Real Estate Analytics: Using AI for Market Intelligence

The Rise of AI in Real Estate Analytics

AI-Powered Market Forecasting

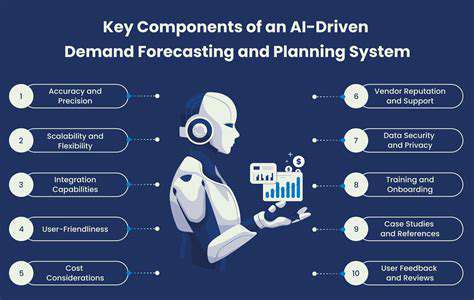

Advancements in AI are revolutionizing real estate market forecasting. Sophisticated algorithms can analyze vast datasets, including historical sales data, economic indicators, and even social media trends, to predict future market movements with greater accuracy than traditional methods. This allows investors and real estate professionals to make more informed decisions about property valuations, pricing strategies, and investment opportunities. The ability to anticipate market fluctuations empowers proactive strategies, minimizing risk and maximizing potential returns.

By identifying emerging trends and potential market shifts, AI-driven forecasting tools enable real estate players to adapt their strategies in real-time. This dynamic responsiveness is a significant advantage in today's rapidly changing market conditions, ensuring they are always positioned to capitalize on opportunities and mitigate potential risks. Forecasting accuracy is continually improving, making AI a valuable asset for decision-making across the entire real estate spectrum.

Automated Property Valuation

AI is transforming the way property valuations are conducted. Instead of relying solely on traditional appraisal methods, AI algorithms can analyze a multitude of factors, including comparable sales, property characteristics, location data, and market trends, to generate more precise and efficient valuations. This automation not only speeds up the valuation process but also reduces the potential for human error and bias, leading to fairer and more transparent assessments. The ability to process vast amounts of data quickly and objectively makes AI a significant asset in the appraisal industry.

This automated approach is particularly beneficial for large-scale property portfolios or when dealing with complex properties. Real estate companies can significantly reduce the time and cost associated with traditional valuations, allowing them to focus their resources on other critical aspects of their operations. The accuracy of AI-powered valuations is constantly improving, making it a reliable and efficient tool for real estate professionals.

Personalized Buyer Experiences

AI is playing a crucial role in enhancing the buyer experience in real estate. By analyzing buyer preferences and search criteria, AI-powered systems can personalize search results, suggesting properties that align with individual needs and desires. This personalized approach significantly improves the efficiency and effectiveness of the home-buying process, allowing buyers to find their dream homes faster and more easily. Such personalized services contribute to greater customer satisfaction and a more positive overall experience.

Predictive Maintenance and Risk Assessment

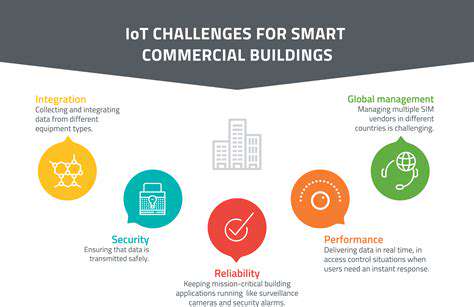

AI is not just for market analysis; it's also revolutionizing the management and maintenance of real estate properties. By analyzing data from various sources, including building sensors, weather patterns, and historical maintenance records, AI algorithms can predict potential maintenance issues and schedule repairs proactively. This proactive approach minimizes downtime and ensures the longevity of properties. Predictive maintenance is crucial for maximizing returns and minimizing unexpected expenses.

AI-Driven Data Analysis for Market Forecasting

Leveraging AI for Enhanced Market Insights

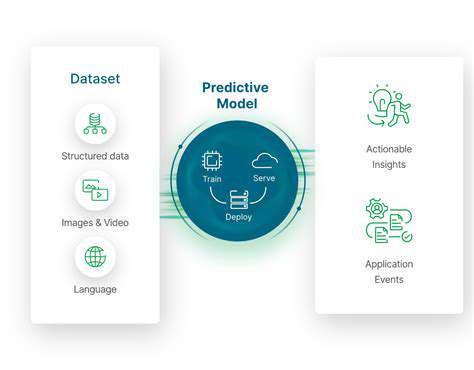

Artificial intelligence (AI) is revolutionizing the way businesses approach data analysis, enabling them to uncover previously hidden patterns and trends within market data. AI algorithms can process vast datasets at an incredible speed, identifying intricate correlations and relationships that human analysts might miss. This enhanced analytical capability empowers businesses to make more informed decisions, leading to improved strategies and ultimately, a significant competitive edge. AI-driven analysis can predict market fluctuations with greater accuracy than traditional methods, giving businesses crucial time to adapt and optimize their strategies.

By automating repetitive tasks and providing real-time insights, AI streamlines the data analysis process. This frees up human analysts to focus on higher-level strategic planning and interpretation of the data, allowing for a more comprehensive understanding of complex market dynamics. This increased efficiency translates directly into cost savings and faster time-to-market for new products and services.

