AI for Commercial Property Acquisition due diligence

Optimizing Productivity Through Technology

Revolutionizing Property Evaluation Methods

Advanced technological solutions are transforming how commercial properties undergo evaluation before purchase. Modern systems automate critical functions including data examination, paperwork assessment, and risk evaluation, enabling faster and more precise processing than conventional approaches. This efficiency gain creates opportunities to redirect attention toward other vital components of the property transaction process. These innovative tools can uncover potential concerns in a property's background, financial documentation, or legal paperwork that might otherwise go unnoticed, resulting in more exhaustive inspections that help prevent unexpected complications and financial setbacks.

Additionally, sophisticated analysis of extensive market data, including sales comparisons and economic factors, provides enhanced understanding of a property's valuation and profit potential. This evidence-based methodology supports better-informed choices while minimizing chances of excessive expenditures or missed investment prospects. The heightened precision offered by automated evaluation systems fosters increased transparency throughout the acquisition procedure.

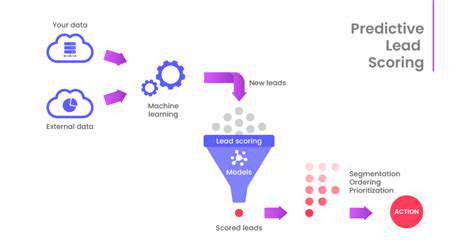

Data-Driven Forecasting for Strategic Investments

Predictive analytical techniques, a cornerstone of modern technology applications, supply investors with crucial projections about market trajectories and property valuation trends. By processing historical records, current market movements, and economic predictions, advanced systems generate reliable forecasts concerning commercial property profitability. This forward-looking perspective proves indispensable for developing strategic investment plans, facilitating more deliberate and well-researched property acquisitions.

These systems can also anticipate possible obstacles related to specific properties, such as variations in leasing revenue, tenant profile changes, or economic fluctuations. Early detection of potential issues allows for proactive strategy adjustments or risk mitigation measures before problems arise, leading to improved long-term results. The predictive power of modern analytical tools provides substantial advantages when navigating commercial real estate market complexities while optimizing investment returns.

Comprehensive analysis of prospective tenant combinations, market requirements, and extended economic considerations enables accurate assessment of a property's sustained viability. This detailed examination helps ensure alignment with future market developments while maximizing investment potential.

Incorporating these analytical insights into decision-making processes promotes more strategic, evidence-based investment choices that typically yield increased profitability with reduced exposure to risk.

The Evolution of Technology in Property Transactions

Advanced Forecasting Models for Strategic Planning

State-of-the-art predictive modeling techniques are transforming commercial property transaction methodologies. Processing enormous datasets containing market movements, economic metrics, and historical property data enables creation of remarkably accurate future market value projections. This analytical capacity provides investors with actionable intelligence for making well-informed decisions regarding property valuations, anticipated returns, and comprehensive investment approaches. These predictive capabilities extend beyond basic price estimations, offering valuable perspectives on factors including tenant requirements, occupancy levels, and potential influences of technological advancements on property valuations.

Machine learning integration facilitates development of adaptive models that evolve alongside changing market dynamics. This flexibility proves essential in today's unpredictable economic environment, helping investors remain responsive to emerging prospects and potential challenges. Consequently, predictive modeling substantially decreases uncertainty traditionally associated with acquisition processes, resulting in more secure and profitable commercial real estate investments.

Automated Processes for Increased Efficiency

Technological automation of routine tasks, including property investigations, due diligence, and agreement negotiations, represents a major progression. Modern tools can rapidly analyze enormous data quantities to identify properties matching specific investment parameters. This automated screening not only accelerates the acquisition timeline but also minimizes potential human errors while maintaining evaluation consistency across potential investments.

Beyond preliminary research, automated systems can assist with negotiation processes. By evaluating market statistics and comparable transaction terms, these tools can recommend optimal pricing approaches and bargaining techniques. This automation permits human professionals to concentrate on more complex transaction components like strategic analysis and stakeholder relationship development. The resulting efficiency improvements typically translate to shorter acquisition periods and potentially reduced transaction expenses.

Additionally, advanced platforms can streamline management of diverse property portfolios. Through monitoring key performance metrics and delivering real-time market insights, these systems enable proactive portfolio oversight and adaptation to changing market conditions. This comprehensive portfolio management approach improves overall efficiency and profitability of commercial property holdings.

The capacity to process massive data volumes and identify patterns potentially overlooked by human analysts dramatically enhances accuracy and efficiency throughout commercial property transactions. This leads to superior investment choices, minimized risk exposure, and ultimately, improved investor returns.

Technological integration in commercial property transactions is ushering in unprecedented efficiency and sophistication within the industry. By harnessing data analysis and automation capabilities, investors can secure competitive advantages and achieve greater success in the increasingly complex commercial real estate marketplace.

Task automation extends beyond mere speed enhancement - it reallocates human resources toward strategic transaction components. Analytical insights provide clearer market understanding, facilitating better-informed decisions grounded in comprehensive market comprehension.

Read more about AI for Commercial Property Acquisition due diligence

Hot Recommendations

- Sustainable Real Estate Design Principles

- AI in Real Estate: Streamlining the Buying Process

- Climate Risk Disclosure: A Must for Real Estate

- Climate Risk Analytics: Essential for Real Estate Investment Funds

- Modular Sustainable Construction: Scalability and Speed

- Real Estate and Community Disaster Preparedness

- Smart Buildings and Advanced Building Analytics for Optimal Performance

- Smart Waste Sorting and Recycling in Buildings

- Sustainable Real Estate: A Strategic Advantage

- AI in Real Estate Transaction Processing: Speed and Accuracy