The Impact of Climate Change on Real Estate Insurance

Rising Premiums: A Complex Picture

Insurance premium increases have become a pressing issue for both individuals and businesses. Multiple elements drive this upward trend, such as climbing healthcare expenses, inflationary pressures, and the growing occurrence and intensity of certain medical issues. Grasping these foundational aspects is vital for making sense of the insurance market's intricacies.

Premium hikes aren't consistent across all insurance sectors or policy types. Regions with higher rates of particular diseases might experience more pronounced increases than others. This disparity emphasizes why meticulous evaluation is essential when assessing personal insurance requirements.

Evolving Coverages: Addressing Modern Needs

The insurance sector continues to transform its offerings to align with contemporary health and financial demands. Modernization includes breakthroughs in medical tech, heightened focus on preventive care, and the expanding incidence of chronic conditions. This ever-changing environment calls for forward-thinking insurance strategies.

Technological Advancements in Insurance

Innovations in technology are revolutionizing the insurance field, streamlining claim handling, enabling customized pricing structures, and improving risk evaluation. These developments could result in more cost-effective and attainable insurance products for a broader audience.

Data analysis and machine learning are fundamentally altering how insurers calculate risk and determine premiums. This approach based on data may yield more precise pricing and potentially more individualized coverage selections.

The Impact of Inflation on Premiums

Inflation's widespread effects significantly influence insurance expenses. As prices climb across multiple sectors, healthcare providers, treatment centers, and pharmaceutical companies face increased operational costs. These elements collectively contribute to rising insurance premiums.

This chain reaction highlights how economic factors interconnect and why insurance companies must carefully control their expenses. Maintaining affordability demands thoughtful financial management and strategic modifications.

The Role of Healthcare Costs in Premium Increases

Soaring healthcare expenses represent a major factor behind premium growth. While medical advancements bring benefits, they frequently involve higher price tags. This leads to increased charges for medical procedures, hospital care, and specialized treatments.

The expanding occurrence of chronic diseases additionally strains healthcare systems and insurance providers. Effectively managing these costs is critical for preserving the insurance industry's viability and keeping coverage reasonably priced.

Understanding Consumer Expectations and Market Trends

Today's insurance customers have developed more refined expectations regarding coverage and service quality. Clear communication, easy access, and tailored services rank high among their priorities. Recognizing these shifting preferences helps insurers stay relevant in a competitive marketplace.

Digital platforms and online interactions have dramatically changed how consumers connect with insurance companies. Addressing these changing demands requires embracing digital innovation and strengthening customer support systems.

Adapting Coverage to Address Rising Sea Levels and Coastal Erosion

Coastal Communities Facing Increased Vulnerability

Rising sea levels and eroding coastlines present serious dangers to seaside populations globally, threatening buildings, economies, and forcing relocations. These areas frequently lack sufficient resources to adjust to environmental changes, potentially suffering severe economic and social fallout. Existing social inequalities compound these challenges, along with heightened risks from severe storms and floods.

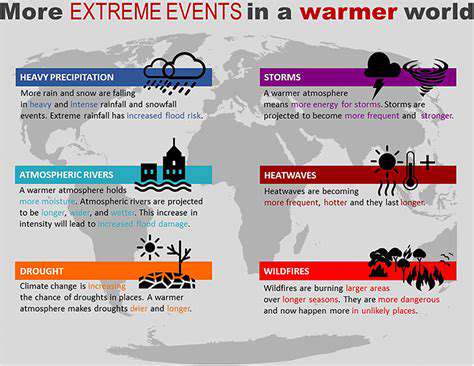

The growing regularity and strength of extreme weather occurrences, partially fueled by climate shifts, intensify pressures on coastal regions. These combined factors highlight the immediate need for preventive adaptation methods to protect vulnerable populations and their vital resources.

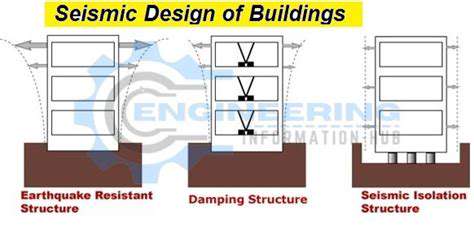

Essential Infrastructure Resilience

Safeguarding critical infrastructure—including transportation networks and utilities—from sea level impacts demands priority attention. Protective measures might involve raising structures, utilizing durable materials, and establishing alert systems to facilitate timely responses. These steps prove essential not only for maintaining crucial services but also for ensuring public security amid escalating environmental threats.

Sustainable Coastal Development Strategies

Implementing eco-conscious coastal planning that reduces ecological harm is key for lasting adaptation. This encompasses thoughtful zoning to limit construction in vulnerable zones, plus promoting natural solutions like wetland and mangrove restoration that serve as protective barriers. Successful implementation requires balancing environmental and financial considerations.

Improved Coastal Monitoring and Forecasting

Enhanced coastal observation and prediction systems, incorporating sophisticated modeling and satellite imaging, enable more accurate projections of sea level changes and erosion trends. This evidence-based method supports better-informed choices when designing protective measures. Detailed understanding of local coastal challenges allows communities to craft precise, effective solutions.

Economic Diversification and Job Creation

Countering the financial consequences of rising seas and coastal erosion necessitates expanding local economic foundations. This involves cultivating alternative sectors, encouraging tourism in lower-risk areas, and developing new opportunities less susceptible to coastal dangers. Such economic broadening can help offset losses related to environmental damage and displacement, promoting regional stability.

Community Engagement and Education

Successful adaptation plans require active community involvement and awareness building. Including local residents in planning and executing protective measures ensures solutions remain practical and culturally suitable. Informing communities about rising sea level risks is equally important for developing readiness and encouraging appropriate responses.

International Collaboration and Knowledge Sharing

Tackling global sea level rise and coastal erosion challenges calls for cross-border cooperation. Countries facing similar issues can accelerate progress by exchanging successful strategies, information, and assets. These partnerships create valuable support networks that facilitate faster advancement in this crucial field.

Read more about The Impact of Climate Change on Real Estate Insurance

Hot Recommendations

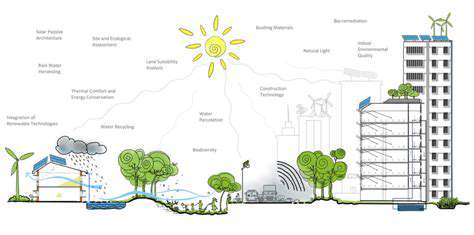

- Sustainable Real Estate Design Principles

- AI in Real Estate: Streamlining the Buying Process

- Climate Risk Disclosure: A Must for Real Estate

- Climate Risk Analytics: Essential for Real Estate Investment Funds

- Modular Sustainable Construction: Scalability and Speed

- Real Estate and Community Disaster Preparedness

- Smart Buildings and Advanced Building Analytics for Optimal Performance

- Smart Waste Sorting and Recycling in Buildings

- Sustainable Real Estate: A Strategic Advantage

- AI in Real Estate Transaction Processing: Speed and Accuracy