AI Driven Valuation: The Competitive Edge in Real Estate Market

The Evolving Landscape of Real Estate Appraisal

The Rise of Technology in Real Estate

The real estate industry is undergoing a significant transformation, driven largely by technological advancements. From sophisticated property valuation software to virtual tours and online marketplaces, technology is streamlining processes, enhancing efficiency, and connecting buyers and sellers in unprecedented ways. This digital revolution is fundamentally altering how real estate transactions are conducted, impacting everything from the initial search to the final closing.

Real estate agents are increasingly leveraging technology to enhance their services, providing clients with data-driven insights, personalized recommendations, and a more seamless experience throughout the entire process. This shift towards digital tools is not just about convenience; it's about providing a more informed and transparent approach to real estate transactions.

Market Trends and Shifting Demographics

The dynamics of the real estate market are constantly evolving, shaped by a multitude of factors including economic conditions, population shifts, and changing consumer preferences. Understanding these trends is crucial for both investors and buyers alike, as it enables informed decision-making and strategic planning. Analyzing demographic shifts and their impact on housing demand is critical for staying ahead of the curve in the constantly changing real estate market.

An increasing number of millennials and Gen Z are entering the market, bringing with them unique needs and expectations. These generations often prioritize factors beyond traditional homeownership, such as location, amenities, and sustainability, demanding a more personalized and flexible approach to the real estate experience.

The Impact of Global Events

Global events, from economic downturns to geopolitical uncertainties, can significantly impact the real estate landscape. Understanding how these events ripple through the market is essential for mitigating risk and capitalizing on opportunities. Recent events have highlighted the importance of adapting to changing economic conditions and geopolitical landscapes in the real estate market.

Fluctuations in interest rates, international trade conflicts, and even pandemics can influence demand, pricing, and investment strategies. These factors often necessitate a more cautious and adaptable approach to real estate investment and transactions, demanding a thorough understanding of market forces.

Sustainable Practices and Green Building

The growing awareness of environmental issues has prompted a significant shift towards sustainable practices in the real estate sector. From energy-efficient homes to eco-friendly construction materials, green building initiatives are gaining momentum, attracting environmentally conscious buyers and investors. The demand for sustainable and environmentally friendly housing options is on the rise, driven by a heightened awareness of environmental concerns and the desire for eco-conscious living.

The integration of sustainable practices into real estate development is no longer a niche trend but a crucial component of responsible and forward-thinking strategies. This shift towards sustainability is not just about environmental responsibility; it's also about creating attractive and valuable real estate assets in the long term.

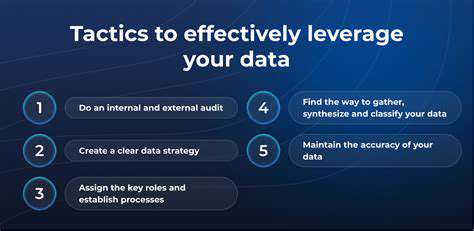

Leveraging Data for Enhanced Accuracy

Data Collection Strategies

A crucial first step in leveraging data for enhanced accuracy is establishing robust data collection strategies. These strategies must consider the specific needs of the project, ensuring that the data gathered is relevant, comprehensive, and reliable. Thorough planning and meticulous execution of these strategies are paramount to achieving the desired level of accuracy. Data collection methodologies should be carefully selected based on the nature of the data being sought and the resources available.

Different methodologies, such as surveys, experiments, and observational studies, each have their strengths and weaknesses. Understanding these nuances is essential to selecting the most appropriate approach for a given situation. This careful consideration ensures that the collected data provides a true reflection of the phenomenon under investigation. Employing appropriate sampling techniques is also critical to ensuring the representativeness of the data.

Data Cleaning and Preprocessing

Raw data often contains errors, inconsistencies, and missing values. Effective data cleaning and preprocessing are essential to ensure the accuracy and reliability of the analysis. This stage involves identifying and correcting these issues, transforming the data into a suitable format, and handling missing values. Careful attention to detail at this stage is crucial for accurate results.

Techniques like data validation, outlier detection, and imputation are essential tools for cleaning and preparing data for analysis. These steps contribute significantly to the quality and reliability of the results, as they reduce the impact of errors and inconsistencies in the dataset. Addressing missing data effectively is a critical component of this stage, as it can significantly impact the validity of the findings.

Data Analysis Techniques

Choosing the right data analysis techniques is paramount to extracting meaningful insights from the gathered data. The selection of techniques should be guided by the specific research questions and the nature of the data. Statistical analysis, machine learning algorithms, and data visualization tools are some common techniques used to analyze data and identify patterns. Applying appropriate statistical tests and interpreting the results accurately are crucial for reliable conclusions.

