Climate Stress Testing for Property Developers

Identifying and Quantifying Climate Risks

Understanding Climate Change Impacts

Climate change is no longer a distant threat; its impacts are being felt globally, and these impacts are increasingly affecting property development projects. Understanding the specific risks associated with climate change, such as more frequent and intense extreme weather events, rising sea levels, and changing precipitation patterns, is crucial for developers to make informed decisions. This involves analyzing historical data, employing climate models, and consulting with climate scientists to project potential future scenarios.

Assessing Physical Risks

Physical risks are direct impacts from climate events. Examples include flooding, wildfires, and storm surges. A thorough assessment of these risks requires detailed analysis of potential damage to buildings, infrastructure, and surrounding land. This includes evaluating the resilience of construction materials, the effectiveness of drainage systems, and the vulnerability of the project site to various climate scenarios.

Accurate risk assessments necessitate considering the specific location of the development. Factors like elevation, proximity to water bodies, and prevailing wind patterns significantly impact the potential for damage.

Evaluating Transition Risks

Transition risks relate to the shift towards a low-carbon economy. These risks encompass regulatory changes, technological advancements, and shifting consumer preferences. For example, stricter building codes, carbon pricing mechanisms, and growing demand for sustainable materials can impact project viability and profitability. Developers need to proactively analyze these emerging trends and incorporate them into their long-term planning.

Quantifying Financial Impacts

Quantifying the financial impacts of climate risks is essential for effective risk management. This involves assigning monetary values to potential losses from physical damage, disruption of operations, and reputational harm. Financial modeling should incorporate various climate scenarios and different levels of adaptation measures to provide a comprehensive understanding of the potential financial exposure. This allows developers to assess the economic feasibility of a project under different climate change scenarios.

Developing Adaptation Strategies

Developing effective adaptation strategies is a key component of mitigating climate risks. These strategies can range from incorporating flood-resistant building materials to implementing sustainable water management systems. Developers should explore innovative solutions and technologies to enhance the resilience of their projects against climate change impacts. This includes incorporating climate-resilient infrastructure elements and promoting sustainable land use practices.

Integration into Project Development Process

Integrating climate risk assessments into the early stages of the project development process is vital for success. This involves incorporating climate considerations into zoning regulations, design specifications, and construction plans. Early engagement with climate experts and stakeholders can help identify potential risks and develop appropriate mitigation and adaptation strategies from the outset, potentially reducing costs and delays later in the project lifecycle. Early proactive steps are essential for minimizing the financial and reputational risks associated with climate change.

Stakeholder Engagement and Communication

Effective stakeholder engagement and transparent communication are crucial for managing climate risks. This involves engaging with local communities, government agencies, and insurance providers to understand their concerns and expectations regarding climate change impacts. Open communication and collaboration are essential for building trust and ensuring the long-term viability of the development project in a changing climate. Building strong relationships and transparently communicating climate risks to stakeholders can foster mutual understanding and support for the project.

Evaluating Investment Portfolio Risks

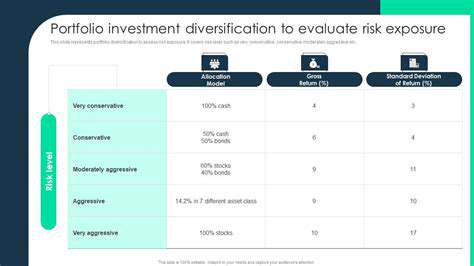

Assessing Portfolio Diversification

A crucial aspect of evaluating an investment portfolio's risk is understanding its diversification. A well-diversified portfolio spreads investments across various asset classes, industries, and geographic regions, minimizing the impact of any single investment's poor performance on the overall portfolio. This diversification strategy aims to reduce overall portfolio risk by mitigating the effects of volatility in specific sectors or markets. A well-rounded portfolio typically includes a mix of stocks, bonds, real estate, and potentially other alternative investments.

Analyzing Historical Performance

Examining historical performance data provides insights into an investment portfolio's risk tolerance and potential returns over time. This analysis involves studying the portfolio's returns in different market conditions, such as bull and bear markets. Analyzing historical data, while not a perfect predictor of future performance, offers valuable context for understanding the portfolio's typical reaction to market fluctuations. Careful consideration should be given to the time frame of the historical data, as shorter periods can be misleading and longer periods may not accurately reflect current market conditions.

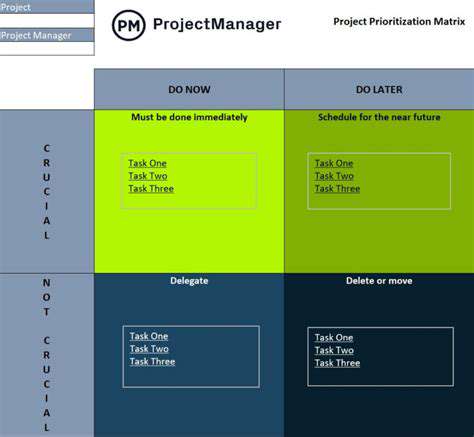

Evaluating Asset Allocation Strategies

The asset allocation strategy employed in the portfolio directly impacts its risk profile. A portfolio heavily weighted towards volatile assets like stocks will inherently carry a higher level of risk compared to one focused on more stable assets like bonds. Understanding how the portfolio is allocated across various asset classes is critical for accurately assessing its overall risk tolerance. The ideal asset allocation depends on individual investor goals, risk tolerance, and time horizon.

Identifying Potential Market Risks

External market factors can significantly affect an investment portfolio's performance and risk. Economic downturns, geopolitical instability, and unexpected events like pandemics can all lead to significant losses in investment values. Analyzing and assessing potential market risks is an essential part of portfolio evaluation. Identifying potential risks allows for proactive strategies to mitigate their negative impact on investment returns. Assessing the sensitivity of specific investments to market fluctuations is also a key component of this step.

Assessing Credit Risk (if applicable)

For portfolios containing debt instruments like bonds, credit risk is a significant consideration. Credit risk refers to the probability that the issuer of the debt instrument will default on its obligations. A detailed analysis of the creditworthiness of the issuers and their ability to meet their debt obligations is essential. Analyzing the credit rating of the issuers can provide a crucial insight into the level of credit risk associated with those bonds. Assessing the overall credit quality of the portfolio is paramount to understanding potential losses.

Considering Liquidity Needs and Goals

The liquidity of a portfolio is crucial for meeting short-term financial obligations. A portfolio that is not liquid enough may not be able to provide the necessary funds for unexpected expenses or opportunities. Understanding the time horizon of the investment goals is vital for evaluating the portfolio's liquidity. Liquidity is a critical factor in portfolio management, as it can significantly impact investment decisions and overall financial well-being. The ability to access funds quickly and easily when needed is a crucial component of a well-managed investment portfolio.

Read more about Climate Stress Testing for Property Developers

Hot Recommendations

- Sustainable Real Estate Design Principles

- AI in Real Estate: Streamlining the Buying Process

- Climate Risk Disclosure: A Must for Real Estate

- Climate Risk Analytics: Essential for Real Estate Investment Funds

- Modular Sustainable Construction: Scalability and Speed

- Real Estate and Community Disaster Preparedness

- Smart Buildings and Advanced Building Analytics for Optimal Performance

- Smart Waste Sorting and Recycling in Buildings

- Sustainable Real Estate: A Strategic Advantage

- AI in Real Estate Transaction Processing: Speed and Accuracy