AI Driven Valuation: The Next Generation of Property Appraisal Technology and Accuracy

Streamlining the Valuation Process

Automating the appraisal process through AI delivers a game-changing boost to both speed and efficiency. Unlike traditional methods, AI-driven systems harness algorithms and machine learning to crunch massive datasets in fractions of the time human appraisers require. This dramatic reduction in turnaround proves invaluable for time-sensitive real estate deals and investment evaluations where every hour counts. The technology's ability to work around the clock without fatigue further amplifies these productivity gains.

Improved Accuracy and Consistency

Modern valuation tools powered by artificial intelligence examine an unprecedented breadth of data points - from micro-market fluctuations and historical sales patterns to granular property details and even local demographic shifts. By systematically processing this wealth of information, AI minimizes the subjective judgments that sometimes skew human appraisals, resulting in remarkably consistent and defensible valuations. The technology's pattern-recognition capabilities often uncover valuation factors that might escape even seasoned professionals.

Reduced Costs and Increased Productivity

Implementing AI automation slashes the labor-intensive aspects of property appraisal, yielding substantial cost reductions for appraisal firms. These savings frequently trickle down to clients through more competitive pricing structures. Perhaps more significantly, liberating appraisers from routine number-crunching allows them to concentrate their expertise on interpreting complex valuation scenarios and providing strategic insights. This symbiosis of human judgment and machine processing creates a more valuable service proposition.

Enhanced Data Management

AI platforms transform property data management through their exceptional capacity to organize, cross-reference, and analyze vast information repositories. This capability proves particularly valuable for maintaining current valuation models as it enables real-time incorporation of market changes. The technology's data structuring also facilitates sophisticated longitudinal analysis, helping identify valuation trends that might otherwise remain obscured in disconnected datasets.

Accessibility and Scalability

The cloud-based nature of modern valuation tools breaks down geographical barriers, enabling seamless collaboration between distributed stakeholders. This accessibility revolution is further amplified by the systems' elastic scalability - they can effortlessly handle appraisal volumes ranging from single residential properties to massive commercial portfolios without compromising precision. Such flexibility makes the technology equally viable for boutique appraisal shops and national valuation firms.

Improved Transparency and Explainability

Leading-edge AI valuation systems increasingly incorporate explainability features that demystify their decision-making processes. These transparency tools prove invaluable when stakeholders need to understand the why behind a valuation figure, particularly in dispute resolution scenarios. By making the valuation rationale accessible and understandable, these systems build confidence in AI-assisted appraisals across the real estate ecosystem.

Future-Proofing the Appraisal Industry

Embracing AI represents more than just a productivity upgrade - it's an essential strategy for long-term relevance in the valuation sector. As machine learning models continue evolving, early adopters gain a competitive edge in delivering faster, more accurate, and more insightful appraisal services. This technological integration positions firms to nimbly adapt as new data sources emerge and valuation methodologies advance, ensuring they remain indispensable in an increasingly data-driven property market.

When you walk into one of Tesla's massive Gigafactories, the immediate contrast with conventional manufacturing becomes strikingly apparent. Rather than the smokestacks and fumes typical of legacy auto plants, these facilities pulse with renewable energy systems. The revolutionary aspect lies in their systemic optimization - every production element gets scrutinized through dual lenses of energy efficiency and waste reduction. Their breakthrough approach stems from completely re-engineering manufacturing paradigms around sustainability principles rather than retrofitting green features onto outdated processes.

The Future of Property Appraisal: Integration and Evolution

Technological Advancements in Appraisal

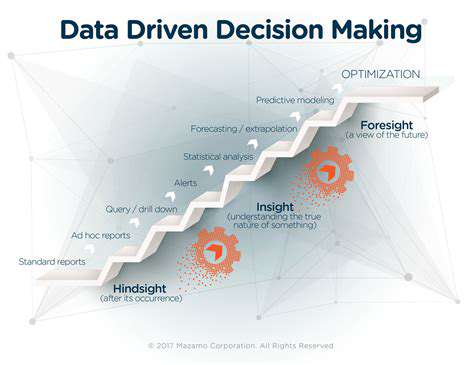

The valuation sector stands at the brink of a technological renaissance that's redefining professional standards. Next-generation analytical platforms now process complex datasets encompassing not just traditional comps and sales histories, but also hyperlocal economic indicators, zoning changes, and even environmental factors affecting property values. These multidimensional analyses provide valuation insights far beyond traditional methods' capabilities. Emerging applications of predictive analytics enable forward-looking valuations that account for anticipated market movements rather than just historical data.

The appraisal toolkit has expanded dramatically with geospatial intelligence and advanced imaging technologies. Drone-captured aerial data combined with 3D property renderings create comprehensive digital twins that support exceptionally detailed assessments. This enriched visual data layer complements quantitative analysis, enabling appraisers to evaluate properties with unprecedented precision and context.

