Sustainable Real Estate Investment: Impact Funds

Impact investing is rapidly emerging as a significant force in the financial world, moving beyond traditional profit-maximization models to incorporate social and environmental goals. This shift represents a fundamental change in how capital is deployed, recognizing that positive societal impact can be a powerful driver of long-term value creation.

Investors are no longer satisfied with financial returns alone—they want their money to make a tangible difference. This growing demand for purpose-driven investments is reshaping the financial landscape as individuals and institutions seek to align their portfolios with their values.

Defining Impact Investing

Unlike traditional philanthropy that focuses solely on charitable giving, impact investing requires measurable financial returns alongside social benefits. It's a strategic approach where capital becomes a tool for solving global challenges while maintaining profitability.

The dual objectives of impact investing create a unique challenge: achieving market-rate returns while delivering verifiable positive change. This balance requires rigorous due diligence and innovative financial structures that traditional investments don't typically consider.

Key Drivers of Impact Investing Growth

Several converging trends explain the rapid adoption of impact investing. Younger generations entering their peak earning years bring different values to investing, while institutional investors face increasing pressure to demonstrate environmental, social, and governance (ESG) credentials.

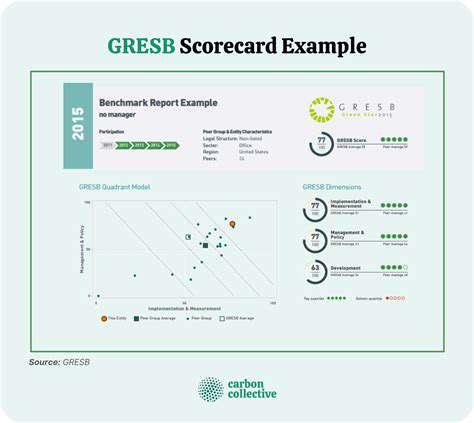

The standardization of impact metrics has been a game-changer, allowing investors to compare and quantify social returns with financial ones. Organizations like the Global Impact Investing Network have developed frameworks that help investors assess and report on non-financial outcomes.

Impact Investing Strategies

The strategies employed by impact investors vary widely based on target outcomes. Some focus on renewable energy infrastructure in developing nations, while others invest in urban revitalization projects that provide both affordable housing and community services.

What unites these diverse approaches is the intentionality behind each investment—every dollar is placed with specific impact goals in mind. This represents a significant departure from traditional investing where social outcomes are often incidental rather than intentional.

Measuring and Reporting Impact

Developing meaningful metrics remains one of the field's greatest challenges. Unlike financial returns that can be measured in standardized units, social impact often requires customized measurement approaches tailored to specific projects and goals.

The most sophisticated impact investors now use a blend of quantitative and qualitative measures, tracking everything from carbon emissions reduced to lives improved through better healthcare access. This data not only demonstrates impact but helps refine future investment strategies.

The Future of Impact Investing

As the sector matures, we're seeing impact investing move from niche to mainstream. Major financial institutions are launching impact investment products, while governments create policies to encourage these approaches through tax incentives and regulatory frameworks.

The next frontier involves scaling successful models while maintaining impact integrity—proving that doing good and doing well financially aren't mutually exclusive goals. This evolution suggests impact investing could eventually become simply how all investing is done.

Navigating the Challenges of Sustainable Real Estate Investment

Navigating the complexities of sustainable practices

Sustainable practices are crucial but implementing them presents unique challenges in the real estate sector. The most significant hurdle often lies in balancing short-term costs with long-term benefits—a calculation that requires specialized knowledge and patience. Many developers struggle to justify higher initial investments in sustainable features when market pressures emphasize quick returns.

These complexities extend beyond construction to include ongoing operations, where sustainable management practices can significantly affect a property's lifecycle costs and environmental footprint.

Economic Barriers to Sustainability

The perception that sustainable features increase costs without corresponding value remains persistent in the industry. However, this overlooks the comprehensive financial picture that includes operational savings, risk mitigation, and asset valuation benefits.

