AI for Fraud Detection in Real Estate Transactions

Analyzing Transactional Data with AI

Understanding Transactional Data

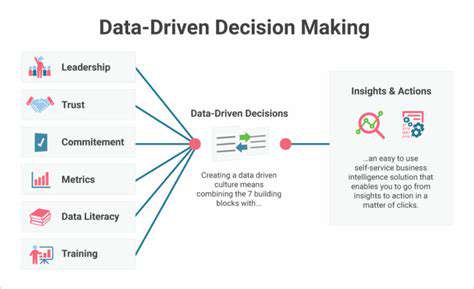

Transactional data captures the granular details of every business interaction, from sales and payments to returns and exchanges. Deciphering these records is vital for spotting trends, uncovering inefficiencies, and capitalizing on growth opportunities. When examined thoroughly, this data reveals customer habits, pinpoints operational weaknesses, and highlights paths to greater profitability. It serves as the foundation for strategic decision-making across industries.

While typically structured for easy processing, the massive scale of transactional datasets demands advanced analytical tools. Data integrity must be rigorously maintained - inconsistencies or errors can significantly skew results and lead to flawed business decisions. Proper data governance protocols ensure reliable insights.

Identifying Key Performance Indicators (KPIs)

Transactional records yield critical performance metrics that illuminate business health. These measurements - whether tracking average purchase amounts, customer retention rates, or sales conversion percentages - create quantifiable benchmarks for success while exposing areas needing attention. A noticeable decline in conversions, for instance, might indicate website issues or ineffective advertising, triggering necessary adjustments.

Regular KPI monitoring transforms reactive businesses into proactive ones. This constant evaluation allows for timely strategy refinements and operational tweaks, maintaining competitive advantage. Sophisticated analysis can also reveal high-value customer demographics, enabling more focused and profitable marketing initiatives.

Analyzing Customer Behavior

Purchase histories and transaction patterns provide unparalleled insight into consumer preferences and habits. This intelligence facilitates precise customer segmentation, customized marketing approaches, and personalized shopping experiences. Businesses that master behavioral analysis craft messaging that deeply resonates with specific buyer groups, boosting engagement and revenue.

Pattern recognition techniques, like identifying frequently co-purchased items, allow for strategic product placement and intelligent recommendations. This data-informed merchandising enhances customer satisfaction while increasing average order values.

Optimizing Operational Efficiency

Transaction flow analysis exposes operational inefficiencies across business functions. Whether revealing supply chain delays, sales process bottlenecks, or customer service shortcomings, these insights drive targeted improvements. Automation opportunities often emerge from such examinations, yielding substantial cost reductions. For example, chronic order fulfillment delays might prompt investment in upgraded inventory management solutions.

A transaction-centric approach to operations creates more agile, responsive businesses. By mapping the complete transaction lifecycle, companies can predict and prevent problems before they affect customer relationships or financial performance.

Predictive Modeling and Future Trends

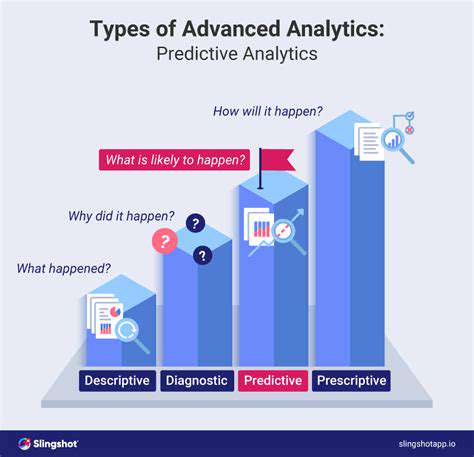

Historical transaction analysis enables powerful forecasting through predictive modeling. These analytical tools help businesses project demand, optimize stock levels, and anticipate customer needs. Forward-looking predictions allow companies to make strategic moves in advance - mitigating risks while seizing emerging opportunities.

Pattern recognition in past transactions often signals future market shifts. These insights guide critical decisions about market expansion, product development, and resource allocation, ensuring optimal return on investments. Predictive intelligence creates a significant competitive edge in volatile markets.

Predictive Modeling for Proactive Fraud Detection

Predictive Modeling Techniques

Predictive modeling transforms historical data into forecasting tools that anticipate future scenarios. These mathematical models enable preemptive action rather than reactive responses. By detecting subtle patterns and correlations, predictive analytics provides actionable intelligence about probable future events. This capability proves invaluable for risk assessment, demand forecasting, and customer retention strategies.

Data Preparation and Feature Engineering

Effective predictive modeling begins with rigorous data preparation. Cleaning, normalizing, and selecting relevant data features significantly impacts model accuracy. Only high-quality, properly processed data yields reliable predictions. Creative feature engineering - deriving new metrics from existing data - often uncovers hidden relationships that boost predictive performance.

Model Selection and Training

Matching the right analytical model to the specific prediction challenge is crucial. Options range from straightforward regression models to complex neural networks, each with distinct strengths. During training, models learn to recognize patterns and make accurate forecasts. Balancing model complexity against the risk of overfitting ensures predictions remain valid for new, unseen data.

Evaluation Metrics and Validation

Comprehensive model assessment requires multiple performance metrics. Accuracy rates, error measurements, and predictive confidence scores collectively evaluate a model's effectiveness. These quantitative assessments validate the model's real-world predictive capability. Rigorous testing against independent datasets confirms the model's reliability before deployment.

Deployment and Monitoring

Implementing predictive models in live environments unlocks their business value. This integration must consider existing workflows and systems. Ongoing performance tracking is essential - models require updates as data patterns evolve over time. Regular recalibration maintains prediction accuracy as market conditions change.

Real-World Applications and Benefits

Predictive analytics delivers value across sectors, from healthcare diagnosis to financial risk assessment. This proactive approach helps organizations identify and address potential problems before they escalate, resulting in substantial cost savings and more informed strategic decisions. The ability to anticipate rather than react creates significant competitive advantages.

Read more about AI for Fraud Detection in Real Estate Transactions

Hot Recommendations

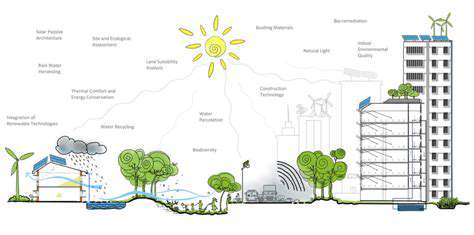

- Sustainable Real Estate Design Principles

- AI in Real Estate: Streamlining the Buying Process

- Climate Risk Disclosure: A Must for Real Estate

- Climate Risk Analytics: Essential for Real Estate Investment Funds

- Modular Sustainable Construction: Scalability and Speed

- Real Estate and Community Disaster Preparedness

- Smart Buildings and Advanced Building Analytics for Optimal Performance

- Smart Waste Sorting and Recycling in Buildings

- Sustainable Real Estate: A Strategic Advantage

- AI in Real Estate Transaction Processing: Speed and Accuracy