The Impact of Big Data and Analytics

Modern valuation practices increasingly resemble data science as much as traditional appraisal work. The capacity to synthesize information from satellite imagery, IoT sensors, municipal databases, and demographic trends creates a rich contextual tapestry for valuations. This data fusion approach reveals subtle market dynamics and valuation influencers that conventional methods might overlook, particularly for properties with unique characteristics or in rapidly evolving neighborhoods.

Social data analysis represents a particularly transformative frontier, as sentiment analysis of local forums and neighborhood social media can provide early signals of emerging market trends. When combined with traditional economic indicators, this creates a more responsive and nuanced valuation framework capable of detecting micro-market shifts before they appear in formal statistics.

The Role of Automation and AI

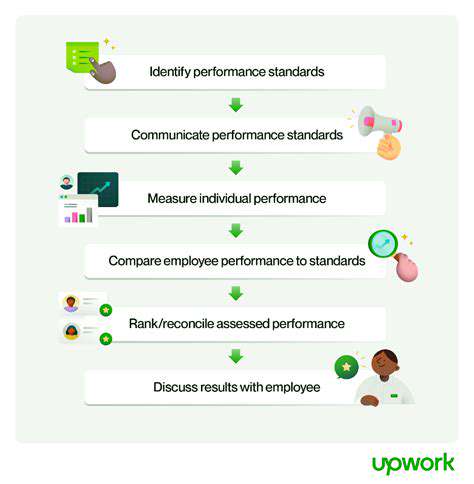

Intelligent automation is reshaping the valuation workflow by handling repetitive analytical tasks with machine precision. These systems don't just accelerate the process - they create new quality assurance layers by cross-verifying human appraisers' work against multiple algorithmic models. The resulting hybrid approach combines the nuance of professional judgment with the consistency and scalability of AI, reducing both turnaround times and error rates.

Looking ahead, neural networks trained on millions of property transactions will likely develop sophisticated valuation heuristics that complement human expertise. These systems won't replace appraisers but will instead evolve into collaborative tools that enhance professionals' capabilities - flagging anomalies, suggesting comparable properties, and even predicting how specific improvements might affect value based on historical data patterns.

The Importance of Ethical Considerations

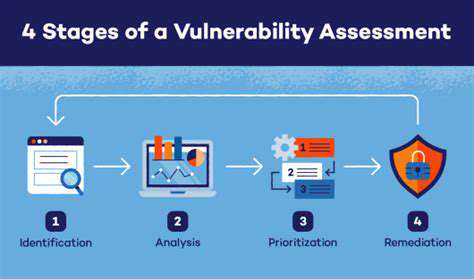

As valuation technologies grow more powerful, the profession must proactively address their responsible implementation. Data security protocols require constant evolution to protect sensitive financial and personal information in increasingly connected systems. Perhaps more critically, the industry must develop robust methodologies to audit algorithmic outputs for potential biases that could disproportionately affect certain property types or neighborhoods.

Transparency initiatives will prove essential for maintaining public trust, potentially including explainable AI frameworks that document the weighting of various valuation factors. Professional standards may need updating to address scenarios where AI-generated valuations conflict with human appraisers' assessments, ensuring accountability remains clear in the decision-making process.

The Future of the Appraisal Profession

The appraisal professional of the future will need to master both valuation principles and data science fundamentals. This hybrid skill set transforms appraisers from data processors into strategic advisors who can interpret complex analytical outputs and provide contextual insights that pure algorithms cannot. Continuing education will emphasize statistical literacy, algorithmic bias detection, and the effective communication of data-driven conclusions to diverse stakeholders.

The most successful firms will likely adopt a cyborg model - not man versus machine, but human expertise augmented by artificial intelligence. This synergy will produce valuations that are simultaneously more precise, more explainable, and more attuned to both quantitative metrics and qualitative market realities. The result promises to be an appraisal ecosystem that better serves all participants in the property market.

Read more about AI Driven Valuation: The Next Generation of Property Appraisal Technology and Accuracy

Hot Recommendations

- Sustainable Real Estate Design Principles

- AI in Real Estate: Streamlining the Buying Process

- Climate Risk Disclosure: A Must for Real Estate

- Climate Risk Analytics: Essential for Real Estate Investment Funds

- Modular Sustainable Construction: Scalability and Speed

- Real Estate and Community Disaster Preparedness

- Smart Buildings and Advanced Building Analytics for Optimal Performance

- Smart Waste Sorting and Recycling in Buildings

- Sustainable Real Estate: A Strategic Advantage

- AI in Real Estate Transaction Processing: Speed and Accuracy