AI Driven Real Estate Investment Insights

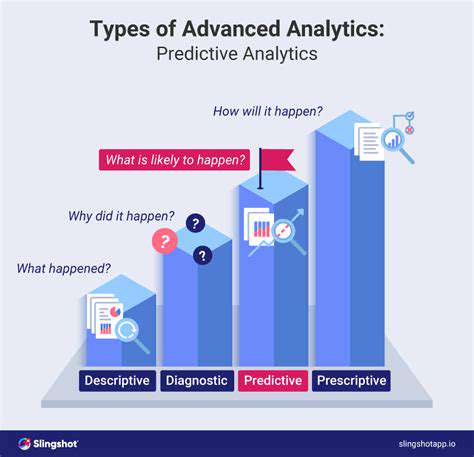

Predictive Analytics for Market Forecasting

Predictive Modeling Techniques

Predictive analytics, a powerful subset of data science, leverages historical data and statistical algorithms to forecast future trends and outcomes in the market. This process involves identifying patterns and relationships within the data to build models that can accurately predict future market behavior. Various techniques are employed, including machine learning algorithms like regression, classification, and clustering, allowing businesses to anticipate market shifts and proactively adjust strategies. By understanding the potential impacts of these shifts, businesses can make more informed decisions and improve their overall market performance.

A key aspect of predictive modeling is the selection of appropriate variables. Careful consideration must be given to the factors that are most likely to influence market dynamics. These variables could include economic indicators, consumer behavior trends, competitor actions, and even external factors like technological advancements. The accuracy of the predictions depends heavily on the quality and relevance of the input data, necessitating robust data collection and management strategies.

Market Forecasting Applications

Predictive analytics has wide-ranging applications in market forecasting. For instance, businesses can use it to predict future demand for their products or services. This allows for optimized inventory management, efficient resource allocation, and targeted marketing campaigns. Furthermore, it enables companies to identify potential market risks and proactively develop mitigation strategies. By anticipating market fluctuations, businesses can adjust their strategies to minimize potential losses and maximize profits.

Predictive analytics is also instrumental in understanding customer behavior and preferences. By analyzing past purchase patterns and demographic data, businesses can anticipate future customer needs and tailor products or services accordingly. This personalized approach enhances customer satisfaction and loyalty, ultimately strengthening the company's market position.

Another important application is the identification of emerging trends and opportunities. By analyzing market data, companies can detect new market segments or innovative product offerings that are likely to gain traction in the future. This foresight allows them to capitalize on emerging opportunities and stay ahead of the competition.

Challenges and Considerations

While predictive analytics offers significant benefits, it's crucial to acknowledge the potential challenges. One major challenge is the quality of the data. Inaccurate, incomplete, or biased data can lead to inaccurate predictions and flawed strategic decisions. Robust data collection and validation processes are essential to ensure the reliability of the models. Furthermore, selecting the appropriate algorithms and model parameters requires expertise and careful consideration.

Another important consideration is the interpretation of the results. Predictive models often provide complex outputs that require careful interpretation to extract actionable insights. A thorough understanding of the underlying data and the limitations of the model is necessary to avoid misinterpretations. Effective communication and collaboration between data scientists and business stakeholders are crucial for turning predictive insights into practical business strategies.

Finally, ethical considerations regarding data privacy and bias in algorithms need to be carefully addressed. Ensuring responsible data handling and mitigating potential biases in the models are critical to building trustworthy and equitable predictive analytics solutions.

Optimizing Portfolio Diversification and Risk Management

Understanding the Importance of Diversification

Diversification in real estate investment portfolios is crucial for mitigating risk and maximizing potential returns. A diversified portfolio spreads investments across various property types, geographic locations, and investment structures. This approach helps to reduce the impact of unforeseen market fluctuations in any single segment. By owning a mix of residential, commercial, and potentially even agricultural properties, investors can effectively hedge against downturns specific to one sector. This strategy allows for smoother performance over the long term, even when certain types of property experience temporary market volatility.

