Climate Risk Analytics for Real Estate Portfolios: A Comprehensive Guide for Investors

Climate Risk Mitigation Strategies

Effective mitigation blends smart design with proactive planning. Flood-resistant foundations, fire-resistant materials, and storm-proof infrastructure represent just the visible components. The most sophisticated strategies incorporate climate analytics into every decision, from site selection to capital improvement planning. These measures don't just protect assets - they create competitive advantages in an increasingly climate-conscious market.

The Role of Data and Analytics in Climate Risk Assessment

Modern climate risk analysis has moved far beyond simple flood zone maps. Today's tools combine hyperlocal historical data with AI-driven projection models to predict risk at the individual property level. This granular approach reveals hidden vulnerabilities and opportunities that broader assessments miss. The most advanced investors now integrate climate analytics directly into their valuation models, creating a more complete picture of long-term asset performance.

Identifying and Assessing Climate-Related Risks

Understanding Climate Change Impacts on Real Estate

The fingerprints of climate change appear across real estate markets worldwide, from flooded coastal properties to wildfire-ravaged suburbs. These aren't isolated incidents but part of a larger pattern reshaping property economics. Investors who fail to recognize this new reality risk being caught flat-footed as climate impacts accelerate.

Evaluating Physical Risks: Flooding and Extreme Weather

Flood risk analysis has evolved dramatically in recent years. Where traditional assessments relied on static flood maps, modern approaches incorporate real-time rainfall data, changing watershed dynamics, and projected sea level rise. The most comprehensive evaluations now model how multiple climate factors might interact to create compound risks - like how drought conditions might exacerbate wildfire risks near flood-prone areas.

Analyzing Regulatory and Legal Risks

The regulatory landscape surrounding climate risk evolves almost as quickly as the climate itself. Forward-looking investors monitor emerging policies the way day traders watch stock tickers - recognizing that a single regulatory change can fundamentally alter a property's value proposition. Staying ahead of these changes requires dedicated resources and specialized expertise that many traditional real estate firms lack.

Assessing Financial Risks: Insurance Premiums and Investment Returns

Insurance markets serve as an early warning system for climate risk, with premiums skyrocketing in vulnerable areas long before properties become uninsurable. Sophisticated investors analyze insurance trends as leading indicators of broader market shifts. Similarly, lenders are increasingly factoring climate risk into financing decisions, creating new hurdles for properties in high-risk zones.

Exploring Transition Risks: Sustainable Development and Technology

The sustainability revolution creates both winners and losers in real estate. Properties that embrace energy efficiency, renewable energy integration, and smart building technologies command premium valuations. Meanwhile, energy-inefficient buildings face growing obsolescence. This divergence will only accelerate as climate-conscious tenants and buyers gain market influence.

Integrating Climate Risk into Real Estate Valuation

Traditional appraisal methods struggle to account for climate risk, often relying on backward-looking data that misses emerging threats. The most advanced valuation frameworks now incorporate climate stress testing, scenario analysis, and resilience scoring. These approaches help investors distinguish between properties that appear similar today but face radically different climate futures.

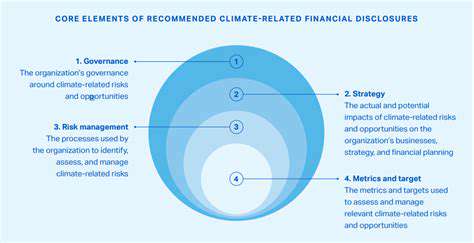

Developing a Robust Climate Risk Framework

Understanding the Scope of Climate Risk

Climate risk assessment isn't about predicting the weather - it's about understanding how climate change reshapes entire economic systems. The most effective frameworks recognize that climate impacts ripple through supply chains, labor markets, and consumer behavior in unpredictable ways. This systems-thinking approach helps identify second- and third-order effects that linear models miss.

Identifying Vulnerable Populations and Assets

Climate vulnerability follows predictable patterns, disproportionately affecting communities with limited resources to adapt. Smart risk frameworks map these social vulnerabilities alongside physical risks, creating a more complete picture of potential impacts. This approach helps prioritize interventions where they can make the greatest difference.

Developing Climate Models and Scenarios

The most useful climate models don't predict a single future but illuminate a range of possible outcomes. By modeling various warming scenarios, investors can stress-test their portfolios against different climate futures. This probabilistic approach provides better decision-making tools than deterministic predictions that may prove inaccurate.

Assessing Financial and Economic Impacts

Climate change creates financial risks that defy traditional analysis. The most comprehensive frameworks quantify both direct impacts (like repair costs) and indirect effects (like workforce disruptions). This holistic view helps investors understand how climate risk might cascade through their entire portfolio rather than affecting properties in isolation.

Implementing Mitigation Strategies

Effective mitigation requires moving beyond generic best practices to property-specific solutions. The most successful strategies combine technological solutions (like flood barriers) with financial innovations (like parametric insurance) tailored to each asset's unique risk profile. This customized approach delivers better protection at lower cost than one-size-fits-all solutions.

Implementing Adaptation Strategies

Adaptation isn't about resisting change but learning to thrive in new conditions. The most resilient properties incorporate flexibility into their design - features that can serve multiple purposes as needs evolve. This adaptive capacity often proves more valuable than rigid protections against specific threats.

Quantifying and Measuring Climate-Related Financial Impacts

Defining Climate Change Metrics

Effective climate measurement begins with choosing the right metrics. While global temperature trends grab headlines, the most actionable insights often come from hyperlocal indicators - things like shifting precipitation patterns or changing freeze-thaw cycles that directly impact specific properties. The best analytics platforms combine macro trends with micro-level data to create truly useful risk assessments.

Analyzing Global Temperature Trends

Temperature data tells only part of the story. Savvy analysts examine how warming trends interact with local geography - how urban heat islands might amplify global trends in cities, or how elevation might moderate impacts in mountainous regions. This spatial analysis reveals risks and opportunities that broad averages obscure.

Assessing Sea Level Rise

Sea level projections vary dramatically by location due to factors like land subsidence and ocean currents. The most precise assessments combine global models with local geological data to predict impacts at the parcel level. This precision matters when making million-dollar decisions about coastal properties.

Evaluating Greenhouse Gas Emissions

Carbon accounting has evolved from corporate sustainability reports to precise property-level metrics. The most advanced frameworks track both operational emissions and embodied carbon in building materials. This complete carbon picture helps identify the most cost-effective reduction opportunities.

Measuring Impacts on Ecosystems

Ecosystem changes create both risks and opportunities for real estate. Declining pollinators might threaten agricultural properties, while rewilding initiatives could enhance values near conservation areas. The best analyses track these ecological shifts with the same rigor applied to traditional market trends.

Developing Climate Models and Projections

The most useful climate models incorporate feedback loops and tipping points that linear models miss. By simulating how various climate factors might interact, these models provide early warnings about potential regime shifts - like how melting permafrost might accelerate warming trends in northern latitudes.