Climate Risk and Real Estate Asset Allocation

Adapting Investment Strategies for a Changing Climate

Understanding the Interplay of Climate Change and Real Estate

Climate change is no longer a distant threat; its impacts are being felt across the globe, and real estate is inextricably linked to these changes. From rising sea levels jeopardizing coastal properties to increased frequency of extreme weather events damaging infrastructure, understanding the nuanced interplay between climate change and real estate is crucial for both investors and property owners. Analyzing historical climate data and projecting future scenarios is vital to assess the long-term viability and resilience of real estate investments.

Assessing Climate-Related Risks in Different Property Types

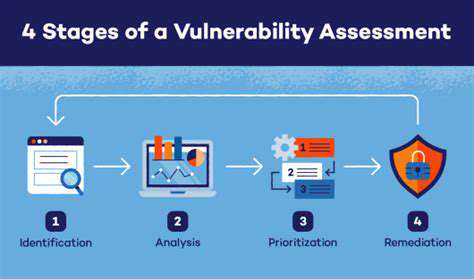

Different types of real estate face varying degrees of climate risk. High-rise buildings in flood-prone areas, for example, will encounter significant challenges compared to properties in arid regions. Coastal properties are vulnerable to sea-level rise and storm surges, while older buildings might struggle with infrastructure inadequacies that increase their susceptibility to extreme weather events. A thorough risk assessment must consider the specific geographic location, property type, and potential climate hazards.

Detailed analysis of local climate patterns, including historical rainfall, temperature fluctuations, and extreme weather events, is critical in determining the climate-related risks associated with a specific property.

Integrating Climate Resilience into Investment Decision-Making

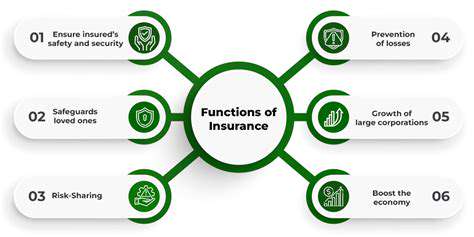

Investors need to incorporate climate considerations into their investment decision-making process. This includes evaluating the resilience of properties against various climate hazards and understanding how future climate scenarios might impact property values and rental income. The process should involve a comprehensive assessment of the property's vulnerability to climate risks, including flood risk, wildfire risk, and heat stress. Integrating these factors into traditional financial models is essential for making informed and sustainable investment choices.

Developing Climate-Proofed Real Estate Portfolios

Creating climate-proofed real estate portfolios requires a proactive approach to mitigating climate risks. This involves a careful selection of properties located in areas less susceptible to climate change impacts, as well as implementing adaptation strategies to enhance the resilience of existing properties. This might involve upgrades to infrastructure, improved drainage systems, or incorporating sustainable building materials. A long-term perspective is critical in building a portfolio that can withstand the challenges of a changing climate.

Exploring Opportunities in Sustainable Real Estate

The shift towards sustainable real estate presents significant investment opportunities. Properties that incorporate green building practices, renewable energy sources, and water-efficient designs are increasingly attractive to environmentally conscious buyers and investors. These properties often command higher values and attract a more desirable tenant base. Understanding the market demand for sustainable real estate is crucial in identifying promising investment opportunities.

The Role of Policy and Regulation in Shaping Investment Strategies

Government policies and regulations play a crucial role in influencing investment strategies related to climate change. Policies that incentivize sustainable building practices and discourage development in high-risk areas can significantly impact investment decisions. Investors need to stay informed about evolving regulations and policies to navigate the complex landscape of climate-related risks and opportunities. Local and national regulations regarding building codes, zoning, and environmental protection can greatly affect the viability of real estate investments.

The Future of Real Estate Investment in a Changing Climate

The future of real estate investment will be significantly shaped by the ongoing impacts of climate change. Investors who anticipate and prepare for these changes will be better positioned to navigate the complexities and capitalize on the opportunities presented by a changing climate. This includes embracing innovative technologies, adopting sustainable practices, and continuously monitoring and adapting investment strategies to ensure long-term profitability and environmental responsibility. Proactive adaptation to climate change will be essential for success in the real estate market of the future.

Integrating Climate Change Scenarios into Portfolio Modeling

Understanding the Importance of Climate Change Scenarios

Climate change is a multifaceted and complex issue, and its impacts are projected to vary considerably depending on the choices we make today. Understanding these potential future scenarios is crucial for developing effective adaptation and mitigation strategies. These scenarios help us anticipate the range of possible outcomes and prepare for a changing world. Ignoring these potential future challenges could lead to significant economic and social disruptions.

Analyzing different climate change scenarios allows us to assess the potential risks and opportunities associated with various levels of warming. This analysis is essential for informed decision-making across sectors, from infrastructure planning to agricultural practices. By considering a range of possible futures, we can make more robust and resilient choices today.

Developing Robust Adaptation Strategies

Integrating climate change scenarios into planning processes is vital for developing robust adaptation strategies. These strategies should consider the potential impacts of different climate change trajectories, allowing for flexibility and resilience in the face of uncertainty. By incorporating a range of possible future outcomes into our models, we can develop more adaptable and sustainable solutions.

Adaptation strategies should consider the interconnectedness of various sectors. For example, changes in water resources due to climate change will impact agriculture, energy production, and human health. Considering these interdependencies is crucial for developing holistic adaptation plans.

