Climate Finance for Real Estate Investments

Green finance marks a fundamental transformation in how financial institutions operate, shifting focus from pure profitability to environmental stewardship. This evolution stems from mounting evidence that unsustainable practices harm both ecosystems and long-term economic stability. Regulatory frameworks, consumer preferences, and investor demands now converge to make sustainability a non-negotiable aspect of modern finance.

Environmental considerations are no longer peripheral concerns but central to financial viability. What began as niche investment strategies have become mainstream requirements for any forward-looking institution.

Key Drivers Behind the Green Finance Movement

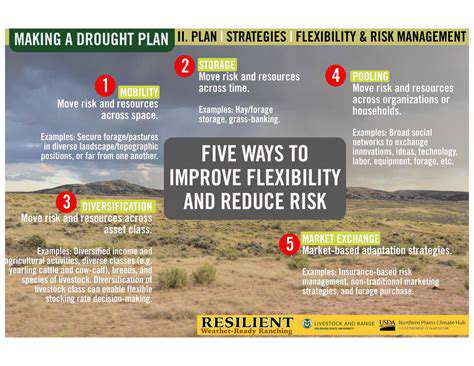

Multiple converging forces accelerate green finance adoption. Climate-related disasters causing billions in damages annually make environmental risk assessment essential rather than optional. Simultaneously, evolving regulations worldwide mandate stricter sustainability reporting and accountability measures.

The investment community increasingly views environmental responsibility as a marker of operational efficiency and future-proofing. Companies lagging in sustainability initiatives now face tangible disadvantages in capital acquisition and market positioning.

The Impact of Green Finance on Investment Strategies

Modern portfolio construction now systematically evaluates environmental, social, and governance (ESG) metrics alongside traditional financial indicators. This paradigm shift redirects capital flows toward renewable energy infrastructure, circular economy models, and climate-resilient development projects.

Financial analysts increasingly recognize that environmental sustainability correlates strongly with reduced operational risks and enhanced long-term returns. Sustainable assets demonstrate remarkable resilience during market volatility, validating their inclusion in balanced portfolios.

Green Finance and the Role of Technology

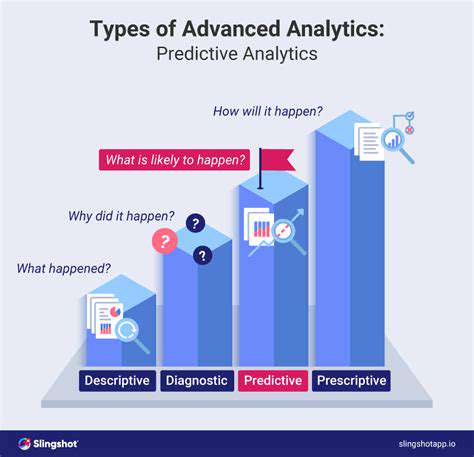

Advanced technologies enable precise monitoring of sustainability metrics across investment portfolios. Machine learning algorithms parse vast datasets to identify environmental risks and opportunities invisible to traditional analysis methods. These tools provide unprecedented transparency in tracking the real-world impact of financed projects.

Distributed ledger technologies create immutable records of sustainability performance across supply chains. This technological infrastructure supports verifiable claims about environmental benefits, preventing greenwashing while rewarding genuine sustainability efforts.

Green Finance and Corporate Social Responsibility

The intersection of finance and sustainability reshapes corporate accountability standards. Environmental performance metrics now feature prominently in annual reports alongside financial statements, reflecting their equal importance to stakeholders.

Investor scrutiny ensures sustainability commitments translate into measurable actions rather than empty promises. The financial sector increasingly serves as both catalyst and enforcer of meaningful environmental progress across industries.

Challenges and Opportunities for Green Finance

Standardization remains a significant hurdle, with competing frameworks for measuring environmental impact creating confusion. Developing universally accepted metrics requires unprecedented cooperation between financial institutions, regulators, and scientific communities.

However, these challenges pale compared to the opportunities. Financial innovation in sustainability-linked bonds, transition finance mechanisms, and blended finance models demonstrates the sector's creative response to environmental imperatives.

The Future of Green Finance

Green finance will likely become simply finance as sustainability criteria become fully integrated into all investment decisions. The rapid growth of climate-aligned assets suggests environmental considerations will dominate 21st century capital allocation strategies. This transition creates enormous potential for financial products that reconcile profitability with planetary boundaries.

Success requires coordinated action across governments, corporations, and civil society to align financial flows with climate stabilization pathways. The financial sector's transformation mirrors broader societal shifts toward sustainable development models.

Assessing Environmental, Social, and Governance (ESG) Factors in Real Estate Investments

Understanding ESG Principles in Real Estate

Modern real estate valuation increasingly incorporates ESG metrics alongside traditional financial indicators. Comprehensive evaluation now examines building energy profiles, construction material lifecycles, and adaptive reuse potential. Social considerations span from workforce housing provisions to neighborhood revitalization impacts. Governance scrutiny includes anti-corruption measures and stakeholder engagement protocols in development processes.

Sophisticated investors recognize that ESG factors directly influence asset longevity and tenant retention rates. Properties demonstrating strong sustainability performance command premium valuations while mitigating regulatory and reputational risks.

Environmental Impact Assessment and Mitigation

Contemporary environmental evaluation extends beyond basic energy audits to encompass whole-life carbon accounting. This includes embodied carbon in building materials, operational emissions over decades of use, and end-of-life deconstruction impacts. Water stewardship metrics now evaluate both consumption efficiency and stormwater management effectiveness.

Leading projects implement nature-based solutions like green roofs and permeable surfaces to enhance urban biodiversity. Circular economy principles guide material selection, favoring recycled content and designing for future disassembly. These strategies simultaneously reduce environmental footprints while future-proofing assets against tightening regulations.

Social Responsibility and Community Impact

Social value creation now forms a core component of real estate underwriting criteria. Development proposals undergo rigorous analysis of their effects on local housing affordability, small business ecosystems, and public health outcomes. Inclusive design principles ensure accessibility across age groups and ability levels.

Community benefit agreements increasingly accompany major developments, legally binding commitments to local hiring, apprenticeship programs, and neighborhood improvements. These measures transform real estate projects from isolated structures into catalysts for community development.

Governance and Transparency in Real Estate

Investor due diligence now scrutinizes corporate governance structures with equal intensity as physical asset quality. Independent sustainability committees, whistleblower protections, and third-party certification processes differentiate market leaders. Digital disclosure platforms provide real-time access to sustainability performance data across property portfolios.

Financial Implications of ESG Integration

The financial case for ESG integration strengthens annually, with sustainable buildings demonstrating lower vacancy rates and higher rental premiums. Energy-efficient properties show remarkable resilience against utility price volatility, while green-certified assets attract longer lease terms. Portfolio-wide ESG alignment correlates strongly with reduced insurance costs and improved debt financing terms.

Forward-looking investors recognize that ESG factors represent both risk mitigation tools and value creation opportunities. The most sophisticated firms now model climate scenarios decades into the future, ensuring their holdings remain viable in rapidly evolving regulatory and physical environments.