The ESG Imperative: Climate Risk in Real Estate Investing

Integrating Climate Risk Assessments into Investment Strategies

Integrating Climate Risk Assessments into Business Strategies

Climate change is no longer a distant threat; its impacts are being felt globally, and businesses are increasingly recognizing the need to incorporate climate risk assessments into their strategic planning. This proactive approach is crucial for long-term sustainability and resilience. Integrating these assessments allows companies to anticipate potential disruptions to supply chains, operations, and market demand, enabling them to develop mitigation and adaptation strategies. Understanding the specific vulnerabilities of a business, from extreme weather events to changing resource availability, is paramount to effective risk management.

Furthermore, integrating climate risk assessments goes beyond simply identifying potential problems. It enables businesses to identify opportunities presented by emerging climate-related technologies and markets. For example, companies can leverage insights from these assessments to develop sustainable products, processes, and business models, ultimately positioning themselves for growth and competitiveness in a changing climate landscape. This forward-thinking approach not only safeguards the company's future but can also enhance its brand reputation and attract environmentally conscious consumers.

Quantifying and Prioritizing Climate Risks

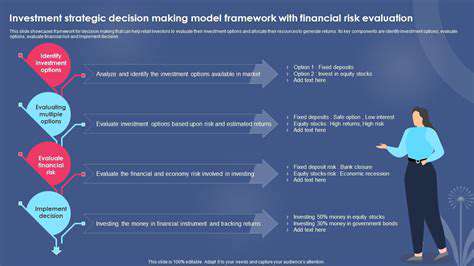

A critical aspect of integrating climate risk assessments is the ability to quantify and prioritize the identified risks. This involves assigning probabilities and potential impacts to various climate-related scenarios, allowing businesses to focus their resources on the most significant threats. Accurate quantification of these risks is essential for effective decision-making, enabling companies to allocate budgets and resources effectively to mitigate or adapt to these risks. This process requires considering a range of factors, including historical climate data, scientific projections, and local regulatory frameworks.

Prioritization is equally important. Not all climate risks are created equal. Some risks may have a low probability but a high impact, while others may have a high probability but a low impact. A robust risk assessment methodology should help in identifying and ranking these risks accordingly, so that management can allocate resources effectively. This focused approach ensures that businesses are addressing the most critical climate risks first, maximizing the return on investment for their risk mitigation and adaptation efforts. Prioritizing and quantifying these risks will also help businesses to develop comprehensive and effective strategies for long-term sustainability.

By meticulously evaluating and prioritizing these risks, companies can develop targeted strategies to minimize their vulnerabilities and capitalize on opportunities presented by a changing climate. This approach fosters greater resilience and sustainability, contributing to both the bottom line and a healthier planet.

Personalized marketing is more than just addressing customers by name; it's a strategic approach that understands and leverages individual customer needs, preferences, and behaviors to create tailored experiences. This approach fosters stronger customer relationships and drives significantly higher conversion rates. It centers around understanding the individual customer journey and using data to tailor messaging and offers accordingly.

The Role of Policy and Regulation in Shaping the Future of Real Estate

The Importance of Clear Policy Frameworks

Effective policy frameworks are crucial for guiding economic development and ensuring a level playing field for businesses. These frameworks provide a clear understanding of acceptable behaviors and actions, minimizing uncertainty and encouraging investment. A well-defined policy landscape fosters innovation and allows businesses to confidently pursue growth strategies, knowing the rules of the game are established and transparent.

Furthermore, well-structured policies facilitate a stable and predictable environment. This stability is essential for attracting foreign investment and fostering domestic entrepreneurship. When businesses can anticipate the regulatory environment, they are more likely to make long-term commitments and contribute to sustained economic growth.

Regulatory Scrutiny and its Impact

Regulatory scrutiny plays a vital role in maintaining market integrity and consumer protection. Rigorous oversight ensures that businesses operate ethically and that products and services meet the necessary safety standards. This ultimately builds consumer trust and confidence in the market, contributing to a healthy and sustainable economy.

