AI Powered Valuation: Accuracy and Efficiency in Real Estate

Accuracy and Reliability in a Dynamic Market

Ensuring Accuracy in Fluctuating Market Conditions

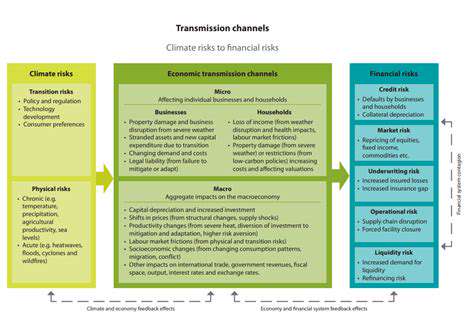

AI-powered valuation models are designed to adapt to market volatility, but maintaining accuracy in dynamic environments requires robust data inputs and sophisticated algorithms. Real-time market data feeds, coupled with machine learning algorithms capable of recognizing subtle trends and patterns, are crucial for accurate valuations. The effectiveness of these models depends heavily on the quality and comprehensiveness of the data utilized. Inaccurate or incomplete data can lead to significant errors in valuation, impacting investment decisions and potentially causing financial losses. Furthermore, the models must continuously learn and adapt to new information to maintain their predictive accuracy amidst the ever-shifting realities of the market.

The ability to adjust valuation models in response to changing market conditions is paramount. This requires incorporating sophisticated feedback loops that monitor the model's performance against real-world data. Regular evaluations and recalibrations are essential to ensure the model continues to reflect the current market dynamics and avoid accumulating prediction errors over time. This iterative process of refinement is key to maintaining the accuracy and reliability of AI-powered valuations in a constantly evolving marketplace.

Reliable Valuation for Informed Decision Making

Reliable AI-powered valuation models are critical for sound investment decisions. By providing accurate and consistent estimates of asset values, these models empower investors with the information necessary to make strategic choices. Confidence in the reliability of these estimations is essential for risk assessment and portfolio optimization. The models should be transparent, allowing users to understand the reasoning behind the valuations, which builds trust and fosters confidence in the decision-making process.

Beyond accuracy, the reliability of the valuation process encompasses the consistency and repeatability of the results. If a model consistently produces accurate valuations across various assets and market conditions, it gains credibility and reliability. The ability of the model to provide a clear and concise explanation of its valuation methodology significantly enhances its reliability, enabling users to understand the factors driving the results and assess the potential risks and uncertainties associated with the valuation.

The Role of Transparency and Explainability

Transparency and explainability are essential elements of reliable AI-powered valuation systems. Users need to understand how the model arrives at its conclusions to build trust and confidence in the results. A black box approach where the model's reasoning is opaque can hinder acceptance and adoption. Clearly articulated methodologies, allowing users to trace the inputs and calculations, foster trust and facilitate better understanding of the valuation process. This level of transparency enables users to identify potential biases or errors in the model's logic, further enhancing the reliability and accountability of the valuations.

Providing clear explanations of the model's decision-making process allows for a deeper understanding of market trends and influences, empowering users to make more informed decisions. By shedding light on the model's reasoning, we can foster greater confidence in the valuations and utilize the insights derived for strategic planning and market analysis. This transparency is crucial for building trust and promoting the responsible use of AI-powered valuations in financial markets.

Furthermore, explainable AI (XAI) techniques should be integrated into the model to provide insights into the factors influencing valuation decisions. This allows for a more thorough analysis of market trends and enhances the overall reliability of the valuation process. The ability to understand the factors driving a valuation, including macroeconomic indicators, industry-specific data, and company-specific metrics, significantly enhances the decision-making process.

In conclusion, transparency and explainability are critical for building trust and ensuring the responsible use of AI-powered valuations in dynamic markets. This approach fosters better understanding, facilitates informed decisions, and ultimately contributes to the overall reliability of the valuation process.

