Automated Valuation Models (AVMs): The AI Advantage

Understanding the Value of Data

Data-driven insights are crucial for any organization, and particularly vital for an Asset Valuation Management (AVM) system. Data allows for a more precise and objective assessment of asset values, minimizing subjective biases. By leveraging historical transaction data, market trends, and other relevant information, AVM systems can provide a more accurate reflection of current market conditions.

The sheer volume and variety of data available today, from public records to proprietary market research, can be overwhelming. However, effectively processing and interpreting this data is critical for producing reliable and actionable AVM insights.

Identifying Key Performance Indicators (KPIs)

Establishing relevant KPIs is essential for evaluating the success of an AVM system. These KPIs need to be specific, measurable, achievable, relevant, and time-bound (SMART). For example, one KPI could be the accuracy of the predicted asset values compared to actual sale prices.

Another critical KPI might be the time taken to generate an asset valuation. A fast and efficient AVM system is essential for timely decision-making within the organization.

Leveraging Machine Learning

Machine learning algorithms can be invaluable for identifying patterns and trends in large datasets, thereby enhancing the accuracy of AVM predictions. These algorithms can learn from past data to anticipate future market movements and adjust valuations accordingly.

Machine learning models can adapt to changing market conditions, making the AVM system more robust and reliable, unlike traditional methods that may struggle to keep up with dynamic market fluctuations.

Analyzing Market Trends

A critical component of any AVM system is the analysis of current and historical market trends. Understanding these trends, whether it's interest rates, economic indicators, or local regulations, provides valuable context for asset valuation.

By analyzing these trends, an AVM system can provide insights into potential future price movements, enabling proactive decision-making by stakeholders.

Integrating External Data Sources

AVM systems are significantly enhanced by the integration of various external data sources. This might include real estate transaction data from public records, market reports from industry experts, or even social media sentiment analysis about particular properties.

The more diverse and reliable data sources integrated into the AVM system, the more robust and accurate the valuations will be. This integration is key to generating comprehensive and useful insights.

Improving Valuation Accuracy

One of the primary goals of a data-driven AVM is to improve the accuracy of asset valuations. This is achieved through rigorous data analysis, the refinement of algorithms, and the incorporation of diverse data sources. Continuous refinement of the AVM system is essential to maintain the accuracy of its valuations.

Ultimately, greater accuracy in asset valuations leads to better decision-making throughout the organization, from investment strategies to operational efficiency.

Ensuring Data Security and Privacy

Data security and privacy are paramount when dealing with sensitive information, such as property valuations. Robust security measures need to be implemented to protect confidential data from unauthorized access or breaches. Compliance with relevant regulations is also crucial.

Implementing strong data encryption and access controls is essential for safeguarding the integrity and confidentiality of the data used in the AVM system. This builds trust and confidence in the system's reliability.

Beyond Basic Metrics: Advanced AVM Capabilities

Understanding the nuances of Advanced Valuation Models

Advanced Valuation Models (AVMs) go beyond basic metrics like square footage and lot size to consider a wider range of factors influencing property value. These models incorporate data points such as comparable sales, recent market trends, and even neighborhood amenities. This detailed approach provides a more comprehensive and nuanced understanding of a property's worth, often proving more accurate than basic methods.

By utilizing various algorithms and statistical techniques, AVMs can predict property values with greater precision. This deeper analysis can help in making better-informed real estate decisions, whether you're a buyer, seller, or investor.

Factors Influencing Advanced AVM Accuracy

The accuracy of an advanced AVM hinges significantly on the quality and comprehensiveness of the data used in its development. Reliable and up-to-date data sources are crucial for producing dependable and accurate valuations. Data points like recent sales, property characteristics, and market conditions need to be meticulously gathered and rigorously analyzed.

Furthermore, the algorithms employed in the model play a vital role. Sophisticated algorithms, capable of identifying complex relationships and patterns within the data, are essential for generating accurate predictions.

Application in Real Estate Transactions

Advanced AVMs are increasingly used in various real estate transactions, from residential sales to commercial property valuations. They provide valuable insights for both buyers and sellers, enabling them to make more informed decisions regarding pricing and negotiation strategies. This is particularly helpful in competitive markets where accurate valuation is key to successful outcomes.

Real estate professionals also leverage AVMs to gain a deeper understanding of market trends and fluctuations, allowing them to better advise their clients on optimal strategies for investment and property acquisition.

Limitations of Advanced Valuation Models

While advanced AVMs offer significant advantages, it's important to acknowledge their limitations. The complexity of these models can sometimes mask underlying issues with the data or the algorithms used. This means that relying solely on an AVM without a thorough review and consideration of local market conditions can lead to inaccurate conclusions.

Subjectivity and human judgment remain essential components in real estate transactions. While AVMs provide valuable data, they should not replace professional appraisal services or comprehensive market research.

The Future of Advanced Valuation Models

The development of advanced AVMs is continuously evolving, driven by advancements in data science and machine learning. Future models are likely to incorporate even more sophisticated data points, including social media trends, environmental factors, and economic indicators. This ongoing evolution promises to enhance the accuracy and reliability of property valuations.

The integration of artificial intelligence and machine learning is also expected to streamline the valuation process, making it faster and more accessible to a wider range of users.

The Future of Real Estate Valuation: A Collaborative Approach

Data-Driven Insights for Enhanced Accuracy

Real estate valuation is undergoing a significant transformation, driven by the increasing availability and sophistication of data. Automated valuation models (AVMs) are leveraging vast datasets, including property characteristics, market trends, and comparable sales, to generate more precise and timely valuations. This data-driven approach allows for a more nuanced understanding of market forces, leading to valuations that reflect current market conditions with greater accuracy. Furthermore, the continuous updating of these datasets ensures that valuations remain relevant and responsive to dynamic market fluctuations.

The Rise of Artificial Intelligence (AI) in Valuation

AI algorithms are playing a pivotal role in enhancing the capabilities of AVMs. Machine learning models, trained on extensive datasets, can identify complex patterns and relationships within the data that would be difficult for human analysts to discern. This allows for more sophisticated and accurate estimations of property values, even in less-traded or unconventional markets. The integration of AI into the valuation process promises to accelerate the speed and efficiency of the entire process, while also improving the consistency and reliability of results.

Collaboration between Human Expertise and AI

While AI and automation are revolutionizing real estate valuation, human expertise remains indispensable. The integration of AI into the process should not be viewed as a replacement for human judgment, but rather as a powerful tool to augment and enhance it. Experienced appraisers can leverage AI-generated valuations as a starting point, critically reviewing them for accuracy and contextualizing them based on local knowledge, property-specific conditions, and unique market dynamics. This collaborative approach ensures a robust and reliable valuation process that incorporates both the power of data and the insights of human experience.

Improving Transparency and Accessibility

A key benefit of automated valuation models is the potential for increased transparency and accessibility. By providing a clear and detailed breakdown of the factors contributing to a valuation, AVMs can help stakeholders understand the reasoning behind the assessment. This transparency can foster trust and confidence in the valuation process, particularly in situations where multiple parties are involved, such as mortgage lending or investment decisions. Furthermore, the accessibility of online valuation tools can empower individuals and businesses to gain insights into property values without the need for extensive expertise or significant financial resources.

Overcoming Challenges and Ensuring Ethical Use

While the future of real estate valuation holds significant promise, it's crucial to address the potential challenges and ensure responsible use of these technologies. Ensuring the accuracy and reliability of AI-generated valuations, mitigating biases within the data, and establishing clear guidelines for the ethical use of these tools are crucial steps in ensuring the long-term success and integrity of the valuation process. Ongoing research and development, coupled with robust regulatory frameworks, are essential to fully realize the benefits of automated valuation while safeguarding the interests of all stakeholders.

Read more about Automated Valuation Models (AVMs): The AI Advantage

Hot Recommendations

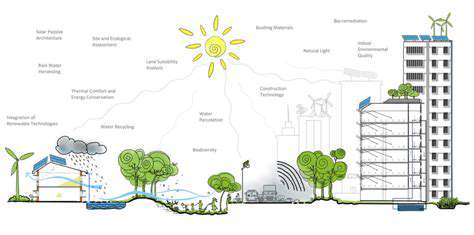

- Sustainable Real Estate Design Principles

- AI in Real Estate: Streamlining the Buying Process

- Climate Risk Disclosure: A Must for Real Estate

- Climate Risk Analytics: Essential for Real Estate Investment Funds

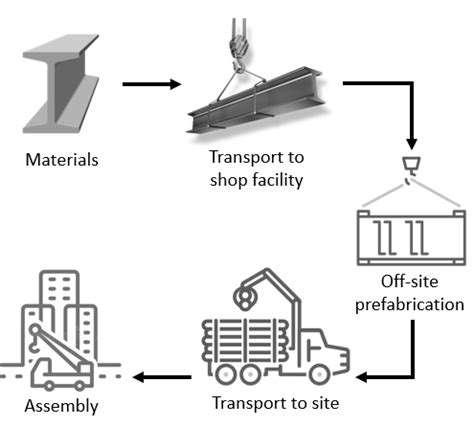

- Modular Sustainable Construction: Scalability and Speed

- Real Estate and Community Disaster Preparedness

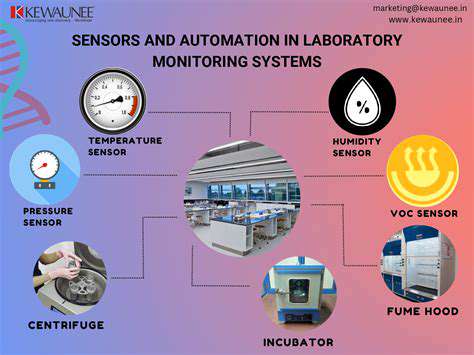

- Smart Buildings and Advanced Building Analytics for Optimal Performance

- Smart Waste Sorting and Recycling in Buildings

- Sustainable Real Estate: A Strategic Advantage

- AI in Real Estate Transaction Processing: Speed and Accuracy