AI Powered Valuation: A Data Driven Approach to Real Estate Asset Value

Improving Accuracy and Efficiency in Real Estate Transactions

Leveraging AI for Precise Property Valuation

AI-powered valuation tools are revolutionizing the real estate market by offering unparalleled precision and efficiency in assessing property worth. These sophisticated algorithms analyze vast datasets encompassing comparable sales, market trends, property characteristics, and even local economic indicators to generate valuations that are significantly more accurate than traditional methods. This increased accuracy translates to more informed decision-making for both buyers and sellers, leading to smoother transactions and reduced potential for disputes.

By automating the data collection and analysis process, AI streamlines the valuation process, drastically reducing the time required for appraisal. This time savings is particularly valuable in today's fast-paced real estate environment, enabling faster closing times and a more responsive market.

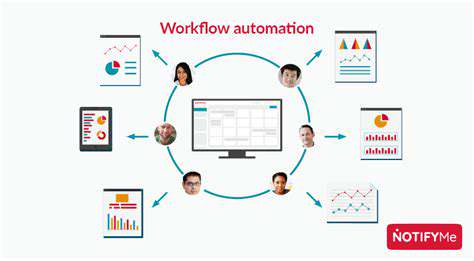

Streamlining the Transaction Process

Beyond valuation, AI is transforming the entire real estate transaction process. From automated contract review to identifying potential risks and ensuring compliance with regulations, AI-powered systems are simplifying complex processes and minimizing errors. This automated efficiency ensures that every step of the transaction is handled with accuracy and speed, minimizing the potential for delays and complications.

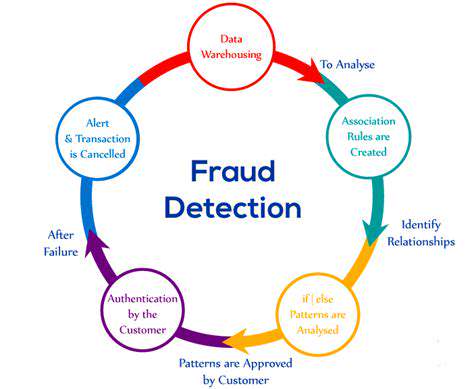

Furthermore, AI can proactively identify potential issues within a transaction, such as discrepancies in property records or inconsistencies in pricing, allowing for early intervention and resolution. This proactive approach minimizes the risk of costly errors or disputes later on in the process.

Reducing Human Error and Bias

Traditional real estate valuation methods are often susceptible to human error and potential biases. AI algorithms, on the other hand, operate without preconceived notions or personal preferences. This impartiality ensures a more objective and fair valuation process, benefitting all parties involved in the transaction. By eliminating the possibility of human bias, AI-powered systems create a more transparent and equitable market for everyone.

Enhancing Market Insights and Forecasting

AI algorithms can analyze vast quantities of data to identify patterns and trends in the real estate market. This allows for more accurate forecasting of future market movements, enabling real estate professionals to make better investment decisions and advise clients on appropriate strategies. The ability to predict market fluctuations significantly reduces risk and improves the chances of successful investment outcomes.

Furthermore, these insights can be used to identify promising investment opportunities, allowing for informed decision-making and capitalizing on potential market surges. This data-driven approach to market analysis is crucial for navigating the complexities of the real estate market and maximizing returns.

Improving Accessibility and Affordability

AI-powered valuation tools can make real estate services more accessible and affordable for a wider range of individuals and communities. By automating many aspects of the process, AI can lower operational costs, making services more affordable for everyone involved. This increased accessibility allows more people to participate in the market, fostering greater equity and opportunity.

Furthermore, the increased transparency and efficiency brought about by AI can lead to more competitive pricing, making real estate transactions more affordable for potential buyers. This overall accessibility and affordability contribute to a more robust and inclusive real estate market for all.

Read more about AI Powered Valuation: A Data Driven Approach to Real Estate Asset Value

Hot Recommendations

- Sustainable Real Estate Design Principles

- AI in Real Estate: Streamlining the Buying Process

- Climate Risk Disclosure: A Must for Real Estate

- Climate Risk Analytics: Essential for Real Estate Investment Funds

- Modular Sustainable Construction: Scalability and Speed

- Real Estate and Community Disaster Preparedness

- Smart Buildings and Advanced Building Analytics for Optimal Performance

- Smart Waste Sorting and Recycling in Buildings

- Sustainable Real Estate: A Strategic Advantage

- AI in Real Estate Transaction Processing: Speed and Accuracy