Climate Finance and Real Estate Development

International Mechanisms for Climate Finance

Supporting developing nations through international climate finance is no longer optional—it's a necessity. These mechanisms, born from global agreements, channel resources from wealthier nations to those most vulnerable to climate change. The financial gap remains a critical barrier, preventing many countries from adopting clean technologies and resilient infrastructure. While debates continue about fair distribution, the urgency of these transfers grows daily.

Organizations like the Green Climate Fund (GCF) have become vital conduits for these resources. Their structured approach to fund management attempts to balance competing priorities. Without transparent tracking systems, even the best-intentioned funds risk being misallocated, making oversight mechanisms as important as the funding itself.

Bilateral Climate Finance

Country-to-country agreements offer a personalized alternative to multilateral systems. These arrangements allow for customized support packages combining funding, knowledge transfer, and infrastructure development. The most successful bilateral programs align closely with the recipient nation's specific environmental challenges and economic realities.

Such targeted cooperation often yields deeper, more sustainable impacts than broader initiatives. The shared history and cultural understanding between partner countries can significantly enhance project outcomes and long-term viability.

Public-Private Partnerships in Climate Finance

The private sector's role in climate financing has transformed from peripheral to central. Collaborative ventures now merge government oversight with corporate innovation and capital. When structured effectively, these partnerships can mobilize resources at scales impossible through public funding alone.

Innovative financial products emerging from these collaborations—like sustainability-linked bonds—are rewriting the rules of climate investment. The technical expertise corporations bring often proves as valuable as their financial contributions.

Green Bonds and Other Innovative Financing Instruments

The explosion of green financial instruments signals a paradigm shift in investment priorities. These tools direct capital toward projects with measurable environmental benefits, from renewable energy to sustainable agriculture. Investor appetite for these vehicles continues to outpace supply, suggesting a fundamental change in market values.

By reducing perceived risks through standardized frameworks, these instruments are making climate-positive projects bankable. Their evolution represents one of the most promising developments in sustainable finance.

Climate Change Adaptation Finance

While mitigation receives more attention, adaptation funding remains chronically under-resourced. This support helps communities prepare for inevitable climate impacts through infrastructure upgrades and agricultural innovations. Neglecting adaptation finance today guarantees exponentially higher costs tomorrow.

Building local capacity for adaptation planning may represent the highest-return investment in climate finance. These skills enable communities to develop context-specific solutions rather than relying on external prescriptions.

Carbon Pricing Mechanisms and Climate Finance

Putting a price on carbon emissions creates a direct funding stream for climate initiatives while incentivizing reductions. These market-based approaches turn environmental externalities into financial considerations. Well-designed carbon markets can become self-sustaining engines for climate action.

As more jurisdictions implement carbon pricing, opportunities grow to link these systems and create larger, more efficient markets. The revenue generated can fund everything from clean energy projects to worker retraining programs.

Green Building Standards and Certifications: Guiding Principles

Green Building Standards: A Foundation for Sustainable Practices

The construction sector's environmental footprint makes green standards essential rather than optional. These frameworks transform abstract sustainability goals into concrete design specifications and operational protocols. Their comprehensive approach addresses everything from sourcing ethical materials to optimizing energy flows throughout a building's lifecycle.

LEED Certification: A Leading Example

As the most recognized green building standard globally, LEED has pushed the industry toward measurable sustainability. Its tiered certification system provides clear benchmarks while allowing flexibility across different project types. The program's continual evolution incorporates emerging technologies and best practices.

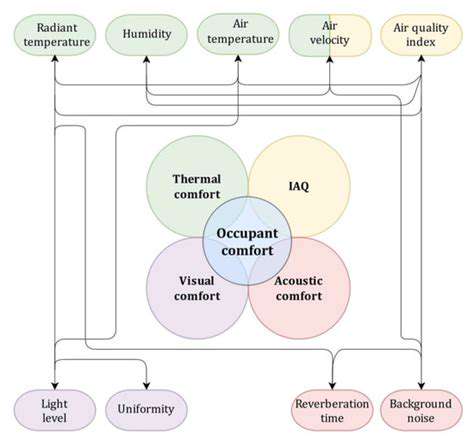

Beyond environmental metrics, LEED emphasizes occupant health through air quality standards and natural lighting requirements. This human-centered approach demonstrates how green buildings can enhance both planetary and personal well-being.

