AI for Real Estate Market Intelligence Platforms

Real-Time Market Data Analysis with AI

Real-time Data Acquisition

Real-time market data analysis depends fundamentally on capturing data from diverse sources as events unfold. Modern systems employ advanced data streaming technologies that enable professionals to track market movements instantaneously. Well-optimized data pipelines prove essential for managing this constant information flow, guaranteeing analysts work with current figures. This live data feed facilitates rapid reactions to market shifts, a critical capability for time-sensitive decision making.

The enormous data volumes demand resilient infrastructure capable of processing continuous inputs. Specialized computing solutions handle these high-velocity data streams effectively. Maintaining data precision remains crucial since inaccuracies might distort analyses and trigger expensive trading mistakes.

Algorithmic Trading Applications

Contemporary trading strategies increasingly incorporate real-time market analytics. Sophisticated algorithms detect and capitalize on market patterns and irregularities, responding immediately to price and volume changes. The immediacy of real-time data proves indispensable for these automated systems.

Continuous market monitoring enables algorithmic systems to initiate trades automatically when specific conditions occur. This automation potentially increases transaction frequency and improves returns. These systems react faster than human traders, reducing risks associated with emotional decision-making.

Advanced Forecasting Methods

Live market data serves as the foundation for various predictive analytics approaches. Professionals utilize this information to create models forecasting price movements, identifying emerging trends, and evaluating event probabilities. These models span from basic statistical techniques to complex neural networks.

Prediction accuracy depends substantially on data quality and volume. Advanced models integrate multiple variables including economic indicators, news analysis, and social media trends to produce more sophisticated forecasts. However, predictive models should complement rather than replace human expertise.

Data Visualization Techniques

Effective analysis requires clear presentation of real-time findings. Visualization tools help professionals quickly comprehend complex market dynamics and spot hidden patterns. Graphical representations illustrate price changes, trading volumes, and other critical metrics efficiently.

Well-designed visualizations enable rapid identification of market anomalies and opportunities. Skilled interpretation transforms raw data into practical insights. Communicating these findings effectively helps stakeholders make informed decisions.

Predictive Modeling for Future Market Trends

Predictive Modeling Fundamentals

Market forecasting utilizes historical data, economic indicators, and property valuation trends to project future conditions. Statistical methods and machine learning identify data patterns, enabling informed predictions. Data quality significantly impacts reliability, as incomplete information generates questionable forecasts.

These models quantify probable market outcomes, helping investors and firms make strategic decisions. Accurate predictions assist in pricing strategies, investment planning, and anticipating market shifts.

Data Collection and Processing

Effective models require diverse, high-quality data sources including historical sales, demographic information, and economic metrics. Public records and specialized research firms often provide this information.

Data transformation represents a critical phase, converting raw information into usable model inputs. This process might involve creating new variables or analyzing textual data. Proper feature engineering ensures models capture market nuances accurately.

Model Development Process

Selecting appropriate modeling techniques depends on data complexity and desired accuracy. Different algorithms suit various data types and relationships. The selection process typically involves testing multiple approaches.

Training involves feeding historical data to the model, allowing it to recognize patterns. Performance evaluation through cross-validation assesses reliability before practical application.

Performance Evaluation Metrics

Model assessment utilizes statistical measures like R-squared and error calculations. These quantify prediction accuracy against historical data.

Continuous monitoring and updating maintain relevance as markets evolve. Regular model refinement adapts to changing market conditions.

Practical Application of Results

Model outputs provide actionable market insights rather than simple predictions. Understanding driving factors helps professionals adjust strategies effectively.

These insights inform pricing decisions, investment allocations, and development plans. Models serve as decision-support tools rather than absolute solutions.

Industry Applications

Predictive modeling assists in property valuation, rental rate determination, and investment analysis. Case studies demonstrate successful implementations across various markets.

Historical market analysis provides context for improving future modeling applications and enhancing prediction accuracy.

Automated Property Valuation and Comparative Market Analysis

Automated Valuation Systems

Automated valuation technology revolutionizes property assessment through speed and efficiency. These systems analyze extensive datasets using advanced algorithms, reducing traditional appraisal timelines. This approach benefits high-volume markets and areas with limited appraisal resources.

Streamlined valuations accelerate real estate transactions significantly. Faster processing benefits sellers through quicker sales and buyers through rapid financing approvals, enhancing market fluidity. Algorithmic consistency also promotes valuation fairness and transparency.

