Green Mortgages: Eligibility and Benefits

What are Green Mortgages?

What are Green Mortgages?

Green mortgages are a type of mortgage that incentivizes environmentally friendly home improvements and practices. They often come with special financing options, lower interest rates, or other perks for borrowers who make sustainable choices like installing solar panels, upgrading insulation, or adopting water-saving fixtures. These mortgages are designed to encourage homeowners to invest in energy efficiency and reduce their environmental footprint, which ultimately benefits both the homeowner and the planet.

Eligibility Criteria for Green Mortgages

Eligibility for a green mortgage can vary depending on the lender and the specific program. Generally, borrowers must meet standard mortgage qualification criteria, such as having a stable income and good credit history. Additionally, there might be specific requirements related to the proposed energy-efficient improvements. For example, the lender may require a certified contractor or specific energy-efficiency ratings for the installations. Lenders often prioritize borrowers who demonstrate a commitment to long-term sustainability.

Benefits of Choosing a Green Mortgage

Beyond the obvious environmental advantages, green mortgages offer numerous benefits to homeowners. Lower interest rates are frequently offered to incentivize sustainable choices. Additionally, there might be special financing options for energy-efficient upgrades, making these improvements more accessible and affordable. Some programs even offer tax credits or rebates, further reducing the financial burden of eco-conscious home improvements.

Types of Green Mortgage Programs

Several different types of green mortgage programs exist. Some focus on financing specific renewable energy installations, like solar panels or wind turbines. Others prioritize energy efficiency improvements, such as insulation upgrades or high-efficiency windows. Some programs combine both, offering a comprehensive approach to sustainable homeownership. It is essential to research different programs to find the one that best aligns with your specific needs and goals.

Government Incentives and Programs

Many governments worldwide offer incentives and programs to encourage the adoption of green mortgages. These incentives can include tax credits, rebates, or grants that help offset the cost of energy-efficient improvements. These programs serve to increase the affordability and accessibility of green mortgages, making sustainable homeownership more widely available. Researching local and national programs can reveal valuable financial support for green home improvements.

Financial Considerations and Costs

While green mortgages can offer financial advantages, it's crucial to carefully consider the costs involved. Initial upfront costs for upgrades like solar panels or insulation might be higher than traditional home improvements. However, the long-term savings from reduced energy bills and the potential for increased property value, along with any available government incentives, can help offset these costs. A thorough cost-benefit analysis is essential before committing to a green mortgage.

Types of Green Mortgage Programs

Eligibility Criteria for Green Mortgages

Navigating the Eligibility criteria for green mortgages can sometimes feel like navigating a complex maze. However, understanding the specific requirements is crucial for securing this type of financing. Lenders typically consider factors such as the energy efficiency improvements made to the property, the specific types of renewable energy systems installed, and the overall sustainability of the home's design. This often involves providing documentation of energy audits, permits for installations, and certifications of sustainable building practices.

Furthermore, traditional mortgage criteria still apply. Creditworthiness, debt-to-income ratios, and down payment requirements are evaluated similarly to conventional loans. The key difference lies in the lender's focus on the environmental enhancements and the associated documentation. A thorough understanding of these aspects will help prospective borrowers determine their eligibility.

Types of Energy-Efficient Improvements

Green mortgages often incentivize specific energy-efficient improvements. These can range from installing solar panels and energy-efficient windows to upgrading insulation and implementing smart home technologies. Each improvement contributes to a reduction in energy consumption and often results in lower utility bills for the homeowner.

The types of improvements eligible for green mortgage programs can vary depending on the lender. Some lenders might prioritize solar installations, while others may focus on energy-efficient appliances or water-saving fixtures. It's essential to research and understand the specific requirements of the chosen lender to ensure that the planned improvements meet the program's criteria.

Renewable Energy Systems and Green Mortgages

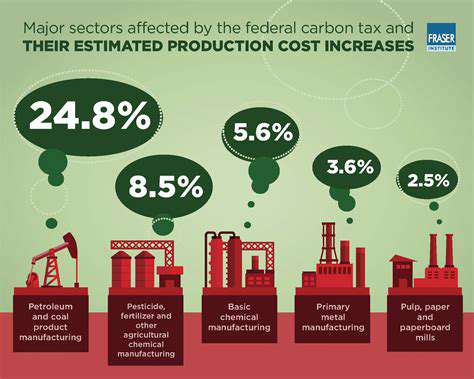

Renewable energy systems, such as solar panels, play a significant role in green mortgages. These systems generate clean energy, reducing reliance on fossil fuels and contributing to a lower carbon footprint. Lenders often offer incentives or lower interest rates for properties equipped with these systems, reflecting the financial benefits of renewable energy.

