Sustainable Real Estate and ESG Investing

The connection between responsible investing and financial performance has become undeniable. Properties with strong ESG credentials command premium rents, experience lower vacancy rates, and demonstrate greater resilience during economic downturns. Forward-thinking property owners now recognize that social responsibility isn't just ethical - it's economically prudent.

The Impact of ESG on Real Estate Investment Decisions

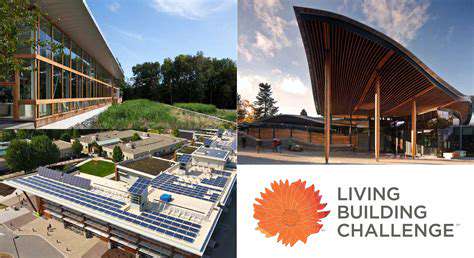

Modern investment committees dedicate entire meetings to analyzing energy consumption patterns, carbon footprints, and community impact assessments. Buildings boasting LEED Platinum certifications or WELL Health-Safety ratings don't just attract tenants - they command attention from institutional investors. The market has spoken: sustainable features translate directly to bottom-line results, with green buildings reporting operational cost savings of 20-30% compared to conventional structures.

We're seeing particular interest in adaptive reuse projects that breathe new life into historic structures while incorporating cutting-edge sustainability features. These ventures satisfy both preservationists and environmentalists while delivering exceptional returns. The most successful developers have learned to view ESG compliance not as a constraint, but as a creative challenge that yields innovative design solutions.

ESG Trends Shaping the Real Estate Industry

Three seismic shifts are redefining commercial real estate: decarbonization initiatives, wellness-oriented design, and transparency mandates. The most progressive firms now employ full-time ESG officers who oversee comprehensive sustainability programs. What began as a niche concern has evolved into a C-suite priority, with executives tying compensation packages to ESG performance metrics.

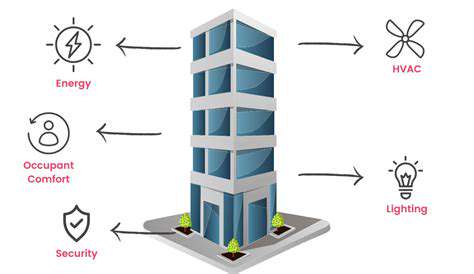

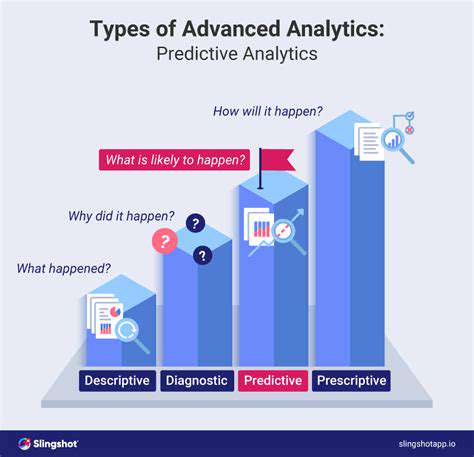

Technological integration represents another frontier. Smart buildings equipped with IoT sensors don't just reduce energy waste - they generate actionable data that improves asset management. These systems allow for predictive maintenance, optimize space utilization, and enhance occupant experiences through personalized climate and lighting controls.

Challenges and Opportunities in Implementing ESG in Real Estate

While the ESG imperative grows clearer each quarter, implementation hurdles remain. The lack of standardized metrics continues to frustrate benchmarking efforts, forcing firms to develop proprietary evaluation frameworks. Retrofitting older properties presents particular difficulties, often requiring creative financing solutions like green bonds or PACE financing.

The silver lining? These challenges create opportunities for first-movers to establish industry best practices. Firms that crack the code on cost-effective retrofits or develop innovative financing models will enjoy substantial competitive advantages. As regulations tighten and tenant expectations evolve, ESG expertise will become a key differentiator in the marketplace.

Environmental Sustainability in Real Estate

Environmental Considerations in Resource Management

The most impactful sustainability strategies begin during the design phase. Thoughtful site selection, orientation optimization, and material specifications can reduce a building's environmental impact by 40% before construction even begins. Pioneering architects now employ life-cycle assessment tools to evaluate every component's ecological footprint from cradle to grave.

What sets exceptional projects apart isn't just the checklist of green features, but the holistic integration of sustainability principles. The buildings that age most gracefully balance energy efficiency with occupant comfort, water conservation with landscape beauty, and material durability with aesthetic appeal.

Minimizing Pollution and Waste

Construction sites have transformed dramatically in recent years. Where dumpsters once overflowed with debris, we now see meticulous sorting stations diverting 90% of materials from landfills. Closed-loop material systems represent the next frontier, with demolition waste being repurposed into new building components on-site.