Data Interpretation and Visualization

Interpreting the results of data analysis requires a deep understanding of the context and the variables involved. The interpretation should be nuanced and consider potential biases or limitations of the data. Effective communication of findings through clear and concise visualizations is also essential to conveying the insights effectively to a wider audience. Visualizations, such as charts, graphs, and maps, can help to highlight key trends and patterns in the data.

Model Validation and Refinement

Model validation is a crucial step in ensuring the accuracy and generalizability of the findings. This involves evaluating the model's performance on a separate dataset from the one used for training. This step helps to identify potential overfitting or underfitting issues and refines the model if necessary. Regular monitoring and refinement of models are essential for maintaining their effectiveness over time, especially in dynamic environments.

Accuracy Metrics and Evaluation

Establishing clear metrics for evaluating the accuracy of the results is essential. This involves choosing appropriate metrics based on the specific context of the analysis, such as precision, recall, F1-score, or root mean squared error. Using these metrics allows for a standardized and objective evaluation of the model's performance. Thorough evaluation allows for a better understanding of the limitations and strengths of the model, leading to further improvements.

Ethical Considerations in Data Use

Data usage must always adhere to ethical principles. This includes ensuring data privacy, obtaining informed consent where necessary, and avoiding bias in the collection, analysis, and interpretation of data. Ethical considerations are paramount and must be integrated throughout the entire data-driven process. Responsible data handling is crucial for maintaining public trust and ensuring the integrity of the analysis and the results obtained. Following guidelines and regulations relevant to the specific application is vital.

Streamlining the Valuation Process and Reducing Costs

Improving Efficiency with AI

AI-powered valuation tools automate many of the repetitive tasks involved in traditional methods. This automation significantly reduces the time spent on data collection, analysis, and report generation. By streamlining these processes, AI frees up valuable time for analysts to focus on more complex aspects of the valuation, such as market analysis and strategic considerations, ultimately leading to more insightful and accurate valuations.

The speed and accuracy of AI algorithms enable faster turnaround times for valuations, which is crucial in today's fast-paced business environment. This agility is critical for meeting deadlines, maintaining competitive advantage, and responding effectively to market fluctuations.

Data Accuracy and Consistency

AI algorithms excel at identifying patterns and anomalies in large datasets, leading to a more comprehensive and accurate understanding of the subject being valued. This enhanced data analysis capability helps to minimize errors and inconsistencies that can occur in manual valuation processes, resulting in greater reliability and confidence in the final valuation outcome.

By leveraging vast amounts of data, AI can identify subtle market trends and nuances often missed by human analysts. This deeper level of insight contributes to more precise valuations and provides a more complete picture of the asset's current and future value.

Reduced Human Error

Manual valuation processes are inherently susceptible to human error, including biases, oversights, and inconsistencies in data interpretation. AI algorithms, however, operate without these human limitations, ensuring greater consistency and objectivity in the valuation process. This increased accuracy and objectivity are crucial for maintaining the integrity and credibility of the valuation.

Enhanced Transparency and Explainability

While some AI models can be black boxes, advancements are being made in developing more transparent AI valuation models. This transparency allows stakeholders to understand the reasoning behind the valuation, fostering trust and confidence in the results. Explainable AI (XAI) approaches provide insights into the factors driving the valuation, increasing the overall understanding and acceptance of the process.

Cost Reduction Through Automation

By automating tasks such as data entry, analysis, and report generation, AI-driven valuation tools significantly reduce the need for extensive human resources, ultimately lowering operational costs. This cost reduction is particularly beneficial for businesses with limited budgets or those dealing with high-volume valuation needs.

The reduced labor costs associated with AI-driven valuation translate directly to a more efficient use of capital, allowing businesses to reinvest savings into other strategic initiatives or allocate resources for value enhancement.

Improved Valuation Frequency and Accessibility

AI-driven valuation tools enable more frequent valuations, providing businesses with real-time insights into asset values. This increased frequency allows for more timely adjustments to business strategies and investment decisions based on current market conditions. This improved accessibility of valuations can be crucial for making informed decisions, especially in dynamic markets.

AI also makes valuations more accessible to smaller businesses or those with limited resources. The cost-effectiveness and ease of use of AI tools democratize access to professional-grade valuation services.

Read more about AI Driven Valuation: The Competitive Edge in Real Estate Market

Hot Recommendations

- Sustainable Real Estate Design Principles

- AI in Real Estate: Streamlining the Buying Process

- Climate Risk Disclosure: A Must for Real Estate

- Climate Risk Analytics: Essential for Real Estate Investment Funds

- Modular Sustainable Construction: Scalability and Speed

- Real Estate and Community Disaster Preparedness

- Smart Buildings and Advanced Building Analytics for Optimal Performance

- Smart Waste Sorting and Recycling in Buildings

- Sustainable Real Estate: A Strategic Advantage

- AI in Real Estate Transaction Processing: Speed and Accuracy