Real Estate Climate Risk: Assessing Portfolio Vulnerabilities and Risks

Developing a Robust Risk Management Framework

Defining Risk

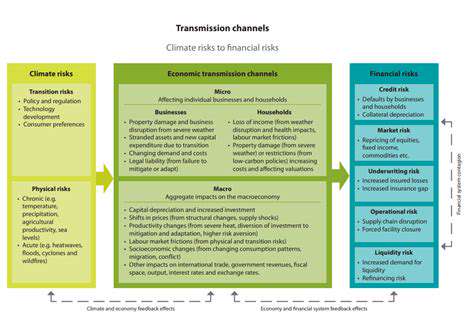

Risk management, at its core, involves identifying, assessing, and mitigating potential threats to achieving organizational objectives. A crucial first step is a precise definition of risk. This encompasses not just financial risks, but also operational, strategic, and reputational risks. Understanding the specific types of risks relevant to your organization is paramount for effective management. A comprehensive risk assessment should consider external factors like market fluctuations and regulatory changes, as well as internal factors like employee performance and technological vulnerabilities.

Clearly defining the scope of what constitutes a risk is essential for ensuring that all relevant threats are considered. Failure to do so can lead to significant gaps in protection and a misallocation of resources. This definition should be tailored to the specific context of your organization, considering its industry, size, and goals.

Assessing Risk

Assessing risk involves evaluating the likelihood and potential impact of each identified risk. This is typically done through a combination of qualitative and quantitative methods. Qualitative assessments rely on expert judgment and experience to estimate the likelihood and impact of risks. Quantitative assessments use data and statistical models to provide more precise estimations. Both methods are valuable tools for a thorough risk analysis.

Developing a robust risk assessment framework is critical to ensuring that the process is consistent and repeatable. This framework should include clear guidelines for data collection, analysis, and reporting. A well-structured framework ensures that the risk assessment process is not only thorough but also efficient.

Developing Mitigation Strategies

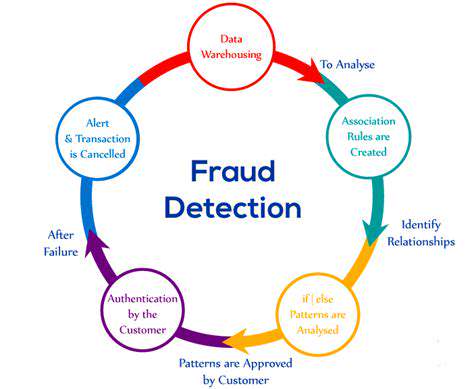

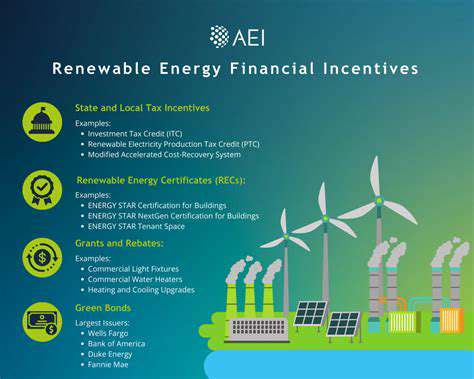

Once risks are identified and assessed, the next crucial step is developing mitigation strategies. These strategies should be tailored to the specific characteristics of each risk, considering the likelihood and potential impact. Strategies might involve implementing preventative controls, developing contingency plans, or transferring the risk to a third party. Prioritizing mitigation efforts based on the potential impact and likelihood of risk events is essential for resource allocation and efficiency.

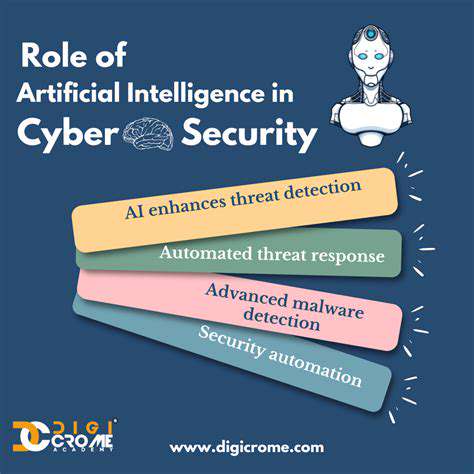

Effective risk mitigation often requires a combination of approaches. For example, a company might implement security protocols to prevent data breaches (a preventative control), while simultaneously creating a business continuity plan to ensure minimal disruption in case of a breach (a contingency plan). These complementary strategies work together to create a robust defense against potential threats.

Implementing and Monitoring

Implementing the chosen mitigation strategies is a critical step in risk management. This involves clear communication, training, and resource allocation. Successful implementation requires buy-in from all relevant stakeholders, who should understand the importance of the risk management process. Consistent monitoring and review of the effectiveness of the implemented strategies is essential for long-term success. Regular reviews will identify any weaknesses in the risk management system and allow for adjustments to improve the process.

Regular reporting and communication to key stakeholders are vital components of the risk management process. This ensures transparency and allows for prompt action in case of emerging or escalating risks. This ongoing monitoring and adjustment is key to a dynamic and effective risk management program.

Read more about Real Estate Climate Risk: Assessing Portfolio Vulnerabilities and Risks

Hot Recommendations

- Sustainable Real Estate Design Principles

- AI in Real Estate: Streamlining the Buying Process

- Climate Risk Disclosure: A Must for Real Estate

- Climate Risk Analytics: Essential for Real Estate Investment Funds

- Modular Sustainable Construction: Scalability and Speed

- Real Estate and Community Disaster Preparedness

- Smart Buildings and Advanced Building Analytics for Optimal Performance

- Smart Waste Sorting and Recycling in Buildings

- Sustainable Real Estate: A Strategic Advantage

- AI in Real Estate Transaction Processing: Speed and Accuracy