Investing for Impact: Sustainable Real Estate

The Evolving Landscape of Eco-Conscious Property Investment

Emerging Prospects and Complexities in the Sector

Growing Potential in Environmentally Responsible Property

The property market focused on ecological responsibility offers numerous compelling prospects for capital allocation aligned with planetary and societal wellbeing. Contemporary homebuyers increasingly prioritize dwellings that minimize environmental impact while fostering community welfare, accelerating capital flows into innovative construction methodologies, energy-conscious architectural solutions, and neighborhood-centric developments. This movement transcends temporary market trends, representing a profound transformation in how individuals perceive asset ownership and the broader implications of their financial commitments.

Public sector support mechanisms further bolster this sector through fiscal advantages, financial assistance programs, and progressive construction regulations that reward sustainable approaches. These policy instruments motivate development teams and financial backers to implement ecological solutions, establishing a virtuous cycle within the marketplace. When combined with heightened ecological awareness, these supportive frameworks create fertile ground for sustained expansion within the green property segment. Capital allocators can harness these favorable conditions to achieve robust financial performance while advancing environmental stewardship objectives.

Navigating Obstacles in Eco-Friendly Property Ventures

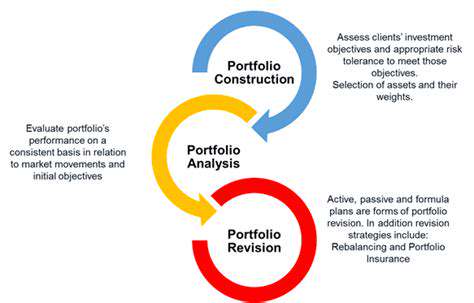

Despite the favorable outlook, the sustainable property arena presents several noteworthy complexities. A primary consideration involves the typically elevated initial expenditures required for implementing environmentally conscious building technologies and methodologies. These increased upfront costs may affect short-term profitability metrics when contrasted with conventional development approaches. Savvy investors must conduct thorough analyses weighing long-term benefits against initial outlays, accounting for potential appreciation in asset valuation, decreased ongoing operational expenses, and heightened tenant desirability.

Another significant hurdle stems from inconsistent evaluation criteria and disclosure protocols for ecological property initiatives. The absence of uniform benchmarks complicates comparative assessments of different assets and their authentic environmental and social contributions. This standardization gap can undermine investor trust and enable superficial sustainability claims rather than substantive ecological improvements. Developing transparent, widely accepted guidelines and rigorous reporting systems remains essential for cultivating confidence and promoting authentic sustainability practices within the industry.

The transition toward ecological property solutions necessitates comprehensive shifts in professional perspectives and technical competencies throughout the construction and investment communities. All participants - from development teams and builders to financial backers and facility operators - must embrace novel technologies, procedures, and benchmarks. This industry-wide transformation will demand substantial educational initiatives, skills development programs, and cross-sector cooperation to ensure effective implementation and broad acceptance of sustainable methodologies.

Addressing these challenges requires decisive actions including meticulous evaluation protocols, clear performance reporting, and coordinated efforts among all involved parties. By confronting these issues directly, capital providers can fully realize the potential of ecological property investments while managing risks and driving positive environmental transformation. The intersection of these complex dynamics and favorable conditions demands careful analysis and progressive thinking from financial backers. Comprehensive research, rigorous assessment processes, and dedication to operational transparency form the foundation for success in this developing marketplace.

Practical approaches for managing these complexities include consulting with ecological building specialists and forming strategic alliances with environmentally aware development firms. Such cooperative strategies enable investors to make well-informed choices while reducing potential downsides.

Forward-Looking Perspectives on Ecological Property Investment

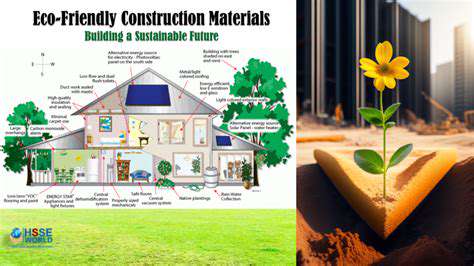

Innovative Construction Methodologies

The trajectory of ecological property development centers on pioneering construction techniques. Incorporating planet-friendly materials, including repurposed and regionally available components, proves essential for minimizing the ecological impact of structures. This methodology not only curtails material waste but also bolsters nearby business ecosystems. Additionally, implementing energy-conscious architectural principles, harnessing passive solar strategies, and integrating renewable power generation represent critical steps toward establishing genuinely sustainable buildings.

