustainable Real Estate Design Principles

- AI in Real Estate: Streamlining the Buying Process

- Climate Risk Disclosure: A Must for Real Estate

- Climate Risk Analytics: Essential for Real Estate Investment Funds

- Modular Sustainable Construction: Scalability and Speed

- Real Estate and Community Disaster Preparedness

- Smart Buildings and Advanced Building Analytics for Optimal Performance

- Smart Waste Sorting and Recycling in Buildings

- Sustainable Real Estate: A Strategic Advantage

- AI in Real Estate Transaction Processing: Speed and Accuracy