However, excessive or poorly designed regulation can stifle innovation and economic activity. A balanced approach is crucial, one that acknowledges the need for market oversight while minimizing unnecessary burdens on businesses.

The Influence of Policy on Market Structure

Policies significantly influence market structure by shaping competition and fostering innovation. Policies aimed at promoting competition, such as antitrust regulations, can lead to greater efficiency and lower prices for consumers. Conversely, policies that create barriers to entry or favor certain players can lead to market inefficiencies and stifle innovation.

The structure of a market directly impacts its dynamism and the ability of new entrants to compete. A healthy market structure, fostered by appropriate policies, creates a fertile ground for innovation and progress.

Policy and Regulation in Fostering Innovation

Policies can be powerful tools for fostering innovation. Targeted incentives and support programs can encourage the development of new technologies and products, leading to economic growth and job creation. Government investments in research and development, for instance, can accelerate technological advancements that benefit society as a whole.

Regulations, in some cases, can also play a constructive role in fostering innovation by setting standards and promoting safety. These regulations, when well-designed, can create a predictable environment for innovation and encourage the development of new products and services.

Policy and Regulation in Addressing Societal Needs

Effective policies and regulations can address critical societal needs such as environmental protection, public health, and labor standards. Strong environmental regulations, for example, can promote sustainable practices and mitigate the negative impacts of industrial activity on the environment. Policies focused on public health can contribute to improved well-being and a healthier population.

Furthermore, regulations designed to protect workers' rights and ensure fair labor practices can create a more equitable and just society. A well-rounded approach to policy and regulation can address the complex needs of society, promoting progress and improving the quality of life for all citizens.

Read more about The ESG Imperative: Climate Risk in Real Estate Investing

Hot Recommendations

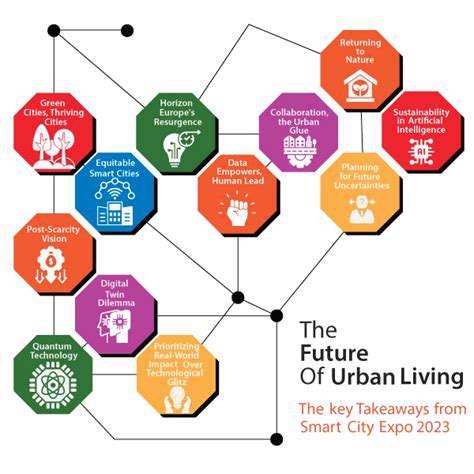

- Sustainable Real Estate Design Principles

- AI in Real Estate: Streamlining the Buying Process

- Climate Risk Disclosure: A Must for Real Estate

- Climate Risk Analytics: Essential for Real Estate Investment Funds

- Modular Sustainable Construction: Scalability and Speed

- Real Estate and Community Disaster Preparedness

- Smart Buildings and Advanced Building Analytics for Optimal Performance

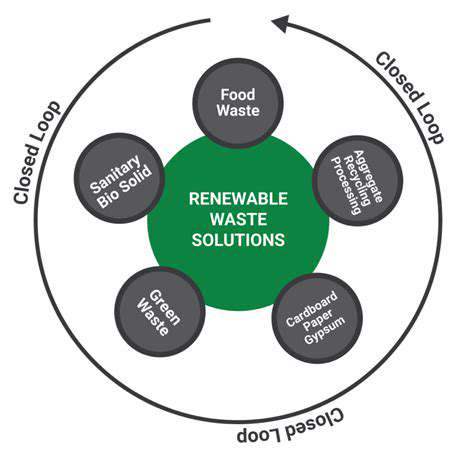

- Smart Waste Sorting and Recycling in Buildings

- Sustainable Real Estate: A Strategic Advantage

- AI in Real Estate Transaction Processing: Speed and Accuracy