Climate Risk and Real Estate Lending: Assessing Portfolio Exposure

Identifying and Quantifying Climate-Related Risks

Understanding Climate-Related Risks in Real Estate Lending

Assessing climate-related risks is becoming increasingly crucial for real estate lenders. These risks encompass a broad spectrum, from the direct impacts of extreme weather events like hurricanes and floods to the more insidious long-term effects of rising sea levels and changing precipitation patterns. Understanding the specific vulnerabilities of a property, a neighborhood, or even a region to these risks is paramount. This involves analyzing historical climate data, future projections, and the potential for physical damage to structures and infrastructure, as well as the impact on property values and rental income streams.

A comprehensive approach to identifying climate-related risks requires more than just looking at historical data. Lenders need to consider the potential for future changes in climate patterns, incorporating projections and modeling to understand the likelihood and severity of future events. This proactive approach allows for better risk assessment and the development of strategies to mitigate potential losses. Crucially, the analysis must extend beyond the immediate physical property to encompass the surrounding environment and potential cascading effects, including infrastructure damage and disruptions to supply chains that can impact property values and rental rates.

Quantifying Climate-Related Risks for Loan Decisions

Quantifying the financial implications of climate-related risks is essential for responsible lending practices. This involves developing methods to estimate the potential losses associated with different types of climate events and scenarios. For example, modeling the potential for flood damage to a property, considering the projected increase in flood risk due to sea level rise, and incorporating the resulting financial impact on the loan portfolio is a critical step.

Developing a robust framework for quantifying climate-related risks necessitates the use of sophisticated analytical tools and data. These tools can help lenders assess the probability and potential severity of various climate-related events, enabling them to make informed decisions about loan approvals, pricing, and collateral valuation. The incorporation of climate data into existing risk models and loan underwriting processes is a crucial step toward mitigating financial losses and safeguarding the long-term viability of the real estate lending portfolio. Furthermore, robust data collection and analysis are needed to understand and account for the specific climate vulnerabilities of different geographic locations and property types. Using this quantitative approach, lenders can better assess the true financial risk associated with each loan application and make more informed, risk-adjusted decisions.

Beyond the direct financial impact on the property itself, lenders need to consider the indirect economic consequences of climate change. Disruptions to local economies and businesses, due to extreme weather events or long-term climate shifts, can also affect the value of a property and the stability of the surrounding market. Accountability for and consideration of these indirect consequences are critical to comprehensive risk assessment.

The Future of Climate Risk Management in Real Estate Lending

The Evolving Landscape of Climate Threats

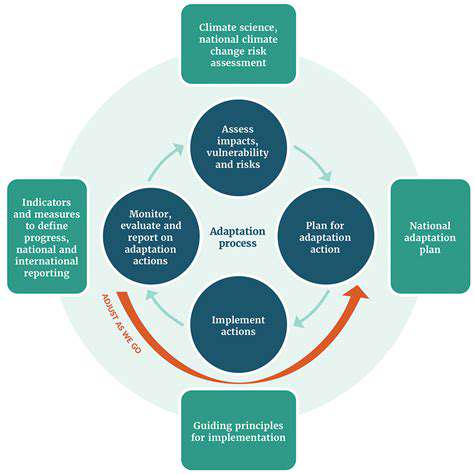

Climate change is no longer a distant threat; its impacts are being felt globally, from extreme weather events to rising sea levels. The frequency and intensity of these events are increasing, demanding a proactive and adaptable approach to climate risk management. This necessitates a shift from reactive measures to preventative strategies, focusing on resilience and mitigation.

Understanding the evolving nature of climate risks is critical. These risks are becoming more complex and interconnected, impacting various sectors, including agriculture, infrastructure, and human health, in ways that were previously unforeseen. This complexity underscores the importance of integrated approaches to climate risk management.

Integrating Climate Considerations into Policy and Planning

Governments and organizations need to incorporate climate change projections into their policies and planning processes. This includes developing adaptation strategies to address the unavoidable impacts of climate change and mitigation strategies to reduce greenhouse gas emissions. Developing policies that prioritize sustainability and resilience will be crucial in building a future that is both environmentally sound and economically viable.

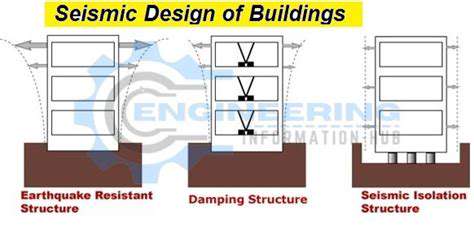

Investing in Climate-Resilient Infrastructure

Investing in infrastructure that can withstand the impacts of climate change is paramount. This includes strengthening existing infrastructure, such as roads, bridges, and buildings, and designing new infrastructure to accommodate anticipated climate risks. This investment is not just about physical structures, but also about creating resilient communities that can recover and adapt quickly in the face of climate-related disasters.

Enhancing Climate Risk Modeling and Forecasting

Advancements in climate modeling and forecasting are critical for improving our ability to anticipate and prepare for climate-related events. These advancements allow for more precise predictions of extreme weather events and their potential impacts, enabling stakeholders to develop effective mitigation and adaptation strategies. The increasing sophistication of climate models provides valuable insights into future scenarios, empowering us to make informed decisions and invest in appropriate measures.

Promoting International Collaboration and Knowledge Sharing

Climate change is a global challenge that requires international collaboration and knowledge sharing. The exchange of best practices, technologies, and resources among nations is essential for developing and implementing effective climate risk management strategies. By working together, countries can pool their resources, expertise, and knowledge to address this common challenge. This collaborative approach will be instrumental in creating a more sustainable and resilient global future.

The Role of Public Awareness and Education

Raising public awareness about climate change and its risks is essential for effective climate risk management. Educating the public about the impacts of climate change and the importance of individual actions, such as reducing energy consumption and adopting sustainable practices, is crucial. Empowering individuals with the knowledge and tools to make informed choices is vital in fostering a culture of climate action. Promoting climate literacy can encourage a wider range of individuals and communities to take responsibility for their role in mitigating and adapting to climate change.

Read more about Climate Risk and Real Estate Lending: Assessing Portfolio Exposure

Hot Recommendations

- Sustainable Real Estate Design Principles

- AI in Real Estate: Streamlining the Buying Process

- Climate Risk Disclosure: A Must for Real Estate

- Climate Risk Analytics: Essential for Real Estate Investment Funds

- Modular Sustainable Construction: Scalability and Speed

- Real Estate and Community Disaster Preparedness

- Smart Buildings and Advanced Building Analytics for Optimal Performance

- Smart Waste Sorting and Recycling in Buildings

- Sustainable Real Estate: A Strategic Advantage

- AI in Real Estate Transaction Processing: Speed and Accuracy