AI for Property Tax Assessment Fairness

Traditional assessment methods, often relying heavily on standardized tests and multiple-choice questions, have long been the cornerstone of education. However, these methods frequently fall short in capturing the full spectrum of student learning and understanding. They primarily evaluate recall and memorization rather than deeper critical thinking and problem-solving skills. This narrow focus can lead to a skewed perception of student achievement, potentially hindering the development of well-rounded individuals.

Furthermore, the emphasis on standardized testing can create undue pressure and anxiety for students, potentially undermining their intrinsic motivation for learning. This pressure can also disproportionately affect students from disadvantaged backgrounds, who may lack the resources or support systems to thrive under such high-stakes environments. The reliance on a single measure can mask individual strengths and weaknesses, making it difficult for educators to tailor instruction effectively to meet the diverse needs of each student.

Limitations of Standardized Testing

Standardized tests, while seemingly objective, often suffer from significant limitations. They frequently fail to assess higher-order thinking skills, such as creativity, problem-solving, and critical analysis. The format of these tests, typically multiple choice, can also disadvantage students who excel in different learning styles or who struggle with test-taking anxiety.

A further concern is the potential for bias in test design and administration. Factors such as language barriers, cultural differences, and socioeconomic disparities can all impact a student's performance on standardized tests, potentially leading to inaccurate or unfair assessments of their abilities. This lack of cultural sensitivity can lead to misinterpretations of student potential and can inadvertently perpetuate inequalities in education.

Ultimately, the reliance on standardized testing alone can provide an incomplete picture of student understanding and growth. Educators need to explore a wider range of assessment methods to gain a more comprehensive view of each student's strengths and weaknesses and to better support their learning journey.

Alternatives to Traditional Assessment Strategies

Fortunately, there are a multitude of alternative assessment strategies that can provide a more nuanced and comprehensive understanding of student learning. These strategies can include project-based learning, performance-based tasks, portfolios, and student self-assessments. These methods encourage active learning, collaboration, and the development of critical thinking skills.

Implementing these alternatives requires a shift in mindset for both teachers and students. Teachers need to develop the necessary skills and resources to design and implement these new assessments, while students need to be empowered to take ownership of their learning and reflect on their progress. Such a shift in pedagogical approach has the potential to create a more engaging and effective learning environment, ultimately fostering a deeper understanding of concepts and promoting lifelong learning.

By embracing a more holistic approach to assessment, educators can better identify and address the unique needs of each student, promoting both academic success and personal growth.

Data-Driven Insights and Enhanced Accuracy

Data Collection and Analysis

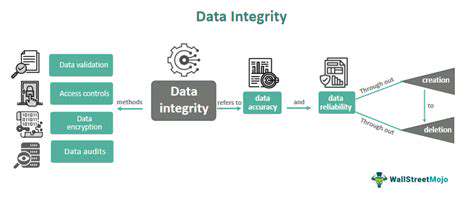

Effective data-driven decision-making hinges on robust data collection methods. This involves defining clear objectives, identifying relevant data sources, and establishing standardized procedures to ensure accuracy and consistency. Employing automated data collection tools can significantly improve efficiency and reduce human error. Furthermore, meticulous data validation and cleaning procedures are crucial to prevent inaccuracies and ensure reliable insights.

Analyzing the collected data requires sophisticated analytical techniques. These techniques range from simple descriptive statistics to complex predictive modeling, depending on the specific business question. Data visualization plays a vital role in communicating these findings effectively, transforming complex data into easily understandable representations. This allows stakeholders to grasp the key trends and patterns quickly and make informed decisions.

Business Problem Identification

A critical first step in leveraging data is identifying the specific business problems needing solutions. This involves meticulous analysis of existing performance metrics, market trends, and competitive landscapes. Identifying these problems requires a collaborative effort between data scientists and business stakeholders. This collaborative approach ensures that the insights gained from the data directly address the company's strategic priorities.

Thorough understanding of the business context is essential. This includes considering the unique operational challenges, customer needs, and market dynamics impacting the organization. By focusing on specific problems, data analysis can be tailored to provide actionable solutions.

Predictive Modeling and Forecasting

Predictive modeling utilizes historical data to forecast future outcomes. This forecasting capability is invaluable for anticipating market trends, demand fluctuations, and potential risks. Accurate forecasts empower businesses to make proactive decisions, optimize resource allocation, and minimize potential losses. The models should be regularly tested and refined to ensure their continued relevance and accuracy.

Implementing robust predictive models often requires advanced statistical techniques and machine learning algorithms. The selection of the appropriate model depends heavily on the nature of the data and the specific problem being addressed. Careful consideration must be given to the model's assumptions and limitations to ensure reliable predictions.

