Sustainable Real Estate: Investing in Resilience and Growth

Implementing Circular Economic Models

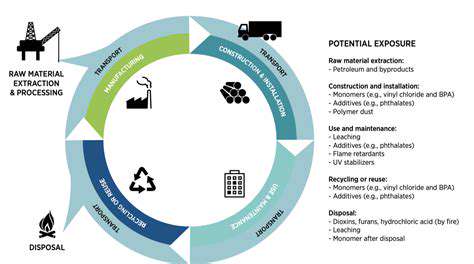

True sustainability in property development requires adopting circular economy principles throughout the building lifecycle. This paradigm shift involves designing structures specifically for eventual disassembly and material recovery. Key components include specifying recycled content, creating modular designs for easy future adaptation, and establishing comprehensive material reclamation systems. This comprehensive approach not only addresses waste reduction but also generates new economic value streams through innovative resource management.

Transitioning to circular models demands reevaluating traditional construction mentalities. It necessitates considering a building's complete lifespan - from initial concept through operation to eventual deconstruction. Such forward-thinking strategies diminish dependence on finite resources while conserving energy and shrinking the industry's environmental impact. Developers embracing these concepts gain competitive advantages through enhanced sustainability credentials and operational efficiencies.

Fostering Socially Inclusive Neighborhoods

Authentic sustainability encompasses social dimensions alongside environmental factors. Responsible development must address housing affordability, encourage resident participation, and cultivate diverse, welcoming communities. Thoughtful projects balance financial viability with meaningful contributions to social infrastructure - supporting local enterprises, generating employment, and designing spaces that facilitate community connections.

Exceptional developments transcend physical structures to consider their social context. This involves substantive engagement with current residents, genuine consideration of their perspectives, and meaningful incorporation of community feedback. Prioritizing social equity in development processes creates more cohesive, dynamic neighborhoods where all members experience genuine belonging.

Truly progressive projects consciously address systemic inequities affecting marginalized populations. This requires proactive outreach to underrepresented groups, ensuring fair resource distribution, and implementing safeguards against displacement pressures. When developers embed social responsibility into project DNA, they catalyze positive transformations extending well beyond property boundaries.

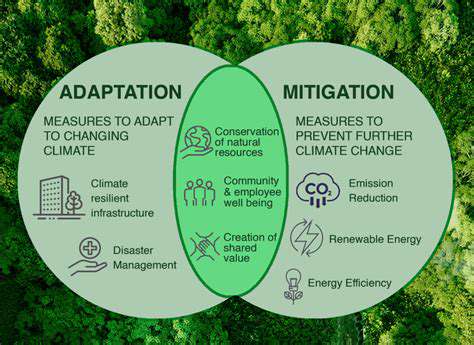

Sustainable real estate at its best recognizes the interdependence of ecological, financial, and social factors. Integrated consideration of these elements produces developments that benefit both the environment and surrounding communities.

Addressing community needs comprehensively builds stronger, more adaptable, and fairer societies.

Financial Incentives and the Return on Sustainable Investment

Encouraging Retirement Preparedness

Strategic financial incentives significantly influence retirement planning behaviors. Governments and employers implement various programs to facilitate long-term savings, recognizing their importance for individual financial security. These initiatives help bridge the gap between retirement aspirations and practical financial realities.

Tax benefits represent particularly powerful motivators, offering immediate fiscal advantages for retirement account contributions. These provisions effectively lower the net cost of saving, making retirement planning more attainable for broader populations.

Tax-Efficient Retirement Vehicles

Specialized retirement accounts provide multiple tax advantages that amplify savings growth. Traditional accounts typically offer upfront tax deductions, reducing current taxable income. Meanwhile, the invested funds benefit from tax-deferred growth, compounding without annual tax erosion.

The tax treatment of retirement accounts creates powerful wealth-building mechanisms unavailable in standard investment scenarios. This structural advantage can substantially increase eventual retirement reserves.

Workplace Retirement Programs

Employer-sponsored plans simplify retirement saving through automatic payroll deductions and often include matching contributions. These employer matches represent essentially free money that dramatically enhances savings potential over time. The convenience and professional management aspects remove common barriers to consistent retirement investing.

Access to institutional-quality investment options and guidance represents another key workplace plan benefit. This professional oversight helps participants navigate complex financial markets more effectively.

Government Retirement Policies

Public policy initiatives play a crucial role in promoting retirement security through various incentive structures. These measures acknowledge society's collective interest in ensuring citizens can maintain financial independence throughout retirement years.

Individual Retirement Arrangements

IRAs offer flexible retirement saving solutions tailored to different financial situations and goals. The choice between traditional and Roth structures allows savers to optimize based on current versus anticipated future tax circumstances.

IRA accessibility and customization options make them indispensable tools for personal retirement planning.

Inflation's Impact on Long-Term Savings

The eroding effects of inflation necessitate careful consideration in retirement planning. Price increases gradually diminish purchasing power, requiring savings to outpace inflation to maintain living standards.

Effective retirement strategies must incorporate inflation-hedging investments to preserve savings' real value over decades. Financial incentives become more meaningful when they account for inflation-adjusted returns.

The Advantage of Early Financial Preparation

Commencing retirement savings during early career stages leverages the extraordinary power of compound growth. Early contributions experience more extended growth periods, often becoming more valuable than larger but later investments.

Establishing savings habits early reduces financial stress while creating a robust foundation for future security. This proactive approach allows individuals to focus on other life priorities while their retirement funds work for them.

Read more about Sustainable Real Estate: Investing in Resilience and Growth

Hot Recommendations

- Sustainable Real Estate Design Principles

- AI in Real Estate: Streamlining the Buying Process

- Climate Risk Disclosure: A Must for Real Estate

- Climate Risk Analytics: Essential for Real Estate Investment Funds

- Modular Sustainable Construction: Scalability and Speed

- Real Estate and Community Disaster Preparedness

- Smart Buildings and Advanced Building Analytics for Optimal Performance

- Smart Waste Sorting and Recycling in Buildings

- Sustainable Real Estate: A Strategic Advantage

- AI in Real Estate Transaction Processing: Speed and Accuracy