AI in Real Estate: Unlocking Hidden Value in Property Portfolios and Assets

Personalized Marketing and Targeted Acquisitions

Personalized Experiences for Enhanced Engagement

Personalized marketing in real estate leverages AI to understand individual buyer preferences and tailor the entire property search journey. This goes beyond simple demographics; AI analyzes browsing history, saved properties, and even social media activity to create highly targeted experiences. For example, a buyer interested in modern, open-concept apartments in a specific neighborhood might receive tailored recommendations, curated property listings, and even virtual tours of properties that perfectly align with their preferences. This personalized approach fosters a stronger connection with potential buyers, leading to increased engagement and ultimately a higher conversion rate.

AI-powered chatbots can provide instant answers to buyer queries, guide them through the property search process, and address their concerns in real-time. This 24/7 availability significantly improves the customer experience, making the entire process more seamless and efficient. By anticipating needs and providing proactive support, AI helps build trust and credibility with potential clients, ultimately driving successful acquisitions.

Targeted Acquisitions: Identifying High-Potential Leads

AI algorithms can sift through vast datasets of potential buyers, identifying those most likely to be interested in specific properties. By analyzing factors like location preferences, financial capacity, and lifestyle choices, AI can pinpoint high-potential leads who are actively searching for properties that match their criteria. This allows real estate agents to focus their efforts on qualified prospects, saving time and resources while increasing the likelihood of successful acquisitions.

This targeted approach is particularly valuable in competitive markets. AI can help agents identify potential buyers before they are even actively looking for a property. Through proactive engagement, real estate professionals can nurture these leads and position themselves as trusted advisors, leading to successful acquisitions.

Predictive Analytics for Strategic Decision-Making

Predictive analytics powered by AI helps real estate professionals understand market trends and make informed decisions about pricing, marketing strategies, and investment opportunities. By analyzing historical data, current market conditions, and various external factors, AI can forecast future market trends with greater accuracy, enabling proactive strategies for success. This data-driven approach allows real estate businesses to anticipate market changes and optimize their strategies accordingly.

Streamlined Processes and Enhanced Efficiency

AI automates many tasks involved in the real estate acquisition process, from property listings and lead management to contract negotiations. This automation significantly streamlines workflows, reduces manual errors, and frees up real estate professionals to focus on higher-value tasks like building relationships and closing deals. By optimizing administrative processes, AI enhances efficiency and productivity across the entire organization. This translates into significant cost savings and improved overall performance.

Real estate agents can utilize AI tools to automate tasks like scheduling appointments, sending follow-up emails, and generating customized reports. These automated tools improve efficiency, freeing up agents to focus on relationship building and client interaction, ultimately leading to better client satisfaction and successful acquisitions.

Enhancing Due Diligence and Risk Assessment

Understanding the Fundamentals of Due Diligence

Due diligence is a crucial process in various business ventures, encompassing a thorough investigation of a target company or investment opportunity. It involves a systematic analysis of financial records, legal documents, and operational practices to assess the potential risks and rewards associated with the subject matter. This process is not just about uncovering problems; it's also about uncovering hidden opportunities and potential for growth. The meticulous examination of past performance and current standing provides critical insights into the viability and sustainability of the venture.

A comprehensive due diligence process often involves multiple stakeholders, each bringing unique perspectives and expertise. From financial analysts to legal professionals, this collaborative approach ensures a more thorough and balanced assessment. This multi-faceted approach helps to mitigate the risks associated with making investment decisions and promotes informed decision-making, ultimately leading to better outcomes.

Identifying and Assessing Key Risks

A critical aspect of due diligence is the identification and assessment of potential risks. This involves scrutinizing various factors, including financial stability, legal compliance, and operational efficiency. Careful consideration of market trends and competitive landscapes is also essential for a complete risk assessment. Understanding the potential for unforeseen events is also vital in developing robust mitigation strategies.

Detailed analysis of financial statements, including balance sheets, income statements, and cash flow statements, helps to identify potential financial vulnerabilities. Thorough examination of contracts, licenses, and permits provides insight into legal compliance and potential liabilities.

Evaluating Financial Performance and Stability

Assessing the financial performance and stability of a target company is paramount to due diligence. Analyzing historical financial data, including profitability, revenue streams, and debt levels, helps to establish a clear picture of the company's financial health. Understanding the company's ability to generate consistent revenue and manage its expenses effectively is crucial. This analysis often requires specialized financial expertise to interpret complex financial data and identify any potential warning signs.

Analyzing Legal and Regulatory Compliance

Legal and regulatory compliance is a critical aspect of due diligence. This involves reviewing all relevant contracts, licenses, permits, and legal agreements to ensure the target company is operating within the bounds of the law. Proper scrutiny of legal documents and compliance history is essential to minimize potential legal disputes and ensure the business operates within the required regulatory frameworks. This process also involves understanding the specific legal requirements of the industry and the jurisdiction in which the business operates.

Considering Operational Efficiency and Effectiveness

Operational efficiency and effectiveness are key factors in evaluating a target company. This involves examining the company's internal processes, procedures, and management structure. Investigating the company's supply chain, production methods, and customer relationships provides insight into its operational capabilities. This analysis can reveal potential bottlenecks or inefficiencies, and can highlight opportunities for improvement.

Addressing Technological and Market Trends

Technological advancements and evolving market trends significantly impact businesses. The due diligence process needs to consider how the target company adapts to these changes. Understanding the competitive landscape and the potential impact of emerging technologies is vital for assessing long-term sustainability. Analyzing the company's preparedness for future challenges and its ability to adapt to market shifts is an important aspect of successful due diligence. This involves researching market trends, competitive pressures, and technological advancements that might affect the company's future success.

Read more about AI in Real Estate: Unlocking Hidden Value in Property Portfolios and Assets

Hot Recommendations

- Sustainable Real Estate Design Principles

- AI in Real Estate: Streamlining the Buying Process

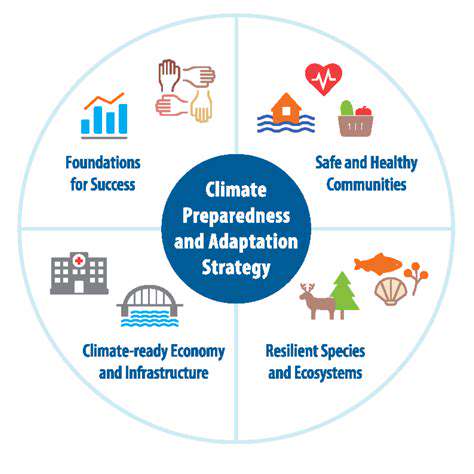

- Climate Risk Disclosure: A Must for Real Estate

- Climate Risk Analytics: Essential for Real Estate Investment Funds

- Modular Sustainable Construction: Scalability and Speed

- Real Estate and Community Disaster Preparedness

- Smart Buildings and Advanced Building Analytics for Optimal Performance

- Smart Waste Sorting and Recycling in Buildings

- Sustainable Real Estate: A Strategic Advantage

- AI in Real Estate Transaction Processing: Speed and Accuracy