Valuation Challenges: Adapting to Climate Uncertainty

Identifying and Measuring Vulnerable Assets

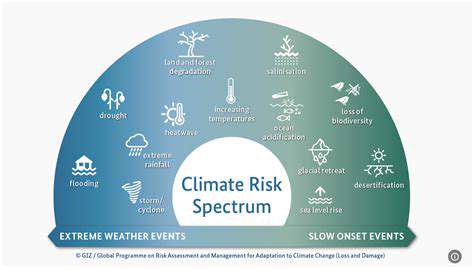

The financial quantification process hinges on cataloging at-risk assets. This inventory must span tangible infrastructure (buildings, roads) and intangible capital (brand equity, customer trust) susceptible to climate disruption. Data quality becomes paramount when evaluating exposure levels, requiring attention to location-specific vulnerabilities, structural resilience, and material durability under extreme conditions.

Asset interdependencies create compounding risks. A Midwestern drought, for instance, doesn't merely reduce crop yields—it triggers food price volatility that reverberates through retail, hospitality, and consumer goods sectors in unpredictable ways.

Developing Valuation Models for Climate Risks

Constructing reliable valuation frameworks necessitates grappling with climate uncertainty. Effective models employ probabilistic scenarios—from best-case to catastrophic projections—while integrating stochastic modeling techniques. The most robust approaches weight outcomes by both financial magnitude and likelihood, using Monte Carlo simulations to map potential impact distributions.

Evaluating the Transition Risks

The decarbonization shift introduces novel financial exposures often overshadowed by physical risks. Regulatory reforms, green technology disruptions, and sustainability-driven market shifts can rapidly devalue carbon-intensive assets. Forward-looking analysis must quantify policy compliance costs, technology adoption curves, and consumer sentiment migration toward eco-conscious brands.

Scenario Planning and Stress Testing for Financial Resilience

Financial institutions now treat climate scenario analysis with the rigor of macroeconomic stress testing. By war-gaming multiple climate futures—including tipping point scenarios—organizations can pressure-test capital adequacy and operational continuity. The most advanced practitioners are developing dynamic models that ingest real-time climate data and regulatory updates, creating living risk assessments that evolve with planetary changes.

The Future of Valuation in a Climate-Conscious World

The Impact of Climate Change on Traditional Valuation Models

Legacy valuation approaches built on historical performance metrics are becoming dangerously obsolete. Climate volatility demands valuation frameworks that treat environmental factors as core financial variables rather than externalities. Contemporary models must simulate how intensifying hurricanes might depress coastal REIT valuations, or how water scarcity could reshape agricultural land worth.

Traditional discounted cash flow analyses frequently underestimate climate-related value erosion. Consider Miami office towers: models ignoring saltwater intrusion risks may overvalue properties by 20-30% against 2050 projections. Such blind spots create systemic mispricing across asset classes.

Emerging Valuation Frameworks for a Sustainable Future

Innovative ESG valuation methodologies are bridging this analytical gap. These systems quantify sustainability performance through metrics like carbon intensity per revenue dollar or circular economy adoption rates. Pioneering firms now weight 30% of corporate valuations on climate preparedness metrics—a figure expected to reach 50% by 2030.

The market rewards climate leadership with valuation premiums. Companies reducing emissions 7% annually consistently outperform sector benchmarks by 3-5x on price-to-earnings multiples. This alpha generation reflects investor recognition that today's sustainability investments buffer against tomorrow's regulatory and physical shocks.

Integrating Climate Change into Investment Strategies

Sophisticated allocators now treat climate intelligence as a core investment skill. Portfolio managers must simultaneously assess physical asset vulnerabilities (flood-prone warehouses) and transition risks (oil reserves becoming stranded assets). The most advanced funds employ climate value-at-risk (VaR) models that stress-test holdings against IPCC emissions pathways.

Transparency fuels this transformation. Asset managers demanding TCFD-aligned disclosures achieve 18% better risk-adjusted returns by avoiding climate value traps. This data edge becomes increasingly vital as carbon pricing regimes expand globally.