System Components

Comprehensive datasets form the foundation of automated models, incorporating location, physical characteristics, and comparable sales. Data quality directly affects valuation accuracy. High-quality, well-structured data ensures reliable automated valuations.

Sophisticated analytical algorithms identify property value patterns. Machine learning components enable continuous improvement through new data assimilation.

Implementation Challenges

Potential data biases represent a significant concern, as historical market disparities might influence results. Careful data selection and ongoing monitoring help mitigate this risk.

Maintaining accuracy across diverse markets and property types requires customized solutions. Continuous system refinement ensures relevance amid changing market conditions.

Future Developments

Emerging technologies promise dynamic valuations incorporating real-time market data. This innovation could transform property assessment processes.

Integration with virtual reality and 3D modeling may enhance property visualization and valuation accuracy. Such advancements could improve user experiences and transaction efficiency.

Personalized Recommendations and Targeted Marketing Strategies

AI-Powered Property Matching

Advanced analytics process extensive real estate data to generate customized property suggestions. This technology enables agents to align marketing with buyer preferences, improving transaction success rates. By analyzing location preferences, budgets, and desired features, AI presents optimally matched listings, saving time for all parties. This targeted methodology proves invaluable in competitive markets, helping agents differentiate through personalized service.

Predictive capabilities allow agents to anticipate market shifts and adjust recommendations proactively. Continuous data updates ensure suggestions remain current and valuable throughout the buying process.

Precision Marketing Techniques

AI tools segment potential buyers by demographics and behavior patterns, enabling highly focused campaigns. This approach ensures appropriate messaging reaches relevant audiences efficiently, improving marketing ROI.

Automating routine marketing tasks allows agents to concentrate on relationship building and lead conversion, enhancing overall productivity.

Market Forecasting Applications

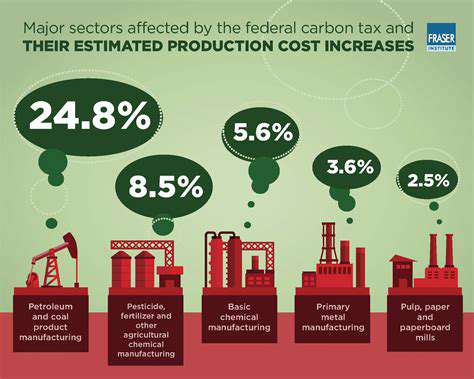

Predictive analytics identify historical patterns to forecast market developments. These insights inform pricing, marketing, and investment decisions, helping professionals navigate dynamic markets effectively.

Data-Driven Pricing Strategies

Analytical models evaluate comparable sales and market conditions to determine optimal listing prices. This approach maximizes property visibility and appeal while ensuring competitive positioning.

Automated Customer Support

AI chatbots provide immediate responses to basic inquiries, improving service accessibility. These tools handle scheduling and information requests, enhancing operational efficiency.

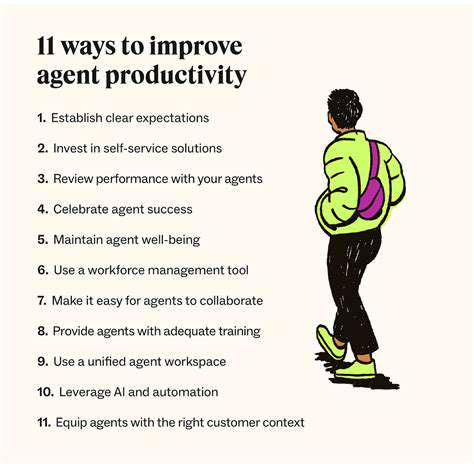

Agent Workflow Optimization

Automating administrative tasks like data entry and report generation allows agents to focus on client interactions. This efficiency improvement enables handling larger transaction volumes while maintaining service quality.

Read more about AI for Real Estate Market Intelligence Platforms

Hot Recommendations

- Sustainable Real Estate Design Principles

- AI in Real Estate: Streamlining the Buying Process

- Climate Risk Disclosure: A Must for Real Estate

- Climate Risk Analytics: Essential for Real Estate Investment Funds

- Modular Sustainable Construction: Scalability and Speed

- Real Estate and Community Disaster Preparedness

- Smart Buildings and Advanced Building Analytics for Optimal Performance

- Smart Waste Sorting and Recycling in Buildings

- Sustainable Real Estate: A Strategic Advantage

- AI in Real Estate Transaction Processing: Speed and Accuracy