AI Driven Valuation: The Competitive Edge in a Changing Market

The future of valuation lies in the seamless integration of AI with traditional methods. Rather than replacing human expertise, AI can augment it, allowing analysts to focus on higher-level tasks such as strategic decision-making and interpretation of complex results. Combining the strengths of both AI and human analysis will lead to a more robust and comprehensive valuation process.

This integration will foster a collaborative environment where AI provides the foundation for more precise and efficient valuations, while human expertise ensures critical analysis and informed decision-making.

Addressing Ethical Considerations

As AI-driven valuation becomes more prevalent, it's crucial to address the ethical considerations that arise. Bias in the data used to train AI models can lead to skewed valuation results, potentially disadvantaging certain groups or sectors. Addressing these biases proactively through diverse and representative datasets is vital to ensuring fairness and equity in the valuation process.

The potential for misuse of AI-generated valuations also necessitates careful consideration. Robust regulatory frameworks and ethical guidelines are needed to mitigate potential risks and ensure responsible application of these powerful tools.

Competitive Advantages in the Market

Companies that successfully embrace AI-driven valuation will gain a significant competitive advantage in the market. By leveraging AI's capabilities for faster, more accurate, and comprehensive valuations, these companies can make more informed decisions, identify opportunities earlier, and react more effectively to market changes. This agility and precision will be crucial for long-term success in a dynamic and increasingly data-driven financial world.

The ability to incorporate real-time market data and sentiment analysis will provide a competitive edge, allowing companies to adapt to changing conditions more rapidly. This proactive approach is vital for maintaining a strong market position in the future.

Predictive Capabilities and Strategic Insights

Predictive Modeling for Enhanced Valuation

AI-driven valuation models leverage sophisticated predictive modeling techniques to analyze vast datasets and identify patterns that traditional methods often miss. These models can incorporate a wide array of factors, from market trends and financial performance to macroeconomic indicators and industry-specific nuances. By effectively processing and interpreting this data, AI can provide a more comprehensive and nuanced understanding of a company's intrinsic value, potentially leading to more accurate and insightful valuations compared to human analysts alone.

The key to effective predictive modeling lies in the quality and quantity of the data. Robust datasets, meticulously curated and encompassing a wide range of relevant information, are crucial for training AI models. This data must also be meticulously cleaned and prepared to minimize errors and biases, ensuring the model's accuracy and reliability. This process, often involving data preprocessing and feature engineering, significantly contributes to the overall effectiveness of the predictive capabilities.

Strategic Insights for Informed Decisions

Beyond simply providing a valuation, AI can offer valuable strategic insights, assisting stakeholders in making informed decisions. By identifying trends and potential risks, AI models can anticipate future performance and proactively adjust strategies accordingly. This forward-looking approach is particularly crucial in dynamic markets, where adapting to evolving conditions is paramount for success.

These strategic insights can be invaluable for investors, helping them understand the potential returns and risks associated with different investment opportunities. Further, companies can utilize these insights to optimize resource allocation, identify new market opportunities, and refine their operational strategies, ultimately driving profitability and long-term success.

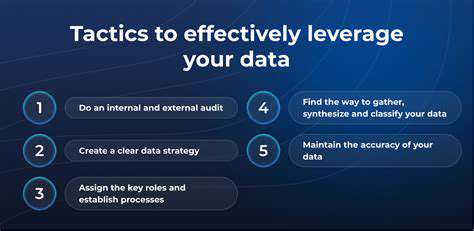

Competitive Advantage Through Data-Driven Insights

In today's competitive landscape, having access to data-driven insights is crucial for gaining a competitive edge. AI-powered valuation tools provide a significant advantage by offering a deeper understanding of market dynamics, allowing businesses to anticipate changes and adapt their strategies more effectively. This proactive approach enables companies to make data-driven decisions, leading to more accurate forecasting and optimized resource allocation.

Improving Valuation Accuracy and Efficiency

AI-driven valuation methods offer significant improvements in both accuracy and efficiency compared to traditional approaches. By automating the analysis of extensive datasets and identifying complex patterns, AI can expedite the valuation process, reducing turnaround times and freeing up valuable human resources for more strategic initiatives. This automation translates directly into cost savings and increased productivity, making AI-driven valuation a highly attractive proposition for businesses of all sizes.

Before crafting any testimonial, deeply understand your target audience. Who are you trying to reach? What are their needs, desires, and pain points? Knowing your audience intimately allows you to tailor testimonials to resonate with their specific concerns and aspirations. This crucial step ensures that the testimonial speaks directly to the audience's motivations, building trust and credibility.

Automation and Efficiency Gains

Streamlining the Valuation Process

AI-powered valuation tools automate a significant portion of the traditional manual process, dramatically reducing the time and resources required. This automation translates to substantial efficiency gains, allowing analysts to focus on higher-level tasks, such as complex data interpretation and strategic decision-making. By automating data collection, cleansing, and analysis, AI systems can process vast quantities of data much faster and with greater accuracy than human analysts, leading to quicker turnaround times for valuations.

The speed and precision of AI-driven valuations are particularly beneficial in dynamic markets. Real-time data feeds and sophisticated algorithms allow for continuous monitoring and updates, ensuring that valuations remain current and relevant in response to market fluctuations. This agility is a significant advantage in a competitive landscape characterized by rapid changes in market conditions.

Enhanced Accuracy and Objectivity

AI algorithms, trained on extensive datasets, can identify patterns and relationships that may be missed by human analysts. This leads to more accurate and objective valuations, minimizing subjective biases that can impact traditional methods. The systematic approach of AI reduces the chance of errors and inconsistencies inherent in manual processes, providing a more reliable foundation for investment decisions.

Eliminating human error is crucial in valuation, especially when dealing with complex financial instruments or large volumes of data. AI-driven systems can handle intricate calculations and data manipulations with unwavering accuracy, ensuring consistent results and fostering greater confidence in valuation outcomes.

Reduced Operational Costs

The efficiency gains inherent in AI-driven valuation directly translate into reduced operational costs. By automating tasks and minimizing manual intervention, organizations can significantly decrease labor expenses associated with traditional valuation methods. This cost reduction is particularly important for companies operating in highly competitive markets where cost optimization is a key driver of success.

Beyond labor savings, AI systems can also optimize resource allocation. By automating repetitive tasks, AI frees up human resources for more strategic initiatives, ultimately increasing the overall efficiency and productivity of the valuation process. This streamlined approach has a tangible impact on the bottom line.

Improved Data Management and Analysis

AI systems excel at managing and analyzing large volumes of data, a crucial component of accurate valuations. These systems can efficiently collect, cleanse, and organize data from various sources, including financial statements, market data, and industry reports. This consolidated and organized data provides a comprehensive view of the subject being valued, allowing for more informed and robust analysis.

Furthermore, AI algorithms can identify hidden correlations and patterns within the data that might be overlooked by human analysts. This deeper understanding of the data enables more sophisticated analysis and a more nuanced valuation, leading to more accurate and insightful conclusions. Ultimately, this enhanced data management and analysis leads to better informed decision-making.

Faster Time to Market

In today's fast-paced business environment, speed is paramount. AI-driven valuation tools can significantly accelerate the valuation process, enabling faster turnaround times for various projects, from mergers and acquisitions to financial reporting. This efficiency is particularly beneficial in dynamic markets where timely insights are critical for strategic decision-making.

The ability to generate valuations rapidly allows organizations to respond to changing market conditions more effectively. This agility, achieved through automation, is a powerful competitive advantage in a marketplace demanding quick and accurate decisions. Quicker valuations mean faster access to capital, allowing companies to capitalize on opportunities more effectively.