Climate Change and Mortgage Risk for Investors

Insurance Implications and Their Impact on Investment Decisions

Insurance Premiums and Rising Costs

Climate change is demonstrably increasing the frequency and severity of extreme weather events, leading to a dramatic rise in insurance premiums. This escalating cost is not just a matter of inconvenience; it directly impacts investment decisions, particularly for businesses operating in vulnerable regions. Companies must factor these increased costs into their budgets, potentially leading to reduced profitability or even relocation to safer areas. This necessitates a strategic approach to risk management and investment diversification.

Catastrophe Bonds and Risk Transfer

Catastrophe bonds are a sophisticated financial instrument that allows insurers to transfer the risk of catastrophic events to the capital markets. Investors, in turn, receive a return based on the probability of a major event occurring. Understanding and utilizing catastrophe bonds is becoming increasingly crucial for investors seeking to mitigate risk associated with climate change impacts on insurance markets. These bonds provide a measurable method for managing potential losses and offer a relatively diversified way to hedge against the rising costs of insurance.

Investment in Climate-Resilient Infrastructure

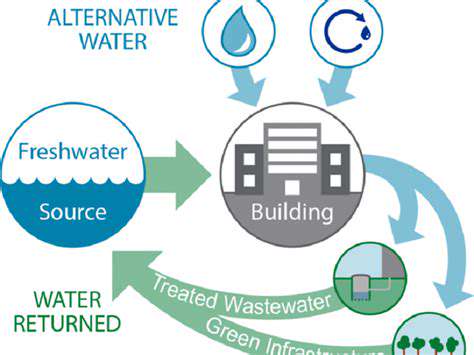

The insurance industry's increasing exposure to climate-related risks is driving investment decisions toward climate-resilient infrastructure. This includes investments in flood defenses, drought-resistant crops, and renewable energy sources. Incorporating these considerations into investment portfolios is not only a responsible approach but also a potentially lucrative one, as the demand for resilient infrastructure will likely continue to grow.

Impact on Real Estate and Property Values

Rising insurance costs directly impact property values, particularly in areas prone to climate-related disasters. Investors in real estate need to factor in the potential for reduced returns due to higher insurance premiums and the increased risk of property damage. This necessitates a thorough assessment of climate risk when evaluating potential investments in real estate markets, potentially leading to a shift in investment strategies towards more climate-resilient locations.

Insurance Coverage Gaps and Mitigation Strategies

Existing insurance policies often have gaps in coverage for climate-related events. This necessitates a proactive approach to risk assessment and adaptation. Investors should scrutinize insurance policies to ensure adequate coverage for potential losses. This careful analysis allows businesses to anticipate and mitigate risks associated with these events, leading to more informed investment decisions.

Reinsurance and Portfolio Diversification

Reinsurance plays a crucial role in managing the risk associated with large-scale insurance claims resulting from climate change. Investors need to understand how reinsurance structures function and the role they play in stabilizing insurance portfolios. This understanding allows for a more diversified and resilient investment portfolio, minimizing the impact of extreme weather events.

Government Regulations and Their Influence on Investment

Government regulations are increasingly influencing investment decisions in response to climate change. Policies regarding emissions reductions, infrastructure resilience, and insurance regulations are shaping the risk landscape for investors. Navigating these regulatory changes is essential for investors to ensure their portfolios align with long-term sustainability goals and minimize potential financial impacts from climate-related events. Understanding and reacting to these changes is critical for long-term investment success.

Strategies for Managing Climate Change Risk in Mortgage Investments

Assessing Climate Change Vulnerability in Property

Evaluating the vulnerability of mortgage-backed properties to climate change impacts is crucial for risk mitigation. This involves analyzing various factors, including the property's location relative to floodplains, wildfire zones, and coastal erosion risks. Historical climate data, projected future scenarios, and local building codes should all be considered. Detailed assessments should incorporate both physical risks, like rising sea levels and extreme weather events, and transition risks, such as policy changes that could impact property values or usage. This proactive approach allows investors to identify potentially problematic areas and make informed decisions about investment strategies.

Beyond geographical location, factors like building construction and maintenance play a significant role. Older structures may be more vulnerable to damage from extreme weather compared to newer, more resilient properties. Understanding the condition of existing infrastructure, such as drainage systems and flood defenses, is also critical. This thorough evaluation process allows investors to identify properties at elevated risk and incorporate that knowledge into their investment strategies, reducing potential losses and maximizing returns.

Adapting Investment Strategies to Climate Change Impacts

Adapting investment strategies to account for climate change requires a multi-faceted approach. This includes diversifying portfolios to include properties in less vulnerable locations, implementing robust due diligence processes to identify and assess climate risks, and incorporating climate-related considerations into appraisal methodologies. A shift towards sustainable and resilient construction practices can also reduce long-term risk and potentially increase property values.

Further, exploring alternative investment vehicles, such as green mortgages or climate-resilient bonds, can help mitigate risks and generate returns aligned with climate goals. This diversification strategy ensures a more robust portfolio that is less susceptible to the impacts of climate change. Moreover, ongoing monitoring and adaptation of investment strategies are essential as climate change continues to evolve and new information becomes available.

Instituting rigorous risk management protocols is also important. These protocols should include regular assessments of climate-related risks, the development of contingency plans for extreme weather events, and the implementation of strategies to mitigate potential losses associated with climate impacts. A proactive approach to risk management is crucial for maintaining portfolio stability and ensuring long-term profitability in the face of climate change uncertainty. This forward-thinking approach will help investors navigate the evolving landscape of climate-related risks.

Finally, engaging in collaborative initiatives with local communities and stakeholders to develop and implement adaptation strategies can foster resilience and create a more sustainable future. This proactive approach will benefit both investors and the communities they invest in.

Read more about Climate Change and Mortgage Risk for Investors

Hot Recommendations

- Sustainable Real Estate Design Principles

- AI in Real Estate: Streamlining the Buying Process

- Climate Risk Disclosure: A Must for Real Estate

- Climate Risk Analytics: Essential for Real Estate Investment Funds

- Modular Sustainable Construction: Scalability and Speed

- Real Estate and Community Disaster Preparedness

- Smart Buildings and Advanced Building Analytics for Optimal Performance

- Smart Waste Sorting and Recycling in Buildings

- Sustainable Real Estate: A Strategic Advantage

- AI in Real Estate Transaction Processing: Speed and Accuracy