A well-diversified portfolio also considers geographic diversification. Investing in properties across different regions reduces the risk associated with localized economic downturns or specific regulatory changes. This geographic spread allows for a more balanced and resilient portfolio, as the performance of one region can offset potential losses in another.

AI-Powered Risk Assessment and Management

Artificial intelligence (AI) is revolutionizing real estate investment by providing sophisticated tools for risk assessment and management. AI algorithms can analyze vast amounts of data, including market trends, property valuations, and economic indicators, to identify potential risks and opportunities. This capability allows investors to make more informed decisions, reducing the reliance on subjective opinions and historical data alone. By identifying potential market downturns or regulatory changes in advance, AI-driven systems can help investors adapt their strategies to minimize negative impacts.

These AI systems can also predict the potential return on investment for various properties, helping investors to allocate capital more effectively. By understanding the inherent risks and potential rewards associated with different properties, investors can structure portfolios that align more closely with their risk tolerance and investment goals.

Leveraging Data Analytics for Informed Decisions

Data analytics plays a pivotal role in optimizing portfolio diversification and risk management. AI-powered platforms can collect and process vast amounts of data from various sources, providing a comprehensive view of the market. This includes historical transaction data, property valuations, rental rates, and even local economic indicators. This comprehensive dataset empowers investors with insights that go beyond conventional methods, enabling them to make more accurate forecasts and informed decisions.

The ability to analyze market trends and predict potential future changes is critical for proactive risk management. For instance, AI can identify emerging trends in the market, such as shifts in consumer preferences or changing regulatory environments, and provide insights into potential implications for property values and rental yields. This allows investors to adapt their strategies and potentially capitalize on emerging opportunities while mitigating unforeseen risks.

Tailoring Strategies to Individual Investor Profiles

A key aspect of successful real estate investment is tailoring strategies to individual investor profiles. By understanding an investor's risk tolerance, financial goals, and investment horizon, AI-driven platforms can recommend personalized portfolio diversification strategies. This individualized approach ensures that investments align with the specific needs and preferences of each investor, thereby maximizing the potential for success. Personalized diversification strategies can consider factors such as the investor's age, desired retirement income, and the time frame for capital appreciation.

This personalized approach also extends to risk management. AI algorithms can dynamically adjust portfolio allocations based on real-time market changes and the investor's individual risk tolerance. This adaptability ensures that the portfolio remains aligned with the investor's objectives and risk appetite throughout the investment journey, leading to more consistent and sustainable returns.

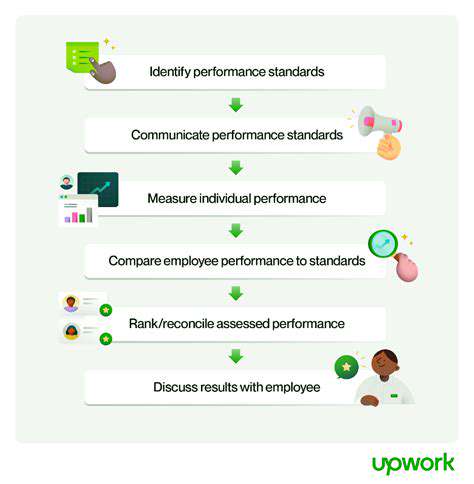

Improving Decision-Making Through Data-Driven Insights

Understanding the Power of Data in Real Estate Investment

Data-driven insights are revolutionizing the real estate investment landscape. By leveraging vast datasets encompassing market trends, property valuations, and historical performance, investors can make more informed decisions, minimizing risk and maximizing potential returns. This shift towards data analysis allows for a nuanced understanding of local market dynamics, enabling investors to identify emerging opportunities and adapt their strategies accordingly. Analyzing data on factors like population growth, employment rates, and economic indicators provides a comprehensive picture of potential market shifts.