The most impressive waste reduction strategies don't stop at construction. Forward-thinking property managers implement comprehensive recycling programs, composting initiatives, and even on-site material exchange platforms for tenants. These programs not only reduce environmental impact but often generate cost savings through reduced disposal fees.

Promoting Conservation and Biodiversity

Urban developments are rediscovering the value of indigenous landscaping. Native plant species require less water, support local ecosystems, and provide habitat for pollinators. Rooftop gardens and vertical green walls do more than beautify - they combat the urban heat island effect while improving air quality.

The most visionary projects integrate nature rather than displacing it. Wetlands are preserved as natural water filtration systems, mature trees are incorporated into site plans, and wildlife corridors are maintained through careful master planning. These approaches demonstrate that development and conservation needn't be mutually exclusive.

Renewable Energy and Resource Efficiency

Solar arrays have become almost ubiquitous on commercial rooftops, but true energy innovators look beyond photovoltaics. Geothermal heating systems, thermal energy storage, and even kinetic energy harvesting from foot traffic represent the next wave of sustainable solutions. The most efficient buildings now produce as much energy as they consume, achieving net-zero status.

Sustainable Consumption and Production Patterns

The circular economy model is gaining traction in real estate operations. Instead of the traditional linear take-make-waste approach, progressive firms emphasize reuse, refurbishment, and material recovery. This paradigm shift requires rethinking everything from furniture procurement to tenant improvement allowances.

Shared amenity spaces exemplify this philosophy beautifully. Instead of each tenant maintaining underutilized conference rooms and kitchens, collaborative spaces maximize efficiency while fostering community. The result? Reduced material consumption and more vibrant tenant interactions.

Social Responsibility and Community Impact

Social Responsibility in Sustainable Real Estate

Truly responsible development considers the broader ecosystem in which a property exists. Industry leaders now view their projects as catalysts for neighborhood improvement rather than isolated structures. This means investing in local workforce development programs, supporting minority-owned contractors, and creating public spaces that serve the entire community.

The most successful developments achieve what urban planners call positive gentrification - revitalization that lifts all boats without displacing long-time residents. This delicate balance requires genuine community engagement, not just perfunctory public hearings. When done right, everyone benefits from rising property values and improved amenities.

Community Impact of ESG Investments

ESG-focused developments often become anchors for neighborhood transformation. A single thoughtfully designed mixed-use project can catalyze street improvements, attract complementary businesses, and create employment opportunities. The ripple effects extend far beyond the property lines, demonstrating that responsible real estate investment can be a powerful tool for social good.

Affordable housing components deserve particular attention. Rather than treating affordable units as regulatory obligations, innovative developers are integrating them seamlessly into market-rate projects. This approach fosters economic diversity while maintaining high design standards throughout the development.

Measuring and Reporting on Community Impact

The most sophisticated firms now track social metrics with the same rigor as financial ones. Detailed dashboards monitor everything from local hiring statistics to small business incubation rates. This data doesn't just satisfy ESG reporting requirements - it drives continuous improvement in community relations strategies.

Transparent reporting builds trust with stakeholders while providing tangible evidence of a development's positive impact. Some firms have begun tying executive bonuses to these social metrics, ensuring accountability at the highest levels. As impact measurement methodologies mature, we'll likely see even more innovative approaches to quantifying social value creation.

Opportunities and Challenges in ESG-Driven Real Estate

The Evolving Regulatory Landscape

Municipalities worldwide are raising the sustainability bar, with cities like New York and London implementing increasingly stringent building performance standards. While these regulations present compliance challenges, they also create opportunities for firms with established ESG expertise to differentiate themselves.

The regulatory environment is evolving so rapidly that ESG compliance has become a moving target. Forward-looking firms maintain dedicated policy teams to anticipate coming changes and position their portfolios accordingly. This proactive approach turns potential obstacles into competitive advantages.

Financial Innovation in Sustainable Real Estate

The capital markets have responded enthusiastically to ESG-focused real estate. Green bonds, sustainability-linked loans, and impact investment funds are growing exponentially. Innovative financing structures now tie interest rates to sustainability performance metrics, creating powerful incentives for ongoing improvement.

The most creative deals blend multiple capital sources to fund transformative projects. Public-private partnerships, community investment vehicles, and crowdfunding platforms are expanding access to sustainable real estate investment opportunities. This democratization of impact investing represents one of the sector's most exciting developments.

The Human Element in ESG Implementation

Technology plays a crucial role in sustainable real estate, but human factors remain paramount. Building operators need specialized training to maximize the potential of smart systems. Tenant engagement programs are essential for achieving energy reduction targets. And community relations require authentic, ongoing dialogue rather than transactional interactions.

Successful ESG implementation ultimately depends on cultural transformation within organizations. Firms that ingrain sustainability into their DNA - from the C-suite to frontline staff - consistently outperform those that treat it as a compliance exercise. The human dimension separates truly sustainable organizations from those merely checking boxes.