Evaluating Mitigation Options

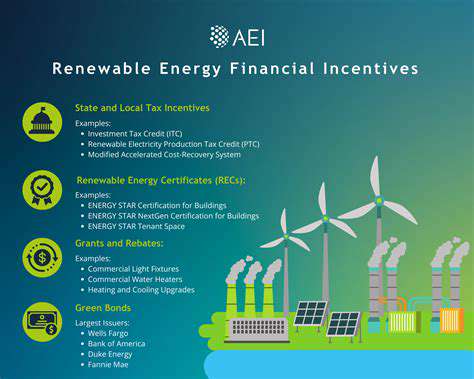

Climate change scenarios are also essential for evaluating potential mitigation options. These scenarios provide a framework for understanding the effectiveness of different interventions, such as reducing greenhouse gas emissions and transitioning to renewable energy sources. By examining the potential outcomes of various mitigation strategies, we can identify the most effective approaches to limit future warming.

Analyzing the economic, social, and environmental impacts of different mitigation pathways is crucial for informing policy decisions. This analysis helps us understand the trade-offs associated with each option and enables the development of strategies that balance economic growth with environmental sustainability.

Enhancing Decision-Making Processes

Integrating climate change scenarios into decision-making processes across all levels – from local communities to international organizations – is critical for effective action. This integration allows for the development of more informed and resilient policies and strategies that address the challenges presented by climate change. This includes considering the potential impacts on infrastructure, public health, and economic development.

By incorporating climate change scenarios into our decision-making frameworks, we can anticipate future challenges and make proactive choices to minimize risks and maximize opportunities. This approach fosters long-term sustainability and ensures that our actions are aligned with the potential future impacts of climate change.

The Importance of Collaboration and Policy Engagement

Understanding the Interconnectedness of Climate Risk and Policy

Climate change is no longer a distant threat; its impacts are being felt across the globe, significantly impacting real estate markets. Understanding how climate risk factors like rising sea levels, extreme weather events, and shifting precipitation patterns are intertwined with policy decisions is crucial for informed investment and development strategies. This interconnectedness necessitates a deep understanding of how government regulations and policies, both local and national, influence the resilience and vulnerability of real estate assets to climate change.

Effective policy engagement requires a nuanced understanding of the various legislative frameworks, regulations, and incentives that address climate change. This includes recognizing how these policies can incentivize or hinder sustainable development practices within the real estate sector, influencing everything from building codes and zoning regulations to carbon emission standards and property insurance policies. Understanding these intricacies is paramount to anticipating future risks and maximizing opportunities within the evolving climate policy landscape.

The Role of Policy in Shaping Climate-Resilient Development

Government policies play a pivotal role in fostering climate-resilient development in the real estate sector. By implementing policies that encourage the adoption of sustainable practices and incentivize the construction of climate-proof infrastructure, governments can guide the market towards responsible development. This includes supporting the use of green building materials, promoting energy efficiency in buildings, and creating incentives for the development of renewable energy sources. These policies ultimately have a direct impact on the long-term value and sustainability of real estate investments.

Specific policies, such as building codes incorporating climate change projections or tax incentives for energy-efficient retrofits, can significantly influence the design and construction of buildings. These policies, when implemented effectively, encourage the development of properties that are not only aesthetically pleasing but also resilient to the impacts of climate change, ensuring the long-term value of real estate investments in the face of changing environmental conditions.

Collaboration Between Stakeholders for Effective Policy Implementation

Successful policy implementation requires collaboration between various stakeholders, including government agencies, real estate developers, investors, and community groups. Open communication and a shared understanding of climate risks and mitigation strategies are essential for ensuring that policies are relevant, effective, and equitable. This collaboration necessitates a willingness to share information and expertise, fostering a collaborative environment where diverse perspectives are considered and incorporated into policy development and implementation.

Engaging with community groups is critical as they often have valuable insights into local vulnerabilities and needs. Effective policy implementation hinges on incorporating these perspectives and addressing the specific concerns of affected communities. This collaborative approach fosters a sense of ownership and engagement, ultimately leading to more effective and sustainable solutions.

Measuring the Impact of Policy on Real Estate Performance

It is essential to develop robust metrics to evaluate the impact of climate policies on real estate performance. This includes tracking indicators like energy efficiency, water conservation, and resilience to extreme weather events. By measuring the effectiveness of various policies, policymakers can identify areas for improvement and refine their strategies for promoting climate-resilient development. This data-driven approach allows for adjustments to policy, ensuring that they continue to remain relevant and effective in the face of evolving climate risks.

Read more about Climate Risk and Real Estate Asset Allocation

Hot Recommendations

- Sustainable Real Estate Design Principles

- AI in Real Estate: Streamlining the Buying Process

- Climate Risk Disclosure: A Must for Real Estate

- Climate Risk Analytics: Essential for Real Estate Investment Funds

- Modular Sustainable Construction: Scalability and Speed

- Real Estate and Community Disaster Preparedness

- Smart Buildings and Advanced Building Analytics for Optimal Performance

- Smart Waste Sorting and Recycling in Buildings

- Sustainable Real Estate: A Strategic Advantage

- AI in Real Estate Transaction Processing: Speed and Accuracy