AI Powered Valuation for Specialized Properties

Traditional valuation methods, though foundational in finance, frequently fall short when assessing contemporary enterprises. These approaches, typically dependent on backward-looking data and standardized financial reports, prove inadequate for firms with unconventional structures, substantial intangible assets, or exponential growth patterns. Recognizing these shortcomings becomes imperative for sound investment choices.

For decades, discounted cash flow models and peer comparisons formed valuation bedrock. Yet these techniques presume stability that evaporates in turbulent sectors or during technological upheaval. Anchoring valuations to historical trends frequently yields misleading results in fluid market conditions. Moreover, the reliability of these methods hinges entirely on input data quality and the reasonableness of underlying assumptions.

Challenges in Capturing Intangible Assets

Traditional approaches particularly falter when quantifying intangible assets like brand equity, patents, or customer loyalty - elements that increasingly define corporate value. These critical yet amorphous assets resist straightforward financial measurement. Conventional models often exclude such factors, potentially obscuring a company's genuine market position.

The subjective nature of intangible asset valuation inevitably introduces estimation variances. When analyses focus exclusively on physical assets and past financials, they disregard potential value drivers that could determine future success.

Oversimplification of Market Dynamics

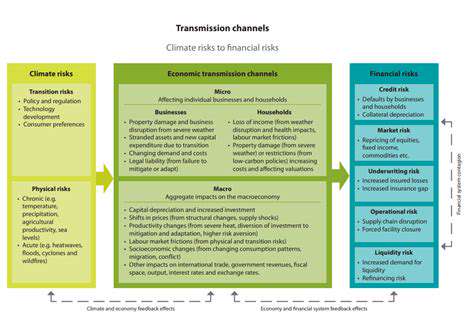

Classic valuation frameworks frequently present reductive views of market behavior. They typically model static conditions, ignoring transformative elements like regulatory evolution, technological breakthroughs, or changing consumer habits. These external forces dramatically influence corporate trajectories yet rarely feature adequately in traditional assessments.

Failure to incorporate these variables distorts future performance projections. Additionally, conventional methods often underestimate disruption risks and competitive threats, yielding incomplete evaluations of a company's prospects.

The Impact of Rapid Growth and Disruption

High-growth ventures and disruptive innovators pose unique valuation challenges. Their volatile financial patterns defy traditional forecasting techniques. Standard methods struggle to accommodate the uncertainty inherent in these dynamic environments.

Such fluid sectors demand valuation approaches that prioritize adaptability and forward vision. Rigid traditional frameworks lack the necessary flexibility to assess these evolving business landscapes accurately.

Beyond the Transactional Data: Integrating Expert Knowledge

Leveraging Expertise for Enhanced Accuracy

While AI systems process vast datasets, they may overlook sector-specific complexities. Human expertise bridges this gap by contextualizing algorithmic outputs. Specialist input - whether through parameter adjustments, custom algorithms, or qualitative annotations - refines valuations by incorporating elements like historical context, market psychology, and industry peculiarities that pure data analysis might miss. This synthesis produces more reliable assessments.

Enhancing Model Robustness with Domain-Specific Knowledge

Subject-matter expertise significantly strengthens AI valuation models. Industry veterans can identify data biases, refine modeling assumptions, and highlight critical factors that automated systems might disregard. This collaborative approach creates more resilient valuation systems capable of weathering market volatility.

Improving Model Interpretability and Explainability

The black box nature of AI valuation poses significant adoption barriers. Expert involvement demystifies model outputs by providing logical frameworks for algorithmic decisions. This transparency builds stakeholder confidence, particularly in high-value financial decisions.

Identifying and Addressing Data Gaps

Specialists play crucial roles in detecting and remedying dataset deficiencies. Their guidance directs targeted data collection and augmentation strategies, ensuring AI systems train on comprehensive, representative market information.

Validating AI-Generated Valuations with Human Oversight

AI outputs require expert verification to ensure alignment with market realities. Human scrutiny catches algorithmic anomalies and confirms valuation plausibility, maintaining essential checks on automated systems.

Developing Customized AI Models for Specific Industries

Valuation paradigms vary dramatically across sectors. Expert-informed AI customization tailors models to industry-specific value drivers, yielding more precise assessments. This specialization enhances relevance and accuracy for niche markets.

The Future of AI-Powered Valuation in Specialized Markets

AI's Impact on Specialized Market Valuation

Artificial intelligence revolutionizes niche market valuations by processing complex datasets beyond human capacity. From fine art to vintage automobiles, AI detects subtle pricing patterns that elude conventional methods. This proves particularly valuable in markets where limited historical data combines with subjective value determinants.

Enhanced Accuracy and Efficiency

AI valuation reduces human subjectivity while dramatically accelerating assessment timelines. Machine analysis identifies non-obvious data correlations, producing more objective valuations in fractions of traditional timeframes - a critical advantage in fast-moving markets.

Addressing Data Scarcity in Specialized Markets

For markets with sparse transaction histories, AI synthesizes alternative data streams - market indicators, expert sentiment, and public records - to construct robust valuation frameworks where traditional methods flounder.

Overcoming Subjectivity and Bias

Algorithmic valuation minimizes human preconceptions that distort traditional appraisals. This objectivity fosters market transparency and fairness, building participant confidence in pricing mechanisms.