Green Mortgages and Incentives for Sustainable Property

Understanding Green Mortgage Programs

Green mortgage programs are designed to incentivize environmentally friendly home improvements and sustainable building practices. These programs often offer attractive financing options, making eco-conscious choices more accessible and affordable for homeowners. These programs recognize the importance of sustainable practices and reward individuals who prioritize environmental responsibility in their homeownership journey. They promote the construction and renovation of energy-efficient homes, reducing homeowners' carbon footprint and contributing to a healthier planet.

Eligibility Requirements and Benefits

Eligibility criteria for green mortgage programs can vary depending on the specific program and lender. Generally, these programs require homeowners to undertake specific energy-efficient upgrades, such as installing solar panels, improving insulation, or upgrading windows and doors. These upgrades often lead to significant long-term savings in energy costs, making the investment in green technology worthwhile. Additional benefits may include lower interest rates, reduced closing costs, or tax incentives.

Types of Green Improvements Supported

Many green mortgage programs support a wide range of energy-efficient improvements. This includes the installation of solar panels, which generate clean, renewable energy. Other eligible improvements might encompass enhanced insulation, energy-efficient windows and doors, and high-efficiency HVAC systems. These improvements directly contribute to reducing a home's environmental impact and conserving energy resources. Program details vary, so it's crucial to check with specific lenders to understand the precise scope of eligible improvements.

Financing Options and Incentives

Green mortgage programs often offer various financing options to accommodate different situations. Some programs might provide reduced interest rates for borrowers who undertake energy-efficient upgrades. These financing options can significantly reduce the overall cost of these improvements, making them more accessible to a broader range of homeowners. Additionally, there might be incentives like tax credits or grants that further reduce the financial burden on those pursuing green home improvements.

Financial Implications and Long-Term Savings

Implementing green improvements through a mortgage program can lead to significant long-term financial benefits. Reduced energy consumption translates to lower utility bills, saving homeowners money each month. The upfront costs of the upgrades, such as solar panel installation, can be offset by lower energy costs over the life of the home. These savings can result in a greater return on investment compared to conventional mortgages.

Environmental Impact and Sustainability

Green mortgage programs play a crucial role in promoting sustainable homeownership. By incentivizing energy-efficient upgrades, these programs encourage the construction and renovation of more sustainable homes. This contributes to a reduction in carbon emissions and helps mitigate the effects of climate change. These programs encourage a shift toward environmentally responsible practices in the construction and homeownership sectors, ultimately benefitting the environment and future generations.

The Future of Green Mortgages and Incentives

Green Mortgage Features: A Growing Range of Options

Green mortgages are evolving beyond simple energy-efficiency upgrades. They're now incorporating a wider array of sustainable features, encompassing everything from solar panel installations to water-efficient fixtures. Lenders are recognizing the long-term value proposition of these environmentally conscious loans, and consequently, the features are becoming more comprehensive, reflecting a proactive approach to addressing climate change and promoting sustainable living practices. This expansion signifies a significant shift in the market, moving beyond basic energy audits to more holistic sustainability strategies.

The inclusion of renewable energy sources, such as solar panels and wind turbines, is also gaining traction. These features not only reduce the borrower's carbon footprint but also offer the potential for significant long-term financial savings through reduced energy consumption. The growing demand for green mortgages is driving innovation and creating diverse choices for environmentally conscious homeowners.

Government Incentives: Driving Adoption of Green Mortgages

Government incentives play a crucial role in stimulating the adoption of green mortgages. These incentives can take various forms, including tax credits, subsidies, and grants, which directly reduce the financial burden on borrowers. These incentives are designed to encourage sustainable practices and reward responsible environmental choices, fostering a more environmentally friendly housing market. Such initiatives effectively make green mortgages more accessible and financially attractive to potential homeowners.