Benefits of Choosing a Green Mortgage

Beyond the environmental advantages, choosing a green mortgage can offer a variety of financial benefits. These benefits often include lower interest rates, potentially higher loan amounts, and attractive incentives like reduced closing costs. The financial incentives are often designed to reflect the long-term energy savings and reduced environmental impact associated with the sustainable home improvements.

Furthermore, green mortgages can sometimes provide access to specialized financing options that are not available with traditional mortgages. This can open up opportunities to acquire or upgrade homes with advanced energy-efficient features, often resulting in potentially lower long-term operational costs for homeowners.

Sustainable Design and Green Mortgages

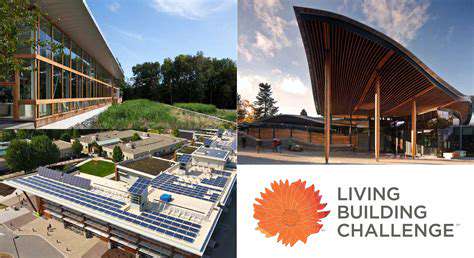

Sustainable design principles play a vital role in green mortgages. Homes built or renovated with sustainable features often meet specific criteria, such as energy-efficient construction, water conservation, and the use of environmentally friendly materials. Lenders often prioritize these features, recognizing the long-term benefits for both the environment and the homeowner.

The integration of sustainable design elements into a property can significantly impact its overall appeal and value over time. Green mortgages acknowledge this by offering attractive financial terms and incentives for properties that exemplify these sustainable practices, recognizing the long-term value and environmental responsibility these projects represent.

Finding the Right Green Mortgage Lender

Understanding Green Mortgage Loans

Green mortgages are designed to incentivize environmentally friendly home improvements and practices. These loans often offer attractive financing options for energy-efficient upgrades, such as solar panels, insulation improvements, and water-saving appliances. Understanding the specific loan terms and eligibility requirements is crucial for maximizing the benefits of a green mortgage. They can potentially lead to lower energy bills and a more sustainable lifestyle for homeowners.

These loans often come with specific requirements regarding the types of upgrades that qualify for financing. These requirements might include specific energy efficiency ratings or certifications for the improvements. It's important to carefully review the lender's criteria to ensure that your planned upgrades will qualify for financing under the green mortgage program.

Eligibility Criteria for Green Mortgages

Eligibility for a green mortgage typically involves meeting certain criteria, including demonstrating a commitment to energy efficiency. Lenders often consider factors like the projected energy savings from the proposed improvements. The specific criteria vary depending on the lender and the program. Homeowners with a clear plan for sustainable improvements are more likely to be considered eligible.

In addition to energy efficiency, some lenders may assess the borrower's credit history and financial stability. This is similar to the criteria for traditional mortgages. A strong financial profile and a well-defined plan for the renovations and improvements are key aspects to consider.

Types of Green Mortgage Programs

Several types of green mortgage programs exist, each with its own features and benefits. Some programs offer incentives for specific upgrades, such as solar panel installations. Others focus on energy efficiency improvements across the home. Each program has its own eligibility criteria and interest rates. It's important for homeowners to research and compare different programs to find the best fit for their needs and budget.

Comparing Green Mortgage Rates and Fees

Comparing green mortgage rates and fees is essential for making an informed decision. Rates may differ from standard mortgages, often reflecting the lower risk associated with energy-efficient upgrades. Researching and comparing different lenders is crucial to finding the most competitive rates. Be sure to factor in any closing costs or additional fees associated with green mortgage programs.

Financing Energy-Efficient Upgrades

Green mortgages offer a unique way to finance energy-efficient home improvements. These loans can provide the necessary funding to install solar panels, upgrade insulation, or implement water-saving technologies. The goal is to reduce the environmental impact of a home and improve its energy efficiency. This can lead to significant long-term savings on utility bills and contribute to a more sustainable future.

The Environmental Impact of Green Mortgages

Green mortgages play a crucial role in promoting sustainable practices in homeownership. By incentivizing energy-efficient improvements, these mortgages encourage homeowners to reduce their carbon footprint. This contributes to a more environmentally conscious community. Ultimately, the widespread adoption of green mortgages can lead to a significant reduction in energy consumption across the nation.

Read more about Green Mortgages: Eligibility and Benefits

Hot Recommendations

- Sustainable Real Estate Design Principles

- AI in Real Estate: Streamlining the Buying Process

- Climate Risk Disclosure: A Must for Real Estate

- Climate Risk Analytics: Essential for Real Estate Investment Funds

- Modular Sustainable Construction: Scalability and Speed

- Real Estate and Community Disaster Preparedness

- Smart Buildings and Advanced Building Analytics for Optimal Performance

- Smart Waste Sorting and Recycling in Buildings

- Sustainable Real Estate: A Strategic Advantage

- AI in Real Estate Transaction Processing: Speed and Accuracy