Machine Learning for Property Value Forecasting

Evaluating Model Performance and Refinement

Understanding Model Accuracy Metrics

Evaluating the accuracy of a machine learning model for predicting property values is crucial. Common metrics include Mean Squared Error (MSE), Root Mean Squared Error (RMSE), and R-squared. MSE measures the average squared difference between predicted and actual property values. RMSE provides a more interpretable measure by taking the square root of MSE, making it easier to understand the magnitude of the error. R-squared, on the other hand, represents the proportion of variance in property values explained by the model, providing a measure of goodness of fit.

Analyzing these metrics is essential to determine how well the model fits the data and to compare different models. A lower MSE and RMSE, and a higher R-squared, generally indicate a better-performing model. However, the choice of the best metric depends on the specific application and the desired level of precision.

Feature Importance Analysis

Identifying the most influential factors impacting property values is vital for model refinement. Feature importance analysis techniques, such as permutation importance or feature coefficients, can highlight which features have the strongest relationship with property values. This understanding can help in focusing on relevant data points or refining the model by incorporating new, more predictive features.

For instance, if the analysis reveals that lot size is a key driver of property value, the model can be adjusted to better account for this factor. This analysis also allows for a deeper understanding of the market, potentially revealing hidden trends and relationships between features and value.

Handling Outliers and Missing Data

Real estate data often contains outliers (extreme values) and missing data points. Outliers can significantly skew model predictions, potentially leading to inaccurate valuations. Robust statistical methods can be applied to identify and handle these outliers, potentially through winsorizing or other techniques. Missing data, on the other hand, can be addressed through imputation, filling in the missing values based on existing data patterns.

Correctly handling these issues is paramount for building a reliable model. Improperly handled outliers or missing data can introduce biases and inaccuracies into the model's predictions, ultimately resulting in unreliable property valuations. Therefore, rigorous data pre-processing techniques are critical.

Model Validation and Cross-Validation

Validating the model's performance on unseen data is crucial to prevent overfitting, where the model performs exceptionally well on the training data but poorly on new, unseen data. Techniques like cross-validation can be used to assess the model's generalization ability and provide a more reliable estimate of its performance on future data.

Cross-validation involves splitting the data into multiple subsets (folds) and training the model on some folds while evaluating it on others. This process provides a more robust evaluation of the model's performance than using a single train-test split. This iterative process helps mitigate the risk of the model being overly tuned to the training data, leading to more reliable estimations of property values.

Model Refinement Strategies

Based on the evaluation results, model refinement strategies can be employed to enhance predictive accuracy. This could involve tuning hyperparameters, such as learning rates or regularization terms, to optimize the model's performance. Additionally, considering alternative model architectures or incorporating more relevant features can significantly improve the model's predictive capabilities.

Regularization Techniques

Regularization techniques, such as L1 or L2 regularization, can prevent overfitting by penalizing complex models. These techniques constrain the magnitude of model coefficients, reducing the influence of less important features and improving the model's generalizability. Using these techniques can enhance the model's ability to predict property values more reliably across various market conditions.

The right choice of regularization depends on the specific dataset and the desired balance between model complexity and accuracy. This process is crucial for achieving a model that generalizes well to unseen data and provides more accurate predictions.

Iterative Improvement and Monitoring

Model performance isn't static; it needs continuous monitoring and refinement. As new market data becomes available, the model should be re-evaluated and potentially retrained to maintain accuracy and relevance. Regular monitoring of key metrics, such as RMSE and R-squared, allows for prompt identification of performance degradation and triggers for model updates.

This iterative process is essential for ensuring the model remains effective in predicting property values as market conditions evolve. Regular retraining and adjustments allow the model to adapt to changing trends and remain a valuable tool for accurate property assessments.

Read more about Machine Learning for Property Value Forecasting

Hot Recommendations

- Sustainable Real Estate Design Principles

- AI in Real Estate: Streamlining the Buying Process

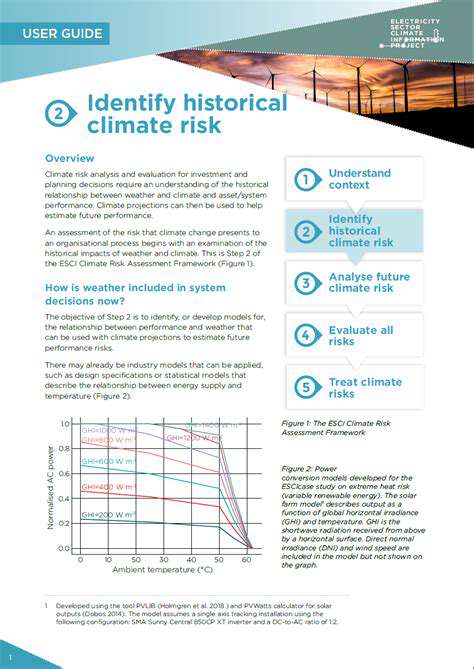

- Climate Risk Disclosure: A Must for Real Estate

- Climate Risk Analytics: Essential for Real Estate Investment Funds

- Modular Sustainable Construction: Scalability and Speed

- Real Estate and Community Disaster Preparedness

- Smart Buildings and Advanced Building Analytics for Optimal Performance

- Smart Waste Sorting and Recycling in Buildings

- Sustainable Real Estate: A Strategic Advantage

- AI in Real Estate Transaction Processing: Speed and Accuracy