The Future of Real Estate Valuation: Integrating AI with Expertise

Advanced Valuation Techniques

The field of real estate valuation is constantly evolving, incorporating sophisticated methodologies to adapt to changing market dynamics and technological advancements. Modern valuation techniques often incorporate data analytics and machine learning algorithms to derive more precise and timely assessments of property value. This allows for more accurate predictions of future market trends and the potential for returns on investment.

These advanced techniques consider various factors beyond traditional methods, such as comparable sales data, including nuanced aspects like property condition, location specifics, and market sentiment. Employing these sophisticated models can lead to a more comprehensive and accurate valuation of real estate assets.

Impact of Technology on Valuation

Technological advancements are revolutionizing real estate valuation, providing access to previously unavailable data and enabling more efficient and streamlined processes. The availability of vast datasets and sophisticated software facilitates real-time market analysis, allowing for more dynamic and responsive valuations.

Real-time data feeds, coupled with property-specific data from various sources, provide a comprehensive view of the market. This allows for quicker and more accurate responses to changing market conditions, leading to more effective investment strategies and decisions.

Data Analytics and Machine Learning

data analytics and machine learning are transforming how real estate valuations are performed. These advanced technologies enable the identification of hidden patterns and correlations within large datasets of market data, resulting in more precise predictions and assessments of property values. Machine learning algorithms are capable of identifying intricate relationships between various factors impacting property value, resulting in more comprehensive and insightful valuations.

The use of algorithms to analyze massive datasets allows for the identification of trends and patterns that might otherwise be missed by traditional methods. This enhanced ability to analyze data is crucial in today's complex real estate market.

The Role of Artificial Intelligence

Artificial intelligence (AI) is poised to play an increasingly significant role in real estate valuation. AI-powered systems can analyze numerous data points, including historical sales data, market trends, economic indicators, and even social media sentiment, to generate more accurate and timely valuation reports.

By processing vast amounts of information, AI algorithms can identify subtle indicators of market shifts and predict future property values with greater precision. This level of efficiency and accuracy in real estate valuation will be invaluable for investors and stakeholders.

Geographic Considerations and Local Market Trends

Local market trends and geographic factors have a significant impact on real estate valuations. Understanding these nuanced details is critical for accurate assessments, as different neighborhoods and regions have unique economic drivers, demographic shifts, and development plans affecting property values. Recognizing the influence of local economic conditions, zoning regulations, and infrastructure developments is essential for a comprehensive understanding of property value.

Factors such as proximity to schools, employment centers, and transportation networks significantly influence property values. Incorporating these geographic considerations into valuation models is essential for a thorough and precise assessment of the real estate market.

The Future of Real Estate Valuation Professionals

The evolving landscape of real estate valuation necessitates that professionals adapt and acquire new skills. Staying current with the latest technological advancements, data analysis techniques, and market trends is critical for success in this ever-changing field.

Real estate appraisers and analysts will need to develop expertise in using data analytics tools and machine learning algorithms. This adaptability and continuous learning will be crucial for maintaining relevance and proficiency in the profession.

Read more about AI Powered Valuation: Accuracy and Efficiency in Real Estate

Hot Recommendations

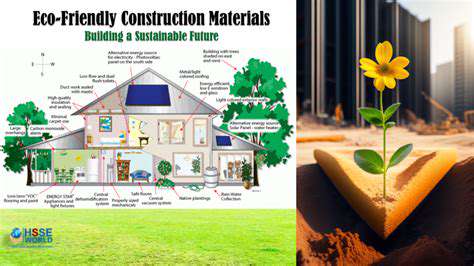

- Sustainable Real Estate Design Principles

- AI in Real Estate: Streamlining the Buying Process

- Climate Risk Disclosure: A Must for Real Estate

- Climate Risk Analytics: Essential for Real Estate Investment Funds

- Modular Sustainable Construction: Scalability and Speed

- Real Estate and Community Disaster Preparedness

- Smart Buildings and Advanced Building Analytics for Optimal Performance

- Smart Waste Sorting and Recycling in Buildings

- Sustainable Real Estate: A Strategic Advantage

- AI in Real Estate Transaction Processing: Speed and Accuracy