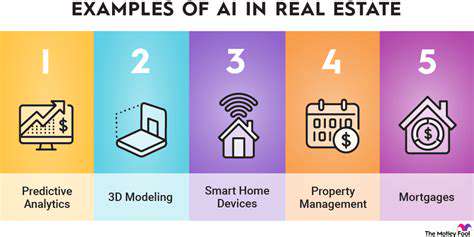

AI in Real Estate Transaction Cost Reduction

Improving Market Analysis and Insights

Leveraging AI for Comprehensive Market Data

AI algorithms can process vast amounts of real estate data, including property listings, transaction histories, market trends, and economic indicators, to provide a comprehensive and nuanced understanding of the market. This deep dive allows for more accurate predictions and informed decisions regarding pricing, investment strategies, and market positioning. By identifying subtle patterns and correlations that might be missed by human analysts, AI can reveal hidden opportunities and potential risks within the real estate market, leading to more profitable and secure investments.

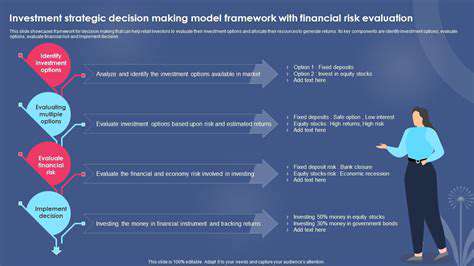

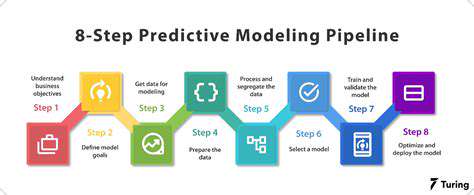

Predictive Modeling for Transaction Forecasting

AI-powered predictive models can forecast future transaction values, market fluctuations, and even the likelihood of a successful sale. This predictive capability is invaluable for real estate professionals. By analyzing historical data and current market conditions, these models can provide insights into potential price appreciation or depreciation, allowing agents, investors, and buyers to make more informed decisions. This proactive approach can significantly reduce the risk associated with real estate transactions and improve the overall efficiency of the process.

Forecasting market trends with AI assists in optimizing investment strategies, managing risk, and anticipating potential challenges. This forward-looking analysis is crucial for navigating market volatility and maximizing returns.

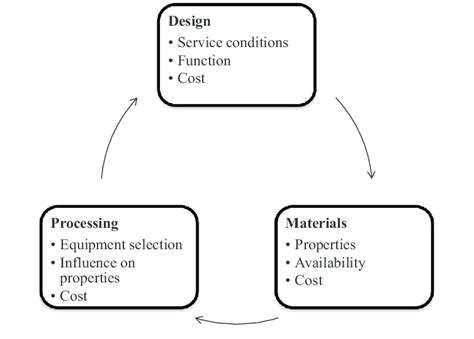

Automated Valuation Models and Pricing Strategies

AI-driven automated valuation models (AVMs) can provide accurate and consistent property valuations, reducing the time and effort required for traditional appraisal processes. These models use sophisticated algorithms to analyze various factors influencing property value, such as location, size, condition, and market trends. This automation significantly streamlines the valuation process, making it faster, more efficient, and more consistent across different properties. This efficiency translates to lower transaction costs and faster closing times.

Enhanced Due Diligence and Risk Assessment

AI can expedite the due diligence process by identifying potential risks and issues associated with specific properties. By analyzing property records, legal documents, and market data, AI can flag potential problems, such as liens, environmental concerns, or zoning violations, before they become significant obstacles. This proactive risk assessment allows stakeholders to make informed decisions and mitigate potential losses, ultimately reducing the overall cost of the transaction.

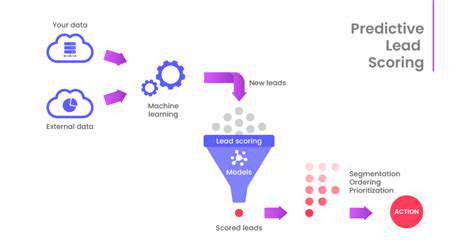

Personalized Recommendations and Targeted Marketing

AI can personalize marketing efforts and provide tailored recommendations to potential buyers and sellers. By analyzing individual preferences, financial situations, and market conditions, AI can suggest properties that align with specific needs and budgets. This targeted approach can significantly reduce the time it takes to find the right property and improve the overall efficiency of the transaction process. This personalized service can also be extended to investors, helping them identify high-potential properties that align with their specific investment goals.

Improved Transparency and Accountability in Transactions

AI-powered systems can enhance transparency in real estate transactions by providing clear and comprehensive information to all stakeholders. This includes detailed reports on market trends, property valuations, and potential risks, fostering greater trust and accountability within the process. Ultimately, this increased transparency fosters a smoother and more efficient transaction process for everyone involved, reducing the overall costs and improving the efficiency of the entire system. By providing readily accessible data, AI can also simplify communication and streamline the decision-making process during the transaction.

Read more about AI in Real Estate Transaction Cost Reduction

Hot Recommendations

- Sustainable Real Estate Design Principles

- AI in Real Estate: Streamlining the Buying Process

- Climate Risk Disclosure: A Must for Real Estate

- Climate Risk Analytics: Essential for Real Estate Investment Funds

- Modular Sustainable Construction: Scalability and Speed

- Real Estate and Community Disaster Preparedness

- Smart Buildings and Advanced Building Analytics for Optimal Performance

- Smart Waste Sorting and Recycling in Buildings

- Sustainable Real Estate: A Strategic Advantage

- AI in Real Estate Transaction Processing: Speed and Accuracy