Forward-thinking investors recognize that energy-efficient buildings often command premium rents and experience lower vacancy rates, creating competitive advantages in crowded markets. These financial benefits, coupled with growing tenant demand for green spaces, are gradually shifting industry perspectives.

Technological Advancements and their Role

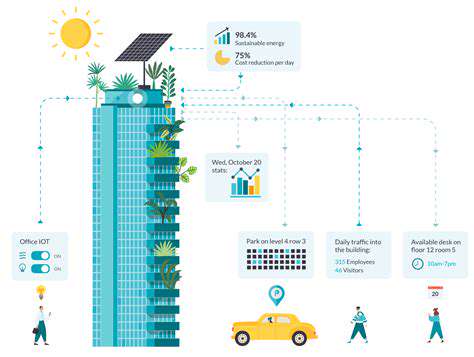

Innovation is rapidly changing the economics of sustainable real estate. Smart building technologies now allow property owners to monitor and optimize energy use in real-time, while advanced materials enable more efficient construction methods with lower environmental impact.

The integration of IoT devices with building management systems represents a particularly promising development, allowing for predictive maintenance and dynamic resource allocation that reduces waste. These technologies are making sustainable practices both more effective and more financially viable.

Social and Cultural Aspects of Sustainability

Changing industry norms and consumer expectations are creating new pressures and opportunities. Tenants increasingly factor sustainability into leasing decisions, while employees prefer working in healthy, environmentally conscious buildings.

This cultural shift is particularly evident among younger demographics who view sustainability as non-negotiable rather than optional. Real estate professionals must adapt to these changing preferences or risk being left behind as market expectations evolve.

Policy and Regulatory Frameworks

Government policies are accelerating the adoption of sustainable practices through a mix of mandates and incentives. Building codes increasingly incorporate energy efficiency standards, while tax credits and grant programs help offset the costs of sustainable upgrades.

In many markets, disclosure requirements for energy performance are creating transparency that rewards sustainable properties with higher valuations. These policy measures are leveling the playing field and reducing the perceived risk of sustainable investments.

Global Collaboration and Partnerships

The scale of environmental challenges requires cooperation across the real estate ecosystem. Industry groups are developing shared standards and best practices, while public-private partnerships are funding innovative demonstration projects.

Perhaps most importantly, knowledge sharing networks are helping smaller players access the expertise needed to implement sustainable solutions cost-effectively. This collaborative approach is essential for driving change across an industry as fragmented as real estate.

The Future of Sustainable Real Estate Investment

Driving Sustainable Practices in Real Estate

The future of sustainable real estate investment lies in making environmental responsibility intrinsic to all aspects of property development and management. This goes beyond just adding green features—it requires rethinking entire business models to align financial success with environmental stewardship. The most progressive firms are developing integrated approaches that consider sustainability at every decision point, from site selection to tenant engagement.

Transparent reporting will continue gaining importance as investors demand verifiable data on environmental performance. Third-party certifications and standardized metrics help create comparability across properties and markets, enabling more informed investment decisions.

Attracting Green-Conscious Investors

The investor base for sustainable real estate is expanding beyond specialized impact funds to include mainstream institutional investors. Pension funds, REITs, and other major capital sources are incorporating sustainability criteria into their investment policies.

What began as a niche strategy is becoming table stakes—soon, the ability to demonstrate strong sustainability performance may be required to access capital at all. This shift is creating new opportunities for developers and owners who can deliver verifiable environmental benefits alongside competitive returns.

Technological Advancements and Innovation

Emerging technologies promise to revolutionize sustainable real estate investment. Digital twins—virtual replicas of physical buildings—allow for sophisticated modeling of energy flows and operational efficiencies before construction begins.

Blockchain applications enable more transparent tracking of sustainable materials through supply chains, while AI-driven analytics help optimize building operations in real-time. These innovations aren't just improving sustainability—they're creating entirely new ways to create value in real estate assets.

The financing landscape is evolving alongside these technological changes. Green bonds have grown significantly, while new instruments like sustainability-linked loans tie financing terms to environmental performance targets. These tools are making sustainable projects more financially attractive while providing measurable accountability.