Floodplain Management for Real Estate Development

Regulatory Frameworks and Compliance Requirements

Regulatory Landscape for Financial Institutions

Financial institutions operate within a complex web of regulations designed to protect consumers, maintain market stability, and prevent financial crime. These regulations, often originating from governmental bodies and international organizations, cover a wide range of activities, including lending practices, investment products, and anti-money laundering procedures. Understanding and adhering to these regulations is crucial for the continued operation and success of any financial institution. This landscape is constantly evolving, requiring ongoing vigilance and adaptation by institutions to stay compliant.

Navigating this intricate regulatory environment requires a deep understanding of the specific rules and guidelines applicable to each institution's activities. This includes comprehending the nuances of regulations related to capital adequacy, risk management, and customer due diligence. Failure to comply with these regulations can result in severe penalties, including hefty fines and even the revocation of operating licenses. Moreover, non-compliance can damage an institution's reputation and erode public trust.

Compliance Procedures and Best Practices

Effective compliance management is not just about knowing the regulations; it's about embedding compliance into every aspect of the institution's operations. This involves establishing robust internal controls, training employees on compliance procedures, and regularly auditing operations to ensure adherence to the established standards. Implementing comprehensive compliance programs that cover all aspects of the business model is vital.

Implementing a strong compliance culture is equally important. This involves fostering a mindset where employees understand the importance of compliance, feel empowered to raise concerns, and know where to seek guidance. Creating clear communication channels and providing regular training sessions can significantly contribute to a robust compliance culture. Maintaining meticulous records and documentation of compliance activities is essential for demonstrating adherence to regulatory requirements and for facilitating audits.

Continuous monitoring and adaptation to evolving regulations are critical components of a successful compliance program. The financial services industry is dynamic, with new regulations and guidelines emerging frequently. Financial institutions must remain vigilant in tracking these changes and adapting their procedures accordingly. Staying ahead of the curve in this evolving regulatory environment can protect the institution from costly errors and maintain its license to operate.

Regular audits and internal reviews should be conducted to identify potential compliance gaps and weaknesses. These reviews should be thorough, objective, and impartial, ensuring that all aspects of the organization's operations are assessed for compliance. This provides a platform for improvement and ensures that necessary changes are implemented promptly.

Mitigation Strategies for Floodplain Development

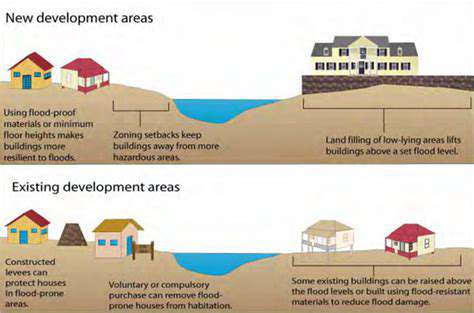

Floodproofing

Floodproofing involves modifying existing structures to resist floodwaters. This can include elevating the foundation, installing floodwalls, and reinforcing the building's exterior to prevent water intrusion. Implementing floodproofing measures significantly reduces the risk of damage during a flood event, and can often be a cost-effective solution for protecting property. It's important to consider the specific flood risk level in the area when determining the appropriate floodproofing measures.

Effective floodproofing requires a thorough understanding of the potential flood levels and the structural integrity of the building. This often necessitates consulting with engineers and contractors experienced in flood mitigation to ensure the work is done correctly and is compliant with local building codes.

Land-Use Planning and Zoning

Strategic land-use planning can effectively minimize flood risks by restricting development in high-risk floodplains. Zoning regulations can dictate the types of structures allowed in these areas, potentially requiring higher building standards or prohibiting new construction altogether. This proactive approach helps to reduce the number of structures vulnerable to flooding and the potential for widespread damage during a flood event.

By identifying and designating high-risk floodplains, communities can prioritize the protection of lives and property. This approach necessitates careful consideration of the potential impacts on community development and economic activity, ensuring that regulations are well-balanced and effectively implemented.

Early Warning Systems

Implementing robust early warning systems is critical for giving communities time to prepare for potential flood events. These systems, which can include weather radar, flood gauges, and mobile alerts, provide timely information about impending floods, allowing residents to evacuate or take necessary precautions to safeguard their homes and businesses. The accuracy and reliability of these systems are paramount in ensuring that individuals receive timely warnings, and this is often dependent on the proper maintenance and upgrades of the systems.

Developing Flood Resilience

Building community resilience to flooding involves strengthening the community's capacity to respond and recover from flood events. This includes enhancing disaster preparedness through training programs, community workshops, and volunteer initiatives. These measures promote a culture of preparedness, empowering residents with the knowledge and skills to effectively mitigate the impacts of flooding. By focusing on preparedness, communities can reduce the suffering and disruption caused by floods.

Insurance and Financial Assistance

Flood insurance is a vital tool for mitigating the financial impacts of flooding. It provides coverage for damages caused by floodwaters, helping to offset the significant costs associated with repairs and rebuilding. Government programs and initiatives can provide crucial financial assistance to flood-affected communities. These programs can support temporary housing, repair costs, and long-term recovery efforts, ensuring that affected individuals and businesses can rebuild and recover from the disaster. This support is paramount in helping communities recover quickly and effectively.

Read more about Floodplain Management for Real Estate Development

Hot Recommendations

- Sustainable Real Estate Design Principles

- AI in Real Estate: Streamlining the Buying Process

- Climate Risk Disclosure: A Must for Real Estate

- Climate Risk Analytics: Essential for Real Estate Investment Funds

- Modular Sustainable Construction: Scalability and Speed

- Real Estate and Community Disaster Preparedness

- Smart Buildings and Advanced Building Analytics for Optimal Performance

- Smart Waste Sorting and Recycling in Buildings

- Sustainable Real Estate: A Strategic Advantage

- AI in Real Estate Transaction Processing: Speed and Accuracy