Renewable Energy Integration in Sustainable Real Estate

Maximizing Return on Investment (ROI) through Renewable Energy Integration

Understanding the Fundamentals of ROI

Return on Investment (ROI) is a crucial metric for evaluating the financial viability of any project, and renewable energy integration is no exception. It essentially quantifies the profitability of an investment by comparing the net profit generated against the total cost of the investment. A higher ROI signifies a more profitable venture, making it a key factor in decision-making for businesses and individuals alike. Understanding the precise calculation and its implications is vital for effectively assessing the potential benefits of renewable energy adoption.

Assessing Initial Investment Costs

Renewable energy projects often involve significant upfront costs, including equipment acquisition, installation, and permitting. These costs can vary considerably depending on the specific technology (solar, wind, hydro), project scale, and local regulations. A thorough cost analysis is essential to accurately project the overall investment required, considering factors like land acquisition, grid connection fees, and potential tax incentives.

Evaluating Long-Term Operational Expenses

While initial investments are crucial, long-term operational expenses are equally important. These include maintenance, repairs, and potential energy storage solutions, especially for intermittent renewable energy sources. Understanding the predictable and unpredictable costs associated with ongoing operations is vital for developing a comprehensive financial model for the project's life cycle. Proper maintenance schedules and preventive measures can significantly reduce these expenses over time.

Considering Potential Revenue Streams

Renewable energy integration can generate various revenue streams, including energy sales to the grid, energy self-consumption, and potential carbon offset credits. Analyzing the potential revenue streams associated with a project is vital for calculating the total return over the project's lifespan. Understanding the market dynamics, pricing mechanisms, and regulatory frameworks for energy sales is crucial for accurately estimating these potential earnings.

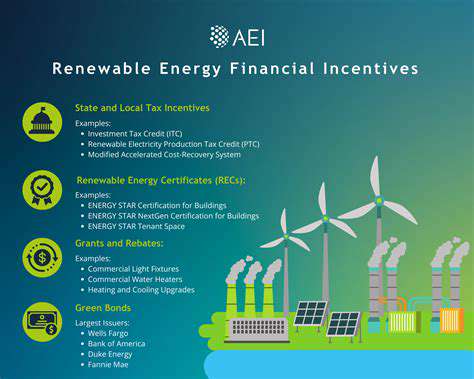

Leveraging Government Incentives and Policies

Many governments offer incentives and policies to encourage renewable energy adoption. These incentives can take various forms, including tax credits, subsidies, grants, and feed-in tariffs. A deep understanding of these incentives and policies specific to a region or country is critical for maximizing ROI. Thorough research and analysis can reveal significant cost reductions and increased profitability, potentially offsetting some of the initial investment costs.

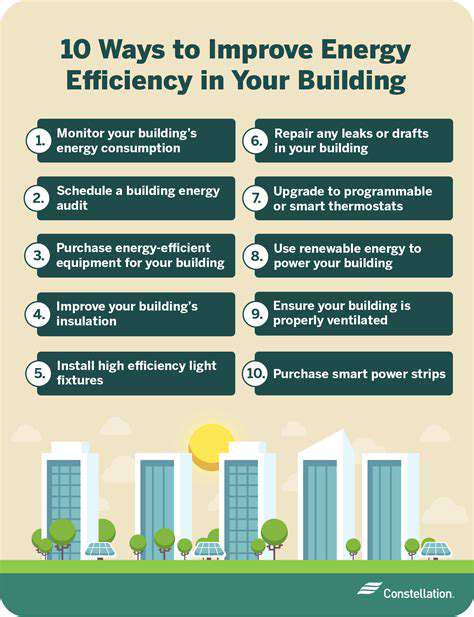

Analyzing the Impact of Energy Efficiency Measures

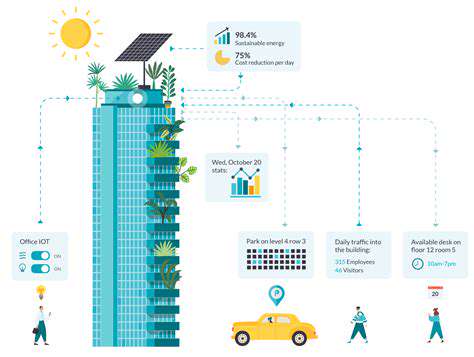

Integrating renewable energy sources can often be effectively coupled with energy efficiency measures. Combining these strategies can create a synergistic effect, reducing energy consumption and further enhancing the profitability of the renewable energy project. Analyzing the potential energy savings achievable through energy efficiency improvements is vital for a more comprehensive ROI calculation. These savings can directly contribute to the overall return on investment and improve the project's financial attractiveness.

Projecting ROI Over Time

A comprehensive ROI analysis requires projecting future financial performance over the project's lifecycle. This involves forecasting energy prices, operating costs, and revenue streams. Considering factors like technological advancements, market fluctuations, and policy changes is critical for developing a realistic and robust financial model. Sophisticated financial modeling tools and expert analysis are often necessary to accurately project long-term ROI and assess the project's viability under various market scenarios.

Read more about Renewable Energy Integration in Sustainable Real Estate

Hot Recommendations

- Sustainable Real Estate Design Principles

- AI in Real Estate: Streamlining the Buying Process

- Climate Risk Disclosure: A Must for Real Estate

- Climate Risk Analytics: Essential for Real Estate Investment Funds

- Modular Sustainable Construction: Scalability and Speed

- Real Estate and Community Disaster Preparedness

- Smart Buildings and Advanced Building Analytics for Optimal Performance

- Smart Waste Sorting and Recycling in Buildings

- Sustainable Real Estate: A Strategic Advantage

- AI in Real Estate Transaction Processing: Speed and Accuracy