AI Powered Due Diligence for Property Acquisitions

AI's Role in Enhanced Data Analysis

AI-Powered Data Extraction

Modern data analysis has been transformed by artificial intelligence, which automates the extraction of valuable insights from massive volumes of unstructured information. While traditional approaches frequently falter under the weight of today's complex datasets, machine learning models demonstrate remarkable efficiency in processing diverse data types—text, images, and audio alike. The true power lies in uncovering subtle patterns and connections that would typically escape human notice, providing organizations with unprecedented visibility into their customer base, market position, and internal processes. Beyond surface-level observations, these intelligent systems excel at revealing obscure yet critical data points that significantly enhance strategic decision-making.

What sets these systems apart is their trainable nature—they can be precisely calibrated to spot particular patterns and irregularities. This forward-thinking methodology enables businesses to detect emerging issues like potential fraud or operational errors at their earliest stages, allowing for timely intervention before problems escalate. The resulting operational optimizations and risk mitigation strategies translate directly into measurable cost reductions and efficiency gains—advantages that prove invaluable in our current hyper-competitive business climate.

Improved Predictive Capabilities

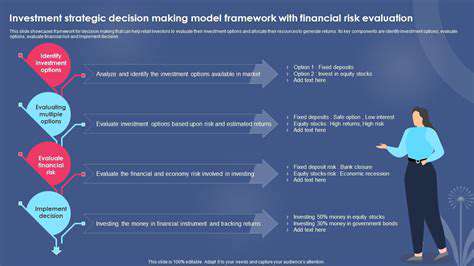

The forecasting prowess of advanced algorithms represents a quantum leap in business intelligence. By meticulously examining historical patterns and correlations, these systems generate remarkably accurate projections across various operational areas—from inventory requirements to customer retention rates. This predictive power fundamentally changes how organizations approach planning, shifting from reactive responses to proactive strategy formulation.

Modern predictive models incorporate an expansive range of influencing factors, including shifting consumer preferences, macroeconomic indicators, and emerging industry developments. These multidimensional analyses produce forecasts of exceptional precision, enabling businesses to fine-tune their operations with surgical accuracy. In today's volatile markets, the capacity to anticipate and adapt to coming changes provides companies with a decisive competitive advantage that often determines market leadership.

Enhanced Data Visualization

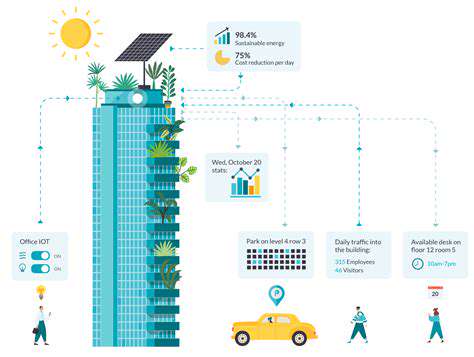

Data interpretation reaches new heights through AI-driven visualization techniques that convert complex datasets into intuitive graphical representations. Where spreadsheets and raw numbers might obscure meaningful patterns, intelligent visualization platforms illuminate critical trends through dynamic charts and interactive dashboards. This visual transformation enables executives to digest complex information rapidly and make confident, data-backed decisions.

The customization capabilities of these tools are particularly noteworthy—they automatically adapt visual outputs to match specific departmental requirements. Marketing teams might receive demographic-focused displays while operations managers view process efficiency metrics, all derived from the same underlying data. This tailored approach ensures every stakeholder accesses precisely the insights they need in the most actionable format, dramatically improving organizational decision-making at all levels.

Automated Data Analysis Tasks

Operational efficiency receives a substantial boost through the automation of routine analytical processes. Tedious preparatory work—data cleansing, standardization, and preliminary assessment—now occurs automatically, liberating human analysts to concentrate on higher-value interpretation and strategy development. This shift not only accelerates workflows but also minimizes the errors inherent in manual processing, yielding more reliable business intelligence.

The continuous monitoring capabilities of these systems represent another significant advancement. Programmed to track performance indicators in real-time, they instantly flag any deviations from expected patterns. This perpetual vigilance proves particularly valuable in fast-moving industries where conditions change rapidly, enabling organizations to respond to emerging situations with unprecedented speed and precision.

Streamlining the Document Review Process

Improving Efficiency with Automated Review

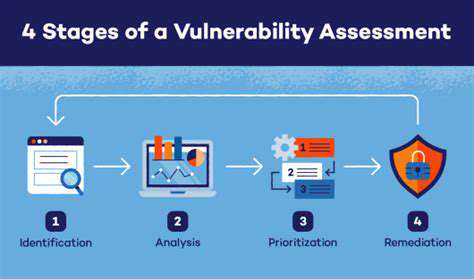

The application of intelligent document processing in property transactions revolutionizes traditional review methods. These advanced systems rapidly analyze and organize extensive documentation, automatically identifying critical sections and potential concerns that might escape manual detection. By handling the initial screening, they allow legal and financial experts to dedicate their attention to the most consequential aspects, simultaneously expediting due diligence while reducing oversight risks. The system's ability to prioritize documents based on customized parameters—specific contract clauses or regulatory references—ensures optimal allocation of human expertise.

Perhaps more impressively, these tools detect subtle inconsistencies and patterns across document collections, surfacing potential issues that would likely remain hidden during conventional reviews. Early identification of such concerns enables preemptive resolution, potentially averting costly disputes or unexpected liabilities. The combined effect is a more streamlined, cost-effective acquisition process characterized by informed decision-making and reduced exposure to oversight-related complications.

Enhancing Accuracy and Reducing Risk

The precision of automated document analysis sets a new standard for transactional accuracy—a critical factor in property acquisitions where minor oversights can trigger major consequences. By systematically capturing all pertinent details, these tools provide complete visibility into a property's legal and financial standing. This comprehensive approach forms the foundation for sound investment decisions and effective risk management strategies.

Beyond simple data extraction, these solutions map intricate relationships between various legal documents, constructing a complete picture of a property's historical and legal context. This holistic perspective is instrumental in preventing future disputes or unanticipated legal challenges, effectively safeguarding investments. The thoroughness of AI-assisted reviews ensures all potential risks receive proper consideration before transaction completion, substantially reducing legal and financial vulnerabilities.

The inherent transparency of automated review processes represents another significant benefit for high-value transactions. Every analytical step remains traceable, allowing stakeholders to verify findings and review methodologies. This audit trail not only reinforces accountability but also minimizes the potential for human error, thereby enhancing the overall reliability of the due diligence process.

Read more about AI Powered Due Diligence for Property Acquisitions

Hot Recommendations

- Sustainable Real Estate Design Principles

- AI in Real Estate: Streamlining the Buying Process

- Climate Risk Disclosure: A Must for Real Estate

- Climate Risk Analytics: Essential for Real Estate Investment Funds

- Modular Sustainable Construction: Scalability and Speed

- Real Estate and Community Disaster Preparedness

- Smart Buildings and Advanced Building Analytics for Optimal Performance

- Smart Waste Sorting and Recycling in Buildings

- Sustainable Real Estate: A Strategic Advantage

- AI in Real Estate Transaction Processing: Speed and Accuracy