AI Driven Valuation: The Competitive Edge in Today's Real Estate Market

Streamlining the Valuation Process for Enhanced Efficiency

Improving Accuracy and Speed

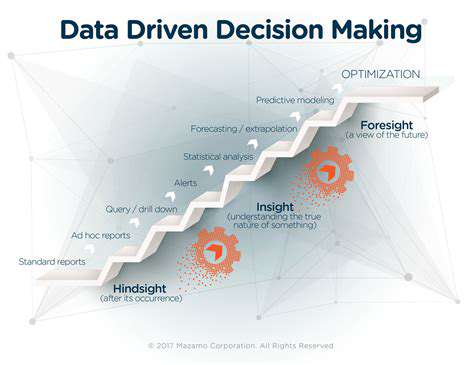

AI-powered valuation tools can analyze vast datasets of comparable properties, transactions, and market trends far more quickly and comprehensively than humans. This detailed analysis minimizes the potential for human error and allows for a more accurate valuation, reducing the time it takes to reach a precise and reliable estimate. The result is a much more efficient process, saving valuable time and resources for all stakeholders involved in the valuation process.

By automating the data collection and analysis stages, AI can significantly reduce the time required to complete a valuation. This translates into faster turnaround times for clients, allowing for quicker decision-making and more efficient project timelines. The automation also minimizes the risk of errors introduced by manual data entry and processing, leading to greater reliability and consistency in the valuation results.

Enhanced Data Integration and Analysis

AI systems can seamlessly integrate data from various sources, including public records, real-time market data feeds, and proprietary databases. This comprehensive data integration allows for a more holistic valuation process, considering a wider range of factors that might influence property value. The integration process itself is streamlined, reducing the time-consuming manual tasks typically associated with data collection and preparation.

AI algorithms excel at identifying complex patterns and relationships within the integrated data, providing insights that would be difficult or impossible for humans to discern. This deeper analysis allows for a more nuanced and accurate understanding of the market conditions and their impact on the subject property's value.

Minimizing Valuation Bias

One of the significant advantages of AI-driven valuation is its ability to minimize human bias. Traditional valuation methods can be susceptible to unconscious biases that can skew the results. AI algorithms, trained on vast datasets, can identify and mitigate these biases, leading to more objective and fair valuations. This impartiality enhances the credibility and reliability of the valuation process, fostering trust among all parties involved.

Streamlined Workflow and Reduced Costs

AI-driven valuation tools automate many aspects of the valuation process, from data collection to report generation. This automation simplifies the workflow, reducing the need for extensive manual intervention. The result is a substantial reduction in administrative costs, enabling firms to allocate resources more efficiently and potentially offer more competitive pricing for their services.

Improving Transparency and Accountability

AI-powered valuation systems often provide detailed explanations of their conclusions, making the valuation process more transparent. This transparency fosters trust and accountability by allowing stakeholders to understand the rationale behind the valuation and the factors that influenced it. The detailed explanations also enable easier review and scrutiny, further enhancing the credibility of the entire valuation process.

Improved Valuation Consistency

AI systems ensure consistent valuation methodology across different properties and projects. This consistency is crucial for maintaining fairness and comparability in the real estate market. By employing standardized algorithms and procedures, AI minimizes the variability that can arise from human judgment, resulting in more reliable and consistent valuations. This standardization also contributes to a more accurate reflection of market trends.

Increased Efficiency and Scalability

The automated nature of AI-driven valuation processes allows for a significantly higher volume of valuations to be completed in a shorter period. This increased efficiency is particularly valuable in dynamic markets or when dealing with a large portfolio of properties. AI systems can be easily scaled to handle increased workloads, making them invaluable in situations where rapid and consistent valuations are crucial.

Read more about AI Driven Valuation: The Competitive Edge in Today's Real Estate Market

Hot Recommendations

- Sustainable Real Estate Design Principles

- AI in Real Estate: Streamlining the Buying Process

- Climate Risk Disclosure: A Must for Real Estate

- Climate Risk Analytics: Essential for Real Estate Investment Funds

- Modular Sustainable Construction: Scalability and Speed

- Real Estate and Community Disaster Preparedness

- Smart Buildings and Advanced Building Analytics for Optimal Performance

- Smart Waste Sorting and Recycling in Buildings

- Sustainable Real Estate: A Strategic Advantage

- AI in Real Estate Transaction Processing: Speed and Accuracy