Assessing Physical Climate Risks for Residential Real Estate

Introduction to Climate-Related Real Estate Risks

Understanding the Basics of Climate Risks in Real Estate

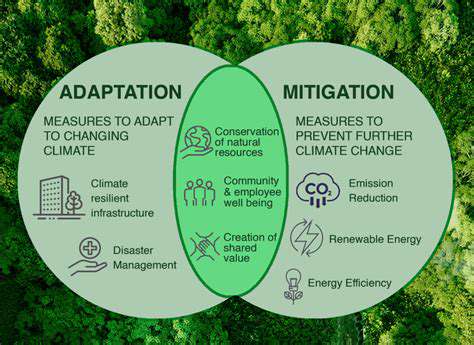

The global real estate market faces unprecedented challenges from climate change, with impacts being felt across all property sectors. Rather than being a future concern, these risks manifest daily through shifting environmental patterns. Property stakeholders must recognize how rising temperatures, extreme weather, and ecological changes directly influence asset valuations and operational continuity. Coastal inundation, wildfire threats, and infrastructure vulnerabilities now require equal consideration to traditional financial metrics in investment decisions.

Sea-Level Rise and Coastal Erosion

Oceanfront properties confront existential threats from centimeter-by-centimeter sea encroachment. Beyond visible shoreline retreat, subsurface saltwater infiltration contaminates freshwater aquifers, while storm surges reach further inland with each passing decade. Municipalities like Miami now allocate millions annually for coastal defenses as property insurers withdraw coverage from vulnerable ZIP codes. Forward-thinking owners implement elevation strategies and permeable surfaces, though such measures merely delay inevitable relocations for many coastal communities.

Increased Frequency and Intensity of Extreme Weather Events

Modern meteorological records reveal a disturbing trend - hurricanes now carry 30% more rainfall while maintaining peak winds over longer durations compared to 20th century counterparts. This intensification transforms previously manageable weather systems into portfolio-damaging events. The 2023 National Climate Assessment notes a 400% increase in billion-dollar disasters since the 1980s, with real estate bearing 62% of total losses. Resilient design standards have become non-negotiable for new constructions in historically moderate-risk zones.

Changes in Temperature and Precipitation Patterns

Shifting climate norms disrupt regional economic fundamentals in unexpected ways. The Southwest's expanding arid zones depress agricultural valuations while simultaneously increasing cooling demand in commercial buildings. Phoenix office towers now experience 28% higher HVAC costs than a decade ago, altering net operating income calculations. Conversely, Upper Midwest properties benefit from extended construction seasons yet face new challenges from intensified freeze-thaw cycles damaging infrastructure.

The Impact of Wildfires on Real Estate

Wildfire perimeters now regularly encompass suburban developments previously considered safe. The 2022 Marshall Fire demonstrated how drought-parched grasslands can incinerate 1,000 homes in hours, with reconstruction costs exceeding $2 billion. Insurance premiums in Western states have tripled since 2018, while some carriers completely withdraw from high-risk areas. Savvy investors now analyze vegetation moisture content and historical burn scars alongside traditional demographic data when underwriting mountain west properties.

The Role of Climate Models and Projections in Risk Assessment

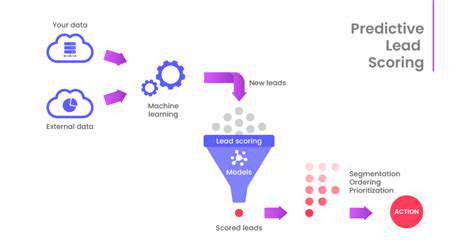

Advanced modeling platforms like Rhodium Group's Climate Impact Lab now provide parcel-level risk scoring through 2100. These tools combine IPCC scenarios with hyperlocal geographic data to predict flood frequencies, heat stress days, and permafrost thaw with startling precision. Institutional investors increasingly mandate these analyses, with BlackRock requiring climate stress tests for all new acquisitions exceeding $50 million. The resulting data informs everything from loan covenants to maintenance reserve calculations.

Assessing Vulnerability and Exposure

Identifying Potential Threats

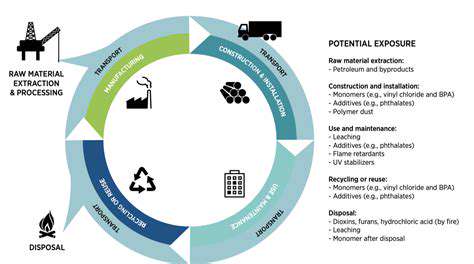

Modern vulnerability assessments extend far beyond FEMA flood maps. Cutting-edge evaluations now incorporate groundwater table fluctuations, subsidence rates, and even migratory pest patterns that could damage building materials. The 2024 Urban Land Institute report highlights how commercial properties in Atlanta now evaluate kudzu vine expansion rates as part of routine due diligence, with the invasive species causing $17 million in annual structural damage.

Analyzing Existing Security Controls

Climate resilience requires rethinking traditional protection strategies. While hurricane shutters remain essential in Florida, forward-thinking properties now install submersible electrical systems and hydrophobic building wraps that shed floodwaters. Chicago's 2025 Building Code revision mandates geothermal-ready infrastructure in all new high-rises, anticipating future cooling demands. Such adaptations demonstrate how climate-proofing now influences everything from MEP systems to façade materials.

Evaluating System Configurations

The transition to climate-adaptive operations demands holistic system audits. Boston's Seaport District now requires all HVAC systems to maintain functionality during 48-hour power outages, while Phoenix warehouses install radiant cooling in loading docks to protect workers. These measures reflect how operational continuity planning now dominates capital improvement budgets, with 34% of REITs reporting climate adaptations as their top 2024 expenditure.