Customer Segmentation and Personalization

Data analysis can reveal valuable insights about customer behavior and preferences. This allows for the creation of distinct customer segments based on shared characteristics, enabling targeted marketing strategies. Understanding these segments leads to personalized experiences that resonate deeply with individual customers.

Personalization of products and services is a key aspect of modern business. By tailoring offerings to specific customer needs, companies can enhance customer satisfaction and loyalty. Personalized experiences are crucial for building strong customer relationships and driving revenue growth. This process requires continuously monitoring customer interactions and adapting strategies accordingly.

Performance Monitoring and Evaluation

A crucial aspect of data-driven insights is establishing a robust performance monitoring framework. This framework involves tracking key performance indicators (KPIs) to assess the effectiveness of implemented strategies. Regular monitoring and evaluation ensure that strategies are aligned with overall business objectives.

This continuous evaluation allows for adjustments and improvements over time. Regular reporting and feedback loops facilitate effective communication amongst stakeholders. This creates a dynamic environment where data-driven insights are consistently integrated into decision-making processes. This iterative approach is critical for long-term success.

Implementing any new initiative, especially one as complex and potentially impactful as I, requires careful consideration of numerous challenges. These challenges often stem from the intricate nature of the process itself, the diverse range of stakeholders involved, and the varying degrees of technical expertise within the team. Understanding and proactively addressing these issues is critical to ensuring a successful rollout and maximizing the benefits of I.

Improving Transparency and Accountability

Data-Driven Insights for Enhanced Accuracy

Implementing AI algorithms in property tax assessment allows for a more comprehensive and nuanced analysis of property values. This data-driven approach can account for a wider range of factors impacting market value, such as recent sales data, comparable property characteristics, neighborhood trends, and even external economic indicators. By leveraging this granular data, AI can identify patterns and anomalies that might be missed by traditional methods, leading to more accurate and fair assessments.

This enhanced accuracy is crucial for ensuring that property taxes reflect the true market value of each property, thereby minimizing potential discrepancies and promoting a fairer system for all taxpayers. The ability to incorporate a wider range of data points and analyze them with sophisticated algorithms results in a more robust and reliable assessment process.

Automated Valuation Processes for Efficiency

AI-powered systems automate many aspects of the property valuation process, significantly reducing the time and resources required for manual assessments. This automation not only streamlines the process but also helps expedite the entire tax cycle. From initial data collection to final assessment generation, AI can handle tasks like data entry, analysis, and report generation, freeing up human assessors to focus on more complex issues and appeals.

This automation leads to significant efficiency gains. By reducing the time spent on routine tasks, the overall process becomes more responsive and less prone to delays, which is vital for maintaining a smooth and efficient tax administration system.

Predictive Modeling for Future Value Estimations

AI-powered predictive models can anticipate future property values based on historical data and current market trends. This forward-looking capability allows for more proactive adjustments to tax assessments, accounting for potential future changes in the market. Such predictive models can help identify properties that are likely to appreciate in value or depreciate, leading to more accurate and forward-thinking assessments.

Improved Transparency in Assessment Methodology

AI algorithms provide a transparent way to understand the factors influencing property valuations. The detailed steps and calculations involved in the assessment process are readily available, providing a clear explanation of how the final value was determined. This transparency builds trust among taxpayers, allowing them to understand the rationale behind their assessments and reducing potential disputes.

The ability to easily access and understand the data and calculations employed by the AI system fosters greater public trust and acceptance of the property tax assessment process.

Enhanced Accountability Through Audit Trails

Implementing AI in property tax assessment creates detailed audit trails, providing a complete record of all data used, calculations performed, and decisions made throughout the process. This detailed audit trail enhances accountability by allowing for a rigorous examination of every step in the assessment process. It facilitates independent verification and ensures that assessments are made fairly and consistently across all properties.

This detailed record-keeping is a crucial element in building public trust and confidence. It allows for greater scrutiny and verification, ensuring that the assessment process is transparent and free from bias or manipulation.

Addressing Bias and Promoting Fairness in Assessments

AI can help mitigate potential biases in property tax assessments. By using objective data and algorithms, the system can minimize the impact of subjective factors that might lead to unfair or discriminatory outcomes. The use of AI can help ensure that all properties are assessed fairly and consistently, regardless of their location, owner characteristics, or other factors. This objective approach to assessment promotes fairness and equality in the tax system.

This approach to eliminating bias is essential for building a more equitable and just property tax system. By reducing the potential for discrimination, AI can create a more trusted and respected tax administration process, benefiting all taxpayers.