The Future of Real Estate Investment: Integrating Climate Risk and AI

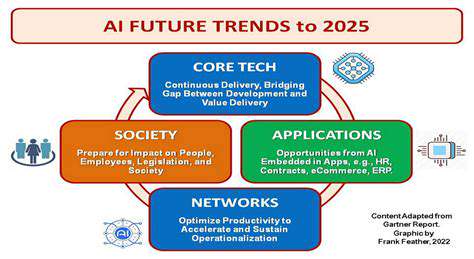

AI's Role in Enhancing Real Estate Investment Decisions

AI-Powered Market Analysis

Advanced algorithms now process enormous volumes of property data, including sales histories, listing details, and economic indicators to uncover patterns and predict market movements. This data-driven approach enables investors to base decisions on concrete evidence rather than speculation. By examining past transactions, current conditions, and economic forecasts, these systems can identify promising opportunities and potential risks in specific areas.

Predictive Modeling for Investment Returns

Sophisticated models assess multiple variables - from property characteristics to macroeconomic factors - to forecast potential investment performance. This predictive capability helps investors evaluate properties more thoroughly before committing funds, reducing the likelihood of poor investment choices.

Automated Valuation and Due Diligence

Digital valuation tools provide faster, more accurate property assessments, streamlining the evaluation process. These systems analyze comparable sales, market conditions, and property features to generate detailed valuation reports, saving investors time and resources.

Personalized Investment Strategies

Technology now tailors investment recommendations to individual preferences and financial situations. By considering factors like risk tolerance and investment goals, these systems suggest properties and strategies suited to each investor's unique circumstances.

Enhanced Property Management and Maintenance

Smart management systems optimize maintenance schedules, predict necessary repairs, and improve tenant relations. These tools can identify potential issues early, enabling timely interventions while automating routine tasks like rent collection and lease administration.

Fraud Detection and Risk Mitigation

Advanced systems analyze transaction patterns to identify potential fraudulent activity, protecting investors from financial harm. This capability helps maintain market integrity by flagging suspicious documents, inflated valuations, or misrepresented information.

Vacation rentals present environmental challenges that investors should consider, particularly regarding carbon emissions. Accessing these often remote properties typically requires air travel or extended driving, contributing significantly to greenhouse gas output. Additionally, energy consumption within the rentals themselves - including heating, cooling, and appliance use - can substantially increase environmental impact without proper management.

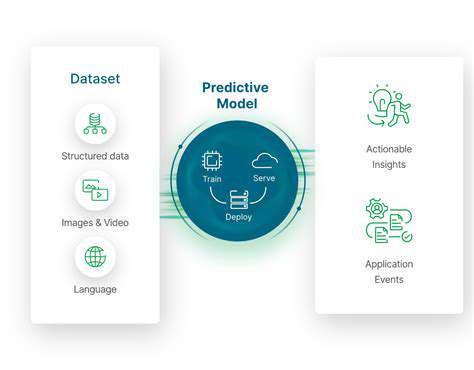

Data Integration and Predictive Modeling for Enhanced ROI

Data Integration Strategies

Combining information from disparate sources into cohesive datasets forms the foundation of effective predictive modeling. This complex process involves cleaning, standardizing, and reconciling data from multiple origins. Proper integration is critical because inconsistent or incomplete data can severely compromise model accuracy.

Various integration methods exist, each with specific advantages. ETL tools simplify the process, while data warehouses may be necessary for large, complex datasets. Maintaining data quality throughout integration ensures the resulting information accurately reflects real-world conditions and supports reliable predictions.

Predictive Modeling Techniques

Selecting appropriate modeling approaches depends on data characteristics and desired outcomes. Options range from straightforward regression analyses to complex machine learning algorithms, with each choice affecting model performance and interpretability.

Developing effective models requires iterative testing of different algorithms and parameters. Performance evaluation using metrics like accuracy and precision helps identify optimal approaches. Understanding model limitations and potential biases is equally important for creating dependable predictive tools.

Feature engineering - creating or transforming data attributes - often proves time-consuming but essential for improving model performance. Thoughtful feature selection and processing enhances a model's ability to recognize patterns and relationships within the data.

Model deployment considerations include scalability, maintenance requirements, and interpretability. Continuous monitoring and updates ensure models remain accurate as new data becomes available. Ethical concerns, particularly regarding potential biases, must also guide model development and implementation.

The Human Element: Adapting to the Future of Real Estate

The Rise of Personalized Experiences

Future real estate success will hinge on creating customized experiences that resonate with buyers and renters. Imagine systems that analyze individual lifestyles to recommend ideal neighborhoods and property configurations. This level of personalization will become increasingly important in a competitive market.

Technology enables this customization through virtual tours and tailored recommendations, making property searches more interactive and efficient. Such personalized approaches enhance customer experiences while strengthening connections between clients and real estate professionals.

The Impact of Technology on Transactions

Digital transformation is streamlining real estate transactions through online listings, virtual tours, automated contracts, and digital closings. These efficiencies benefit all parties while allowing professionals to focus on relationship-building.

Blockchain technology promises to further transform transactions by creating secure, transparent property records. This innovation could reduce fraud while eliminating intermediaries, creating a more efficient marketplace.

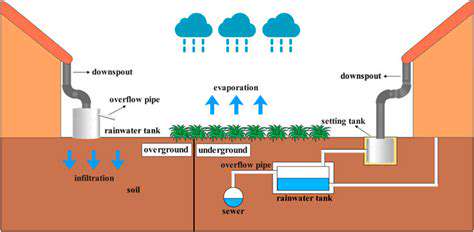

Sustainable Practices and Eco-Conscious Design

Environmental considerations now fundamentally influence real estate decisions. Buyers increasingly seek energy-efficient properties with sustainable materials, prompting developers to incorporate green features that enhance value and reduce long-term costs.

This sustainability focus drives innovation in property design, from green roofs to smart energy systems. These developments benefit both the environment and property owners' financial interests.

The Role of Virtual and Augmented Reality

VR and AR technologies are revolutionizing property viewing experiences. Virtual tours enable remote property exploration, while AR applications help visualize furnishings and decor in potential spaces.

These immersive technologies help buyers connect emotionally with properties, potentially reducing the need for physical viewings. As the technology advances, its role in real estate will continue expanding.

The Future of Real Estate Investment

Data analytics now drives investment decisions, incorporating demographic trends, economic forecasts, and even social media sentiment to identify opportunities. This comprehensive approach surpasses traditional valuation methods.

REITs and other investment vehicles are democratizing property investment, making it accessible to more investors. The evolving investment landscape offers diverse opportunities across experience levels.

Read more about The Future of Real Estate Investment: Integrating Climate Risk and AI

Hot Recommendations

- Sustainable Real Estate Design Principles

- AI in Real Estate: Streamlining the Buying Process

- Climate Risk Disclosure: A Must for Real Estate

- Climate Risk Analytics: Essential for Real Estate Investment Funds

- Modular Sustainable Construction: Scalability and Speed

- Real Estate and Community Disaster Preparedness

- Smart Buildings and Advanced Building Analytics for Optimal Performance

- Smart Waste Sorting and Recycling in Buildings

- Sustainable Real Estate: A Strategic Advantage

- AI in Real Estate Transaction Processing: Speed and Accuracy