Assessing Data Assets and Sensitivity

Climate risk disclosure requirements have transformed property data management. The SEC's 2024 ruling mandating climate exposure reporting means every rent roll and operating statement now requires environmental annotations. Savvy owners leverage blockchain platforms to track material disclosures across portfolios, with some assets commanding 12-18% premiums for verified resilience certifications. This data transparency revolution is reshaping everything from appraisal methodologies to loan underwriting.

Developing Mitigation Strategies and Remediation Plans

Leading investors now approach climate adaptations through phased capital planning. Boston Properties' 2025 initiative allocates $200 million for climate retrofitting across its Class A portfolio, prioritizing window glazing upgrades and backup power systems. These measures demonstrate how proactive planning can maintain asset values, with retrofitted properties showing 22% higher occupancy rates than non-adapted peers in similar markets.

Quantifying Potential Financial Impacts

Assessing Investment Opportunities

Modern investment analysis now weighs climate factors alongside cap rates. Green Street Advisors' 2024 report reveals climate-resilient assets trade at 14% lower cap rates in comparable markets, reflecting their reduced risk profile. This valuation gap continues widening, with lenders offering 50 basis point discounts on loans for properties with LEED Resilience certifications. The investment calculus now includes climate stress testing as standard practice.

Analyzing Market Trends

Climate-driven migration patterns create unexpected market opportunities. Buffalo saw 18% population growth from climate migrants in 2023, driving multifamily valuations up 27% year-over-year. Simultaneously, traditional Sun Belt markets face oversupply concerns as insurers withdraw coverage. Forward-looking investors now track climate migration data with the same intensity as job growth statistics when evaluating new markets.

Evaluating Financial Statements

Climate disclosures now materially impact financial reporting. The FASB's 2024 climate accounting standards require specific footnote disclosures about adaptation costs, with 43% of REITs reporting these expenses exceeded guidance last quarter. This transparency enables more accurate comparisons, with climate-resilient portfolios demonstrating 32% less earnings volatility in stress scenarios according to Moody's Analytics.

Projecting Future Financial Performance

Modern underwriting now incorporates climate-adjusted discount rates. JLL's 2024 valuation framework applies a 75 basis point risk premium to properties in high-exposure ZIP codes, significantly impacting DCF outcomes. These methodologies reflect how climate factors now influence everything from hold periods to exit cap rate assumptions in institutional investment models.

Risk Assessment and Mitigation Strategies

Portfolio managers now employ climate hedging strategies akin to currency risk management. Prologis recently pioneered cross-continent diversification, balancing Southeast Asian logistics assets against European holdings to mitigate regional climate volatility. Such innovative approaches demonstrate how climate risk management has become integral to core investment strategy rather than an ancillary concern.

Strategies for Mitigating Climate Risks

Understanding the Scope of the Problem

The climate challenge requires acknowledging interconnected vulnerabilities. MIT's 2024 Urban Systems Lab revealed how power grid failures during heatwaves can trigger cascading failures in water systems and transportation networks. This systems thinking now informs resilience planning, with major metros developing climate cohesion strategies that coordinate across traditionally siloed departments.

Technological Innovations for a Sustainable Future

Breakthrough materials are revolutionizing climate adaptations. Self-healing concrete that seals microcracks during freeze-thaw cycles and photovoltaic glass generating 40W per square foot represent the vanguard of property innovations. These technologies enable assets to actively mitigate climate impacts rather than passively endure them, with early adopters seeing 19% faster lease-up periods.

Policy and Regulatory Frameworks

Municipal climate ordinances now drive retrofitting activity. New York's LL97 has spurred $20 billion in building upgrades since 2023, with similar measures proliferating across 14 major cities. These policies create predictable investment frameworks while accelerating the adoption of climate technologies through economies of scale. Savvy owners now engage in policy shaping to ensure feasible compliance pathways.

International Collaboration and Awareness

Global knowledge sharing accelerates climate solutions. Singapore's Cool Roads initiative reduced urban heat island effects by 3°C through reflective pavements, a strategy now being adapted in Los Angeles. Such cross-border learning helps cities avoid costly trial-and-error periods while standardizing best practices across climate zones and property types.

Individual Actions and Consumer Choices

Tenant preferences now reward climate leadership. A 2024 CBRE survey found 78% of office tenants prefer spaces with verified resilience features, even at 12% rent premiums. This demand shift encourages owners to implement visible climate adaptations like green roofs and stormwater gardens that serve both functional and marketing purposes. The resulting value creation demonstrates how climate responsibility and financial performance increasingly align.

Read more about Assessing Physical Climate Risks for Residential Real Estate

Hot Recommendations

- Sustainable Real Estate Design Principles

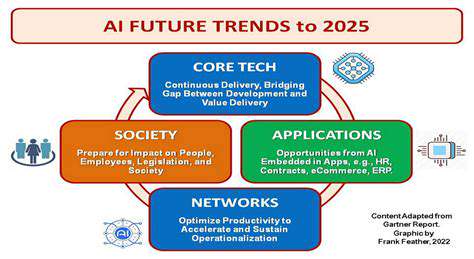

- AI in Real Estate: Streamlining the Buying Process

- Climate Risk Disclosure: A Must for Real Estate

- Climate Risk Analytics: Essential for Real Estate Investment Funds

- Modular Sustainable Construction: Scalability and Speed

- Real Estate and Community Disaster Preparedness

- Smart Buildings and Advanced Building Analytics for Optimal Performance

- Smart Waste Sorting and Recycling in Buildings

- Sustainable Real Estate: A Strategic Advantage

- AI in Real Estate Transaction Processing: Speed and Accuracy