Climate Risk Disclosure: What Property Owners Need to Know

This isn't merely an environmental issue; it's the defining economic challenge of our generation, requiring mobilization comparable to wartime economies. Analysis from the World Bank suggests climate-smart investments could generate $26 trillion in economic benefits through 2030, while delayed action might trigger financial crises surpassing the 2008 meltdown. The choice between proactive adaptation and reactive triage grows starker each year.

Policy Solutions and Innovations

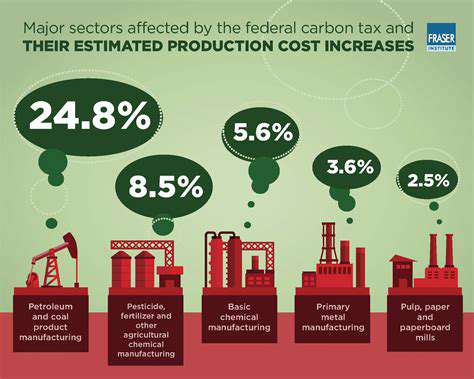

Mitigating climate risks demands coordinated policy action across multiple fronts. Renewable energy deployment must accelerate to 3-4 times current rates to meet Paris Agreement targets, creating millions of skilled jobs in the process. Carbon pricing mechanisms now cover 20% of global emissions, but must expand significantly to drive meaningful behavioral change.

Breakthrough technologies show promise - next-generation battery storage enables intermittent renewables to replace baseload power, while AI-driven smart grids optimize energy distribution. However, the real game-changer lies in circular economy models that could reduce industrial emissions 45% by redesigning production systems from the ground up. These systemic shifts require policy frameworks that incentivize innovation while ensuring just transitions for affected workers and communities.

What Does Climate Risk Disclosure Entail?

Understanding the Importance of Climate Risk

Climate risk disclosure has evolved from voluntary reporting to regulatory requirement across major markets. Corporations now face legal liability for failing to disclose material climate risks, with shareholder lawsuits increasing 85% year-over-year. The SEC's proposed climate disclosure rules would mandate standardized reporting of Scope 1-3 emissions, physical risk exposure, and transition planning - creating new compliance burdens but also leveling the playing field.

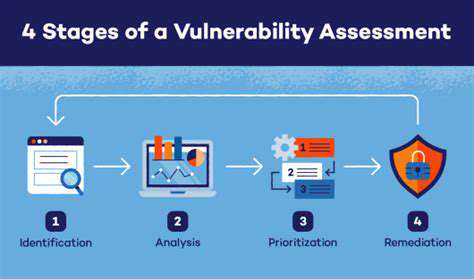

Identifying Key Climate Risks

Sophisticated risk modeling now distinguishes between acute physical risks (hurricane damage) and chronic physical risks (rising temperatures reducing labor productivity). Forward-looking companies analyze how +2°C and +4°C scenarios would impact their asset portfolios, with some fossil fuel assets facing 40-60% write-downs in aggressive transition scenarios. Supply chain mapping tools reveal hidden vulnerabilities - a single supplier's flood risk might threaten entire production lines.

Materiality Assessment and Reporting

The materiality determination process has become increasingly quantitative, with climate risks factored into discounted cash flow analyses and credit ratings. Moody's now incorporates climate risk into 80% of its corporate ratings, while BlackRock screens all major investments through climate stress tests. This financialization of climate risk forces executives to treat it with the same rigor as traditional financial metrics.

The Role of Stakeholder Engagement

Progressive firms conduct climate scenario workshops with lenders, insurers, and community leaders to stress-test resilience plans. Some manufacturers now involve suppliers in joint climate adaptation programs, recognizing that their carbon footprint extends far beyond factory walls. This collaborative approach builds trust while surfacing innovative solutions that solitary analysis might miss.

Disclosure Standards and Frameworks

The IFRS Foundation's new International Sustainability Standards Board (ISSB) aims to create a global baseline for climate reporting, while the EU's Corporate Sustainability Reporting Directive (CSRD) mandates double materiality assessments. These frameworks help investors compare apples-to-apples, though jurisdictional differences create compliance complexities for multinationals.

The Future of Climate Risk Disclosure

Next-generation disclosure will likely incorporate real-time sensor data from IoT devices, AI-driven risk modeling, and blockchain-verified emission tracking. As physical climate risks intensify, we may see mandatory climate resilience certifications for assets and infrastructure, similar to energy efficiency ratings today.

The Role of Insurance in Climate Risk Disclosure

Understanding the Importance of Climate Risk Disclosure

Insurance markets serve as climate risk early warning systems, with premium adjustments reflecting evolving risk perceptions. Some coastal properties now face 500% premium increases or outright coverage denials, sending unambiguous signals about climate vulnerability. Reinsurers like Swiss Re publish detailed climate models that inform both underwriting decisions and corporate risk management strategies.

Insurance as a Catalyst for Climate Action

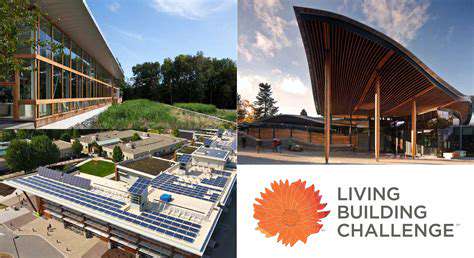

Leading insurers now offer premium discounts for climate-resilient construction, renewable energy adoption, and supply chain diversification. Some policies include green upgrade clauses that use claim payouts to rebuild damaged properties to higher resilience standards. These mechanisms align insurer and policyholder incentives toward long-term risk reduction.

Insurance's Role in Assessing Physical Risks

Catastrophe modeling has advanced from historical loss analysis to probabilistic climate-forward projections. New parametric insurance products trigger automatic payouts when predefined climate thresholds (e.g., wind speeds, rainfall levels) are exceeded, providing faster liquidity after disasters while reducing claims adjustment costs.

Insurance and Transition Risks

Specialized products now cover risks like carbon credit invalidation, climate policy reversal, and stranded asset devaluation. Some insurers offer transition bonds that lower premiums for companies meeting verified decarbonization milestones. These innovations help businesses navigate the uncertain policy landscape while maintaining investor confidence.

Insurance and the Financial Implications of Climate Change

The insurance protection gap - uninsured climate-related losses - now exceeds $100 billion annually, exposing systemic vulnerabilities. Some regulators now require insurers to conduct climate solvency stress tests, recognizing that traditional actuarial models underestimate climate volatility. This regulatory pressure accelerates the shift toward more robust risk assessment frameworks.