AI for Property Tax Assessment Disputes

Dispute resolution encompasses a wide range of processes and techniques aimed at resolving disagreements between parties. This often involves facilitating communication, identifying common ground, and exploring various options to reach a mutually agreeable outcome. Effective dispute resolution is crucial for maintaining healthy relationships, minimizing legal costs, and fostering a positive environment in both personal and professional contexts. It's a proactive approach that seeks to address problems before they escalate.

The primary goal of dispute resolution is to achieve a just and lasting solution. This can involve a variety of methods, from informal negotiations to formal arbitration or litigation. Understanding the nuances of these processes is vital for navigating disputes effectively.

Negotiation: The Foundation of Dispute Resolution

Negotiation is a fundamental aspect of dispute resolution, often serving as a preliminary step or a primary means of resolution. It involves direct communication between the parties, aiming to reach a mutually acceptable agreement. This approach prioritizes collaboration and finding common ground, which can often lead to more sustainable solutions than adversarial methods. Effective negotiation requires active listening, clear communication, and the ability to identify and address the underlying interests of all parties involved.

Mediation: Facilitating Communication

Mediation involves a neutral third party, the mediator, facilitating communication and negotiation between disputing parties. The mediator helps identify areas of agreement, explore options, and guide the parties toward a mutually acceptable resolution. Mediation is a powerful tool for preserving relationships and avoiding the often costly and time-consuming processes of litigation. It often fosters a more collaborative environment compared to other dispute resolution methods.

Mediation is particularly effective when parties are willing to compromise and work towards a common goal. It provides a structured and confidential environment for the parties to discuss their concerns and find mutually agreeable solutions.

Arbitration: A Binding Decision-Making Process

Arbitration is a more formal dispute resolution process where a neutral third party, the arbitrator, hears evidence and arguments from both sides and makes a binding decision. This decision is typically legally enforceable. This approach is often faster and more cost-effective than litigation, and can offer greater confidentiality. It's particularly suitable for cases where a speedy resolution is needed, or where the parties desire a more private setting.

Litigation: The Formal Court Process

Litigation involves presenting the case to a court of law, following established legal procedures. This method is often the last resort when other forms of dispute resolution have failed. Litigation can be a lengthy and complex process, involving significant legal costs and the potential for prolonged disagreements. It is crucial to understand the legal ramifications before pursuing litigation.

It is essential to weigh the benefits and drawbacks of litigation carefully, considering factors such as the complexity of the case, the potential outcomes, and the resources available to pursue the case.

Alternative Dispute Resolution (ADR) Methods

Alternative Dispute Resolution (ADR) encompasses various methods beyond traditional litigation. These methods often aim to provide a more efficient, cost-effective, and less adversarial approach to resolving disputes. ADR methods can include mediation, arbitration, and negotiation. Understanding the differences and advantages of each method is crucial for selecting the most appropriate approach for a given situation.

Careful consideration should be given to the specific needs of the parties involved and the nature of the dispute when choosing an ADR method. This process often leads to more mutually agreeable outcomes and greater satisfaction than traditional legal processes.

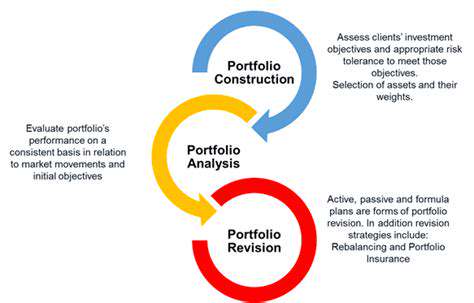

Choosing the Right Dispute Resolution Method

Selecting the most suitable dispute resolution method requires careful consideration of several factors. The complexity of the dispute, the relationship between the parties, the desired outcome, and the available resources are all critical elements to consider. Thorough assessment and planning are vital in ensuring the chosen method effectively addresses the specific needs of the parties involved. Seeking guidance from legal professionals or dispute resolution experts can be invaluable in this process.

The Future of AI in Property Tax Assessments

AI-Powered Assessments: Revolutionizing Valuation

Artificial intelligence (AI) is poised to transform property tax assessments, moving beyond traditional methods to a more data-driven and accurate approach. AI algorithms can analyze a vast array of data points, including property characteristics, market trends, and comparable sales, to generate more precise valuations. This precision is crucial in ensuring fairness and equity within the property tax system.

By incorporating real-time market fluctuations and neighborhood dynamics, AI can adapt assessments more quickly and effectively than human assessors. This agility is essential for keeping pace with the ever-changing real estate market.

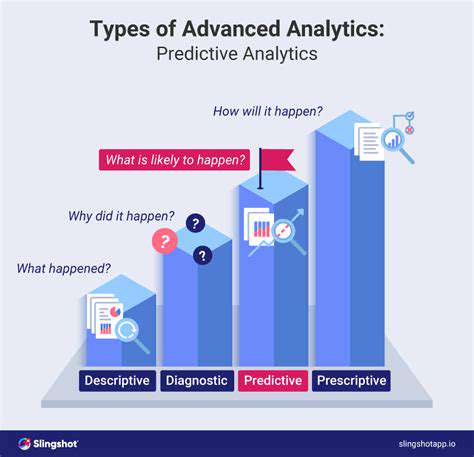

Predictive Modeling for Tax Forecasting

AI's predictive capabilities extend beyond individual property valuations to encompass broader tax forecasting. By analyzing historical data and current trends, AI models can project future property values and tax revenues with greater accuracy. This forward-looking approach is invaluable for municipal budgets and long-term planning.

This predictive ability allows for more effective resource allocation and infrastructure development, which ultimately benefits the community as a whole. Forecasting future revenue streams based on AI-driven predictions can help municipalities plan for growth and expansion.

Automated Data Collection and Processing

One of the significant benefits of AI in property tax administration is the automation of data collection and processing. AI-powered systems can extract data from various sources, including public records, online listings, and satellite imagery. This automated process significantly reduces the time and resources required for manual data entry, streamlining the entire assessment process.

This automation not only saves time but also reduces the potential for errors, leading to more accurate and consistent assessments. The reduction in manual data entry also frees up human assessors to focus on more complex tasks requiring critical thinking and judgment.

Improved Fairness and Transparency

Implementing AI in property tax assessments can contribute to a more transparent and fair system. By using objective data and algorithms, AI minimizes potential biases and ensures that assessments are based on consistent criteria. This transparency fosters public trust and reduces the likelihood of disputes.

The use of AI in property tax assessments can help eliminate subjective judgments that may lead to unfair or inequitable outcomes. This objective approach enhances the perceived fairness of the entire process.

Enhanced Efficiency and Reduced Costs

AI-powered systems can significantly improve the efficiency of property tax administration. Automating tasks like data entry, analysis, and reporting frees up staff time, allowing them to focus on more complex issues. This efficiency translates to cost savings for municipalities, potentially allowing for the redirection of resources to other critical areas.

By streamlining the assessment process and reducing the need for extensive manual labor, AI can lead to substantial cost reductions for municipalities. This efficiency is particularly valuable in times of economic uncertainty.

Addressing the Challenges of Implementation

While AI presents significant opportunities, challenges exist in its implementation within property tax systems. These include data accessibility, algorithm bias, and the need for ongoing maintenance and updates. Addressing these challenges is crucial for ensuring the successful and effective integration of AI into property tax administration.

Ensuring data accuracy and integrity is paramount to the reliability of AI-driven assessments. Robust data validation and quality control measures are essential to maintain the integrity and reliability of the AI-powered system.