Other Notable Certifications: Expanding the Scope

Regional alternatives to LEED address local environmental priorities and construction traditions. Some focus on specific aspects like water conservation or material circularity. This diversity enables projects to select certifications aligned with their unique contexts and sustainability goals.

Environmental Impact of Buildings: A Major Consideration

The construction and operation of buildings accounts for a staggering portion of global emissions and resource use. Green standards attack this problem through whole-system thinking—reducing embodied carbon in materials while optimizing operational efficiency. The most advanced standards now mandate post-occupancy performance verification.

Economic Benefits of Green Building

While initial costs may be higher, green buildings consistently demonstrate superior lifetime value. Energy savings typically recoup premium investments within years, while healthier indoor environments reduce employee absenteeism and turnover. The financial case for green construction grows stronger with each technological advancement.

Financial Incentives for Green Building Projects

Governments worldwide are accelerating the green transition through creative incentive programs. These range from expedited permitting for sustainable projects to density bonuses for high-performance buildings. Such policies help overcome inertia in an industry traditionally resistant to change.

The Role of Climate Finance in Supporting Green Building

Dedicated climate funding bridges the affordability gap for green construction in developing markets. These programs often combine financial support with technical assistance to build local capacity. Strategic investments in demonstration projects can catalyze market transformation across entire regions.

The Role of Technology in Sustainable Real Estate Development

Technological Advancements in Sustainable Design

Digital tools are revolutionizing how buildings are conceived, constructed, and operated. Advanced materials science has produced everything from self-healing concrete to photovoltaic glass. Computational design allows architects to optimize structures for both aesthetics and performance.

Building Information Modeling (BIM) creates digital twins that simulate energy flows and material stresses before construction begins. This prevents costly mistakes and enables continuous improvement throughout a building's lifecycle.

Innovative Financing Mechanisms for Green Projects

The financial sector has responded to sustainability demands with creative instruments. Green bonds now fund everything from retrofits to net-zero communities. Performance-based contracts align returns with measurable environmental outcomes, ensuring accountability.

The most impactful financing models de-risk innovation while rewarding verified results. Blended finance structures combine public and private capital to tackle projects too large or novel for single investors.

Data-Driven Decision Making for Sustainable Outcomes

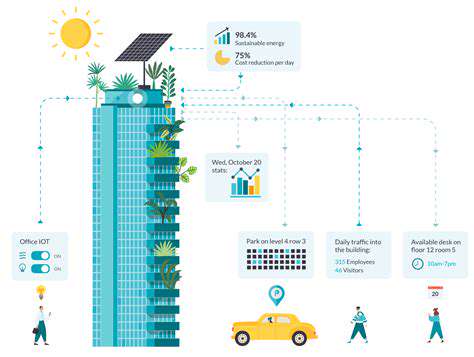

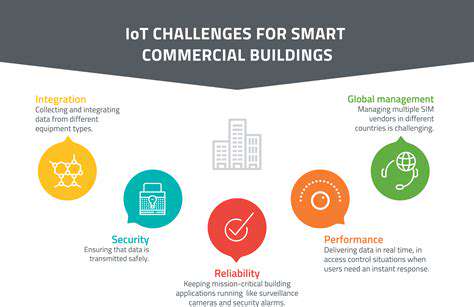

The proliferation of IoT sensors has created unprecedented visibility into building performance. Machine learning algorithms parse this data to identify optimization opportunities humans might miss. Real-time dashboards empower facility managers to make proactive adjustments.

This constant feedback loop enables buildings to adapt to changing conditions and usage patterns. The resulting efficiency gains often surpass original design projections, proving the value of ongoing monitoring and adjustment.

Read more about Climate Finance and Real Estate Development

Hot Recommendations

- Sustainable Real Estate Design Principles

- AI in Real Estate: Streamlining the Buying Process

- Climate Risk Disclosure: A Must for Real Estate

- Climate Risk Analytics: Essential for Real Estate Investment Funds

- Modular Sustainable Construction: Scalability and Speed

- Real Estate and Community Disaster Preparedness

- Smart Buildings and Advanced Building Analytics for Optimal Performance

- Smart Waste Sorting and Recycling in Buildings

- Sustainable Real Estate: A Strategic Advantage

- AI in Real Estate Transaction Processing: Speed and Accuracy