Predictive Modeling and Forecasting

One of the most significant applications of AI in market analysis is predictive modeling. AI algorithms can analyze historical market data, including sales figures, customer demographics, and economic indicators, to develop accurate predictive models. These models can forecast future market trends, helping businesses anticipate potential challenges and capitalize on emerging opportunities. Accurate forecasting provides businesses with a crucial advantage by enabling proactive adjustments to their strategies and operations.

Predictive modeling is particularly valuable in identifying potential risks and opportunities. By identifying potential market downturns or unexpected surges in demand, businesses can proactively adjust their inventory levels, pricing strategies, and marketing campaigns, mitigating potential losses and maximizing profits. These forecasting abilities are particularly important in dynamic markets, where changes occur rapidly.

Personalized Customer Experiences

AI-powered data analysis enables businesses to gain a deeper understanding of their customer base, allowing for the development of highly personalized experiences. By analyzing customer data such as purchase history, browsing behavior, and feedback, AI algorithms can identify individual customer needs and preferences. This allows businesses to tailor their marketing messages and product offerings to resonate with specific customer segments. This level of personalization fosters stronger customer relationships and increases customer loyalty.

AI-driven insights into customer behavior also allow businesses to identify and address potential customer pain points and issues more effectively. This leads to improved customer satisfaction and a more positive brand image. This enhanced customer understanding allows businesses to optimize their services and products, leading to improved customer satisfaction and increased revenue.

Optimizing Property Valuation and Pricing Strategies

Understanding Property Valuation Metrics

Property valuation is a complex process that relies on a variety of factors. Understanding these metrics is crucial for accurate assessments. Different methods exist for determining market value, such as comparable sales analysis, income capitalization, and cost approaches. Each method considers specific aspects of the property, like location, size, and condition. This knowledge is vital for making informed decisions about property investments and transactions.

Factors like recent sales of similar properties in the area, current market trends, and property condition significantly impact valuation. Analyzing these metrics allows for a more nuanced understanding of a property's worth in the current market. A deep dive into these metrics ensures a robust and reliable assessment.

Factors Influencing Property Value

Several factors influence a property's value, making precise determination challenging. Location plays a pivotal role, with proximity to amenities, schools, and employment centers often increasing desirability and value. Property features, such as size, number of bedrooms and bathrooms, and condition of the structure, directly impact its appeal to potential buyers. Market conditions are also dynamic and play a large role in overall value fluctuations.

Economic conditions, interest rates, and local regulations all contribute to the overall property value. Understanding these factors allows for a more holistic assessment of the property's worth. A thorough analysis considers all relevant factors for accurate and reliable valuation.

Comparable Sales Analysis

Comparable sales analysis is a fundamental method used in property valuation. This technique involves identifying similar properties that have recently sold in the same neighborhood or area. Key characteristics like size, age, and condition of these comparable properties are analyzed in detail. This comparative analysis helps to establish a range of likely values for the subject property.

Careful consideration of the similarities and differences between the subject property and comparables is essential. Adjustments are made to reflect variations in size, features, and location. These adjustments provide a more accurate valuation for the property being assessed. The detailed comparison ensures a reliable valuation.

Income Capitalization Method

The income capitalization method is often used for income-generating properties, such as rental apartments or commercial buildings. This method estimates the property's value based on its potential rental income. The process involves estimating future income streams and applying a capitalization rate to determine the present value of these future benefits.

Calculating the appropriate capitalization rate is crucial for accurate valuation. Factors like market conditions, vacancy rates, and operating expenses are considered. This technique provides a framework for evaluating the profitability and potential return on investment for the property.

Cost Approach to Valuation

The cost approach to valuation estimates the property's value based on the cost of replacing or reproducing the structure. This method considers the current cost of materials, labor, and construction techniques. It's particularly useful for newer properties or unique structures where comparable sales data is limited.

The approach also takes into account depreciation, reflecting the loss of value due to wear and tear or obsolescence. A thorough cost analysis, including the impact of depreciation, is necessary for a precise valuation. This method is a valuable tool for evaluating properties with unique characteristics.

Valuation Software and Tools

Utilizing advanced valuation software and tools can significantly streamline the process. These tools often include databases of comparable sales, market data, and advanced analytical capabilities. Using these tools can significantly reduce the time and effort involved in property valuation. These tools also provide accurate and updated market information for the region. Effective software allows for a more precise evaluation of properties.

Software can automate many aspects of the valuation process, allowing valuers to focus on more complex aspects of the analysis. Furthermore, these tools often offer valuable insights into market trends, which can assist in making informed decisions.

Read more about Real Estate Analytics: Using AI for Market Intelligence

Hot Recommendations

- Sustainable Real Estate Design Principles

- AI in Real Estate: Streamlining the Buying Process

- Climate Risk Disclosure: A Must for Real Estate

- Climate Risk Analytics: Essential for Real Estate Investment Funds

- Modular Sustainable Construction: Scalability and Speed

- Real Estate and Community Disaster Preparedness

- Smart Buildings and Advanced Building Analytics for Optimal Performance

- Smart Waste Sorting and Recycling in Buildings

- Sustainable Real Estate: A Strategic Advantage

- AI in Real Estate Transaction Processing: Speed and Accuracy