Utilizing AI for Predictive Modeling in Real Estate

Artificial intelligence (AI) is a powerful tool in predictive modeling for real estate investment. AI algorithms can analyze complex datasets, identifying patterns and correlations that might be missed by human analysts. This predictive capability allows investors to forecast future market trends, estimate property values with greater accuracy, and anticipate potential risks. AI-driven models can also evaluate various investment scenarios, helping investors choose the strategies that best align with their goals and risk tolerance.

Analyzing Market Trends with Data Visualization Tools

Data visualization tools play a crucial role in transforming complex data into actionable insights. Presenting data visually, through charts, graphs, and maps, allows investors to quickly grasp market trends and spot potential opportunities. For example, visualizing property sales data over time can reveal seasonal patterns or identify areas experiencing rapid growth. These tools enable a more intuitive understanding of the market landscape, fostering better decision-making.

Evaluating Property Value Assessments with Machine Learning

Machine learning algorithms can significantly improve the accuracy of property value assessments. By analyzing a multitude of factors, including comparable sales, location characteristics, and property features, these algorithms can generate more precise valuations than traditional methods. This enhanced accuracy is vital for making informed investment decisions. Machine learning models can also adapt to evolving market conditions, ensuring valuations remain relevant and reliable over time.

Identifying Investment Opportunities Through Targeted Data Segmentation

Data segmentation allows investors to identify specific target markets for their investments. By dividing the market into segments based on various criteria, such as demographics, property type, or location, investors can pinpoint areas with high growth potential and focus their efforts on those specific segments. This targeted approach helps optimize investment strategies and reduces the risk associated with broad-based investments. For instance, segmenting by income levels can reveal opportunities in areas experiencing population growth and increased demand for certain property types.

Optimizing Portfolio Management with AI-Powered Strategies

AI-powered portfolio management tools can streamline the entire investment process. These tools can help optimize investment portfolios by analyzing market trends, identifying potential risks, and adjusting allocations based on real-time data. By automating these tasks, investors can free up time and resources to focus on other crucial aspects of their business. This automation, coupled with the ability to continuously rebalance portfolios based on changing market conditions, enhances overall investment performance and reduces the emotional biases often associated with human decision-making in portfolio management.

Read more about AI Driven Real Estate Investment Insights

Hot Recommendations

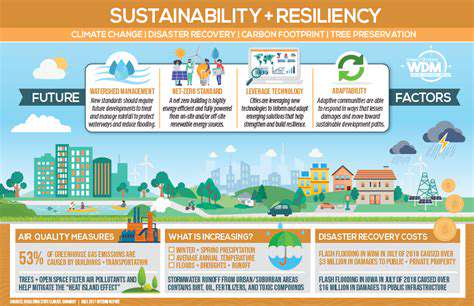

- Sustainable Real Estate Design Principles

- AI in Real Estate: Streamlining the Buying Process

- Climate Risk Disclosure: A Must for Real Estate

- Climate Risk Analytics: Essential for Real Estate Investment Funds

- Modular Sustainable Construction: Scalability and Speed

- Real Estate and Community Disaster Preparedness

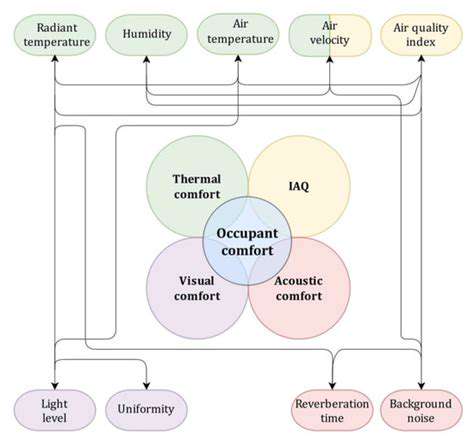

- Smart Buildings and Advanced Building Analytics for Optimal Performance

- Smart Waste Sorting and Recycling in Buildings

- Sustainable Real Estate: A Strategic Advantage

- AI in Real Estate Transaction Processing: Speed and Accuracy