Adherence to recognized environmental certification standards, such as LEED protocols, guarantees consistent application of these practices across project timelines. Such standardization helps preserve rigorous environmental requirements while enabling clear communication regarding implemented sustainability measures.

Urban Planning Implications

Ecological property principles increasingly shape metropolitan development frameworks. Developing integrated neighborhoods that blend living spaces, business establishments, and leisure facilities can enhance community connectivity while decreasing dependence on single-mode transportation. This urban design philosophy promotes pedestrian accessibility and stimulates mass transit usage, thereby substantially reducing the environmental consequences of individual automobile commuting.

Intelligent urban initiatives incorporating advanced systems like adaptive power networks and interconnected infrastructure can optimize resource allocation and improve the sustainability of metropolitan areas. These technological progressions prove indispensable for establishing efficient, environmentally aware cities moving forward.

Economic Advantages and Capital Allocation

The expanding demand for ecological properties is stimulating innovative financial mechanisms and investment possibilities. Public sector incentives, tax advantages, and specialized environmental financing alternatives are growing more available and appealing to capital providers. This trend encourages redirection of funds toward ecologically sound developments, nurturing a more sustainable property marketplace.

Financial stakeholders increasingly acknowledge the enduring economic viability of green buildings. These structures generally demonstrate reduced maintenance expenditures and greater resale values over extended periods, rendering them particularly attractive to environmentally minded investors.

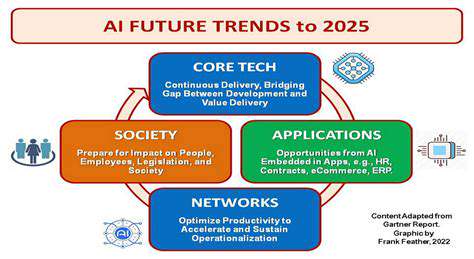

Technological Transformations

Cutting-edge innovations are fundamentally altering the ecological property industry. Automated residential systems, energy optimization platforms, and intelligent building controls are redefining resource consumption patterns within constructed environments. These technological solutions can dramatically decrease energy demands and water usage, creating more sustainable and economically efficient structures.

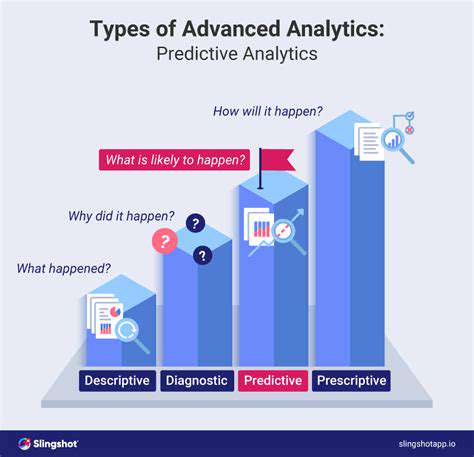

Sophisticated data analysis and predictive algorithms help maximize building performance and pinpoint opportunities for enhancement. This empirical methodology allows ongoing observation and refinements to optimize sustainability initiatives and minimize ecological consequences.

Community Integration and Social Considerations

Ecological property development extends beyond environmental factors to encompass vibrant neighborhood creation. Incorporating natural landscapes, collective gardening spaces, and shared facilities within developments can strengthen social bonds and elevate living standards. These elements encourage resident interaction and cultivate communal identity. Moreover, reasonably priced and accessible housing options constitute fundamental aspects of sustainable neighborhoods, guaranteeing fair access to resources and prospects for all community members.

Continuous community involvement throughout the development process remains vital for ensuring alignment with resident requirements and principles. This inclusive strategy guarantees projects achieve not only environmental objectives but also social responsibility and broad accessibility goals.

Read more about Investing for Impact: Sustainable Real Estate

Hot Recommendations

- Sustainable Real Estate Design Principles

- AI in Real Estate: Streamlining the Buying Process

- Climate Risk Disclosure: A Must for Real Estate

- Climate Risk Analytics: Essential for Real Estate Investment Funds

- Modular Sustainable Construction: Scalability and Speed

- Real Estate and Community Disaster Preparedness

- Smart Buildings and Advanced Building Analytics for Optimal Performance

- Smart Waste Sorting and Recycling in Buildings

- Sustainable Real Estate: A Strategic Advantage

- AI in Real Estate Transaction Processing: Speed and Accuracy