Specific incentives often target specific energy-efficient upgrades, such as insulation improvements or high-efficiency windows, further encouraging a holistic approach to sustainability in homeownership. The interplay between government policies and the private sector is paving the way for a greener future in the real estate market.

Financial Benefits for Borrowers: Saving Money and Enhancing Value

Beyond the environmental benefits, green mortgages can offer significant financial advantages to borrowers. Many green mortgages feature lower interest rates, reflecting the reduced risk associated with environmentally conscious borrowers. This lower interest rate can translate into substantial savings over the life of the loan. Borrowers may also qualify for tax deductions or credits, further reducing the financial burden of a green mortgage.

The increased energy efficiency of green homes can lead to lower utility bills over time, which can further enhance the financial benefits of these mortgages. This reduction in ongoing costs directly translates to greater affordability for homeowners and a more sustainable lifestyle.

Environmental Impact: Reducing Carbon Footprint and Protecting Resources

The adoption of green mortgages has a profound impact on the environment. By encouraging the construction and renovation of energy-efficient homes, these mortgages directly reduce the carbon footprint of the housing sector. This reduction in greenhouse gas emissions is crucial in mitigating climate change and preserving natural resources. The implementation of green mortgages represents a step towards a more environmentally sustainable future, reducing the environmental impact of the housing industry and promoting a more responsible approach to resource management.

Market Trends: Growing Demand and Future Projections

The market for green mortgages is experiencing robust growth, driven by increasing consumer awareness of environmental issues and a growing emphasis on sustainable living. This trend is expected to continue, with projections indicating a substantial rise in the demand for green mortgage options. The market is likely to be further influenced by evolving government regulations and incentives, which will play a significant role in shaping the future of green mortgages.

This increasing demand is creating a vibrant marketplace with a wide range of green mortgage products. This competitive environment is likely to drive down costs and make green mortgages more accessible to a broader range of homeowners. The long-term vision for green mortgages points towards a more sustainable and environmentally responsible housing market.

Challenges and Considerations: Addressing Barriers to Adoption

Despite the growing appeal of green mortgages, several challenges remain in their widespread adoption. The upfront costs associated with energy-efficient upgrades can be a significant barrier for some potential borrowers. Furthermore, the availability of qualified contractors and the complexity of certain green mortgage requirements can pose additional obstacles. Overcoming these challenges is crucial to fostering a more inclusive and accessible green mortgage market.

Educating potential borrowers about the long-term financial and environmental benefits of green mortgages is essential. Clear communication about the available incentives and the overall value proposition of these mortgages can encourage broader adoption and create a more sustainable future for housing.

Read more about Green Mortgages and Incentives for Sustainable Property

Hot Recommendations

- Sustainable Real Estate Design Principles

- AI in Real Estate: Streamlining the Buying Process

- Climate Risk Disclosure: A Must for Real Estate

- Climate Risk Analytics: Essential for Real Estate Investment Funds

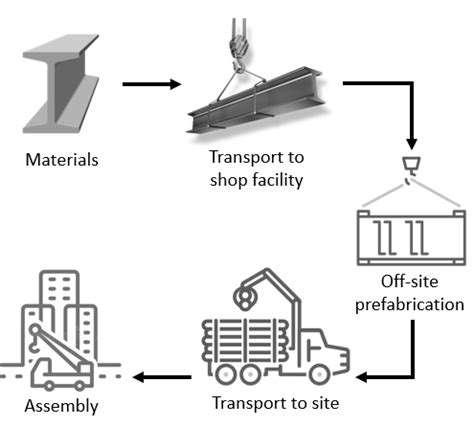

- Modular Sustainable Construction: Scalability and Speed

- Real Estate and Community Disaster Preparedness

- Smart Buildings and Advanced Building Analytics for Optimal Performance

- Smart Waste Sorting and Recycling in Buildings

- Sustainable Real Estate: A Strategic Advantage

- AI in Real Estate Transaction Processing: Speed and Accuracy