AI Driven Real Estate Valuations: Beyond the Hype

Historical Approaches to Valuation

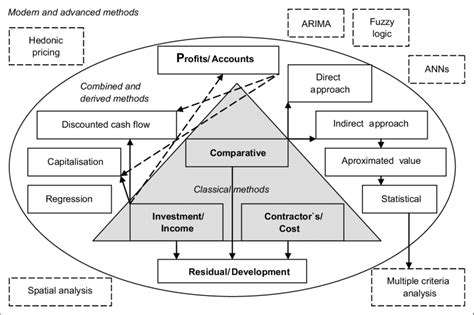

Early real estate valuation methods often relied on simple comparisons of similar properties. This involved assessing comparable sales in a given area, considering factors like size, location, and condition. These basic techniques, while rudimentary, formed the groundwork for more sophisticated valuation methods that followed. Understanding historical approaches provides valuable context for understanding modern valuation practices.

The evolution of these approaches has been significantly shaped by changes in the economic and social landscape. For example, during periods of rapid urban development, valuation methods needed to adapt to account for new construction and changing neighborhood characteristics. This highlights the dynamic nature of real estate valuation and the continuous need for adaptation.

The Role of Market Conditions

Current market conditions play a crucial role in determining property values. Factors like interest rates, inflation, and economic growth all exert significant influence on the demand for real estate. Understanding these market forces is paramount for accurate valuation.

Supply and demand dynamics are critical indicators. A shortage of available properties in a given market can drive up prices, while an overabundance can depress them. This interplay between supply and demand is a fundamental aspect of any real estate valuation process.

The Impact of Economic Cycles

Real estate values are intrinsically linked to broader economic cycles. During periods of economic expansion, demand for properties tends to increase, leading to higher values. Conversely, during recessions, demand often falls, resulting in lower property values. Understanding these cyclical patterns is vital for effective valuation.

Economic downturns can significantly impact real estate markets. Reduced investor confidence, job losses, and decreased consumer spending all contribute to the decline in property values during these times. These factors are critical to consider when assessing the potential impact on real estate values.

The Influence of Location and Amenities

Location is arguably the most crucial factor in determining a property's value. Proximity to amenities like schools, hospitals, shopping centers, and transportation hubs all affect desirability and consequently, value. A property in a desirable location will typically command a higher price than one in a less desirable location.

The quality of local amenities also plays a significant role. Well-maintained parks, vibrant community centers, and safe neighborhoods all contribute to a property's appeal and ultimately its value. Careful consideration of these factors is essential for accurate real estate valuation.

The Integration of Technology

Technology has revolutionized the real estate valuation process. Online real estate portals provide access to vast amounts of data on comparable properties, allowing for more comprehensive analysis and comparisons. Modern valuation tools utilize advanced algorithms and sophisticated analytical techniques to provide insights that were previously unavailable.

The use of aerial photography and 3D modeling in real estate valuation provides a more comprehensive understanding of property features and surroundings. These advancements enhance accuracy and efficiency in the process, resulting in more precise valuations.

Modern Valuation Techniques

Modern valuation techniques often incorporate a combination of approaches, including discounted cash flow analysis, comparable sales analysis, and income capitalization methods. These methods allow for a more thorough and multifaceted assessment of a property's value. Combining these techniques provides a more robust understanding of the property's intrinsic worth and future potential.

Appraisers are increasingly utilizing data analytics and predictive modeling to forecast future market trends and their impact on property values. This forward-looking perspective is crucial for making informed decisions in the real estate market.

AI's Role in Data Aggregation and Analysis: Unveiling Hidden Insights

AI-Powered Data Collection: A New Era

Artificial intelligence is revolutionizing data aggregation, moving beyond traditional methods to encompass a wider range of data sources. This includes not only structured data from databases but also unstructured data like text from social media posts, sensor readings, and even audio recordings. AI algorithms excel at identifying and extracting relevant information from these diverse sources, automating the process and significantly increasing the speed and scale of data collection. This automated approach reduces the time and resources needed for manual data entry and curation, allowing organizations to focus on higher-value tasks.

The sheer volume and velocity of modern data streams are simply overwhelming for human analysts. AI's ability to sift through petabytes of information, identify patterns, and flag anomalies is crucial for uncovering hidden insights. This capacity to process vast datasets efficiently is transforming how businesses and researchers approach data analysis, opening doors to opportunities previously unimaginable.

Intelligent Data Processing: Beyond Basic Aggregation

AI isn't just about collecting data; it's about processing it intelligently. Advanced algorithms can perform complex tasks such as data cleaning, transformation, and normalization. This ensures that the data is accurate, consistent, and readily usable for analysis. AI can identify and handle missing values, outliers, and inconsistencies, significantly improving the quality and reliability of the data used in subsequent analysis.

Furthermore, AI algorithms can identify complex relationships and correlations within the data that might go unnoticed by human analysts. This ability to uncover hidden patterns allows for more sophisticated insights and the development of more accurate predictive models.

Unveiling Hidden Insights Through Analysis: A Deeper Look

AI-powered analysis extends beyond basic descriptive statistics. Machine learning models can identify trends, predict future outcomes, and uncover causal relationships. This capability is invaluable for businesses seeking to anticipate market fluctuations, personalize customer experiences, or optimize operational processes. By understanding the underlying drivers of observed phenomena, businesses can make more informed decisions and achieve a greater return on investment.

The Future of Data Aggregation and Analysis: Enhanced Collaboration

The synergy between AI and human analysts is paramount. AI can automate repetitive tasks, freeing up human analysts to focus on higher-level tasks such as interpretation, contextualization, and strategic decision-making. This collaborative approach ensures that insights derived from data analysis are not only accurate but also relevant and actionable. This collaboration also allows for continuous improvement of the AI models themselves, creating a virtuous cycle of increasing accuracy and efficiency.

The integration of AI into data aggregation and analysis is not just about increasing efficiency; it's about unlocking a new era of knowledge discovery. This technology has the potential to transform industries, improve decision-making, and create a more data-driven world.

The Benefits of AI-Driven Valuation: Speed, Efficiency, and Objectivity

AI-Powered Efficiency in Valuation

AI-driven valuation tools automate many repetitive tasks, significantly reducing the time and resources needed for traditional methods. This increased efficiency allows analysts to focus on more complex aspects of the valuation process, ultimately leading to more insightful and comprehensive reports. By streamlining the data collection and analysis phases, AI frees up valuable time and human capital for deeper strategic insights. This is particularly beneficial for large-scale valuations, where the sheer volume of data can be overwhelming for human analysts to process effectively.

Moreover, AI can process vast amounts of data far more quickly than humans, enabling real-time updates and adjustments to valuations as market conditions change. This agility is crucial in dynamic markets, where rapid changes in economic factors can significantly impact asset values.

Enhanced Accuracy and Objectivity

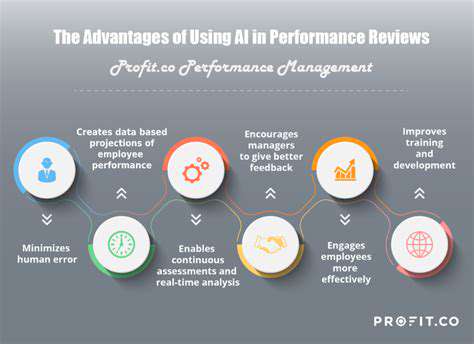

AI algorithms can identify subtle patterns and correlations in data that might be missed by human analysts. This ability to uncover hidden insights leads to more accurate and objective valuations. Algorithms are trained on large datasets, reducing the risk of human bias and ensuring a more consistent and reliable evaluation process. This is particularly important in complex valuations, where nuanced factors and intricate relationships can significantly affect the final assessment.

The use of AI minimizes the subjectivity inherent in traditional valuation methods. This objective approach fosters greater transparency and trust in the valuation process, crucial for stakeholders involved in investment decisions.

Improved Valuation Speed

AI-driven valuation platforms can process extensive datasets and perform complex calculations at a speed unmatched by human analysts. This speed advantage allows for significantly faster turnaround times, enabling quicker decision-making and market responsiveness. Valuations are completed much faster, often within hours or days, compared to the weeks or months it may take for traditional methods. This rapid turnaround time is critical for businesses requiring immediate valuation results, such as mergers and acquisitions.

Reduced Cost of Valuation

Automation through AI often lowers the overall cost of valuation. By reducing the need for extensive human labor, the cost of personnel is minimized. This can lead to a significant reduction in valuation fees, making it more accessible to smaller businesses or those with limited budgets. Furthermore, AI-powered platforms often have lower ongoing maintenance costs compared to employing a team of valuation experts.

Increased Data Integration and Analysis

AI can integrate data from diverse sources, encompassing financial statements, market trends, and economic indicators. This comprehensive approach provides a more holistic view of the asset being valued. By combining disparate data points, AI algorithms can identify previously hidden correlations and create more comprehensive valuation models. This enhanced data integration improves the accuracy and reliability of the final valuation.

Transparency and Auditability

AI-driven valuation processes are often more transparent and auditable than traditional methods. The detailed step-by-step process followed by the AI algorithms can be traced and analyzed, providing a clear audit trail. This enhanced transparency builds trust amongst stakeholders and facilitates accountability in the valuation process. This increased transparency is especially important in regulated industries where compliance and traceability are paramount. The detailed records of data inputs and calculations create a robust audit trail, simplifying the verification process.

The Future of Real Estate Valuation: A Collaborative Approach

The Rise of AI in Real Estate Valuation

Artificial intelligence (AI) is rapidly transforming various industries, and real estate valuation is no exception. AI-powered algorithms can process vast datasets of property characteristics, market trends, and economic indicators to produce valuations that are often more accurate and efficient than traditional methods. This shift towards AI-driven valuation is not just about speed; it's about incorporating a wider range of data points and applying sophisticated analytical models to identify subtle patterns and predict future market movements.

The integration of AI into real estate valuation promises to bring about significant improvements in accuracy and efficiency. By leveraging machine learning algorithms, AI systems can analyze complex data sets and identify correlations that might be missed by human valuers, leading to more precise and reliable estimations.

Data-Driven Insights for Enhanced Accuracy

AI-driven valuation models rely heavily on data. The more comprehensive and accurate the data, the more reliable the valuation. This includes not just the readily available data like property size and location, but also intricate details like neighborhood demographics, school ratings, crime statistics, and even historical sales data of comparable properties. Access to and analysis of these granular data points is crucial for creating accurate and comprehensive valuations.

AI can seamlessly integrate diverse data sources, from public records to social media trends, to provide a holistic view of the real estate market. This approach allows for a more nuanced understanding of market forces and property values, ultimately leading to a more accurate valuation.

Improving Efficiency and Speed in the Valuation Process

Traditional real estate valuation methods can be time-consuming and labor-intensive. AI automates much of this process, significantly reducing the time required to generate a valuation. This efficiency translates into faster turnaround times for clients, enabling quicker decision-making in transactions and investments. AI-powered systems can process vast amounts of information in seconds, generating valuations far more quickly than human valuers could.

Collaborative Valuation Platforms for Enhanced Transparency

AI-driven valuation platforms can be designed to be collaborative, allowing multiple stakeholders in a transaction to access and review the valuation data. This transparency fosters trust and confidence in the valuation process. Valuations supported by detailed explanations of the underlying data and the algorithms used enhance the level of understanding for all parties involved.

Overcoming Bias and Ensuring Fairness in Valuation

One of the crucial aspects of AI in real estate is the potential for bias in the algorithms. Careful attention must be paid to ensure that the models are trained on diverse and representative datasets to prevent the perpetuation of existing biases in real estate valuation. Rigorous testing and auditing of these AI models are essential to maintain fairness and accuracy in valuations, especially in diverse and complex markets.

The Role of Human Expertise in the AI-Driven Valuation Process

While AI can significantly enhance the accuracy and efficiency of real estate valuation, human expertise remains crucial. Real estate agents, appraisers, and investors need to understand how these AI tools work and what limitations they may have. Human judgment can play a vital role in interpreting the AI-generated valuations and assessing the context of specific transactions.

Ethical Considerations and the Future of Real Estate Valuation

As AI becomes more integrated into real estate valuation, ethical considerations become paramount. Issues such as data privacy, algorithmic transparency, and potential biases must be addressed proactively. The development and implementation of AI-driven valuation systems should prioritize ethical frameworks to ensure fairness, accuracy, and transparency in the real estate market. Ongoing monitoring and refinement of these systems are essential to mitigate risks and ensure responsible development.

Read more about AI Driven Real Estate Valuations: Beyond the Hype

Hot Recommendations

- Sustainable Real Estate Design Principles

- AI in Real Estate: Streamlining the Buying Process

- Climate Risk Disclosure: A Must for Real Estate

- Climate Risk Analytics: Essential for Real Estate Investment Funds

- Modular Sustainable Construction: Scalability and Speed

- Real Estate and Community Disaster Preparedness

- Smart Buildings and Advanced Building Analytics for Optimal Performance

- Smart Waste Sorting and Recycling in Buildings

- Sustainable Real Estate: A Strategic Advantage

- AI in Real Estate Transaction